⚠️Your Portfolio is in Danger!

The market is sending mixed signals! While some sectors are soaring, others are showing signs of serious trouble.

🚨 Warning: The market is sending mixed signals!

While some sectors are soaring, others are showing signs of serious trouble.

This week, we're cutting through the noise to give you the information you need to protect your investments.

We recommend articles that analyze the latest bank earnings, assess the global economic outlook, and even reveal a surprising way to profit from the sports world.

Don't miss out on this crucial market update!

👨💼 Luxury Giant Burberry shares drop 15%, Replaces CEO

What's Behind Burberry's Sudden Leadership Shakeup and Market Plunge? Discover why Burberry is shaking things up - and what it means for the brand's future!

🇨🇳 China’s Q2 GDP Growth Misses the Mark!

China's GDP growth misses the mark at 4.7%. Dive deeper into the reasons for this economic slowdown.

🚙 Canada Considers Tariffs on China as EV Trade War Heats Up!

Learn how Canada's potential tariffs could impact the global EV market - and what China's response might be!

🏟️ How Euro 2024 and Copa America Events Are Lifting Stock Markets!

Get the inside story on how Euro 2024 and Copa America events are boosting investor sentiment and market performance!

🏦 JPMorgan, Citigroup, and Wells Fargo's Q2 2024 Results Are In!

Learn how the big banks fared in Q2 2024 - and what it means for the economy and your investments!

🌽 The Corn Market Has Hit Its Lowest Point - Is It Time For a Rebound?

The Corn Market could be coming back and better than ever! Get ready to profit from the rebound of the year – discover how to ride the wave to financial freedom.

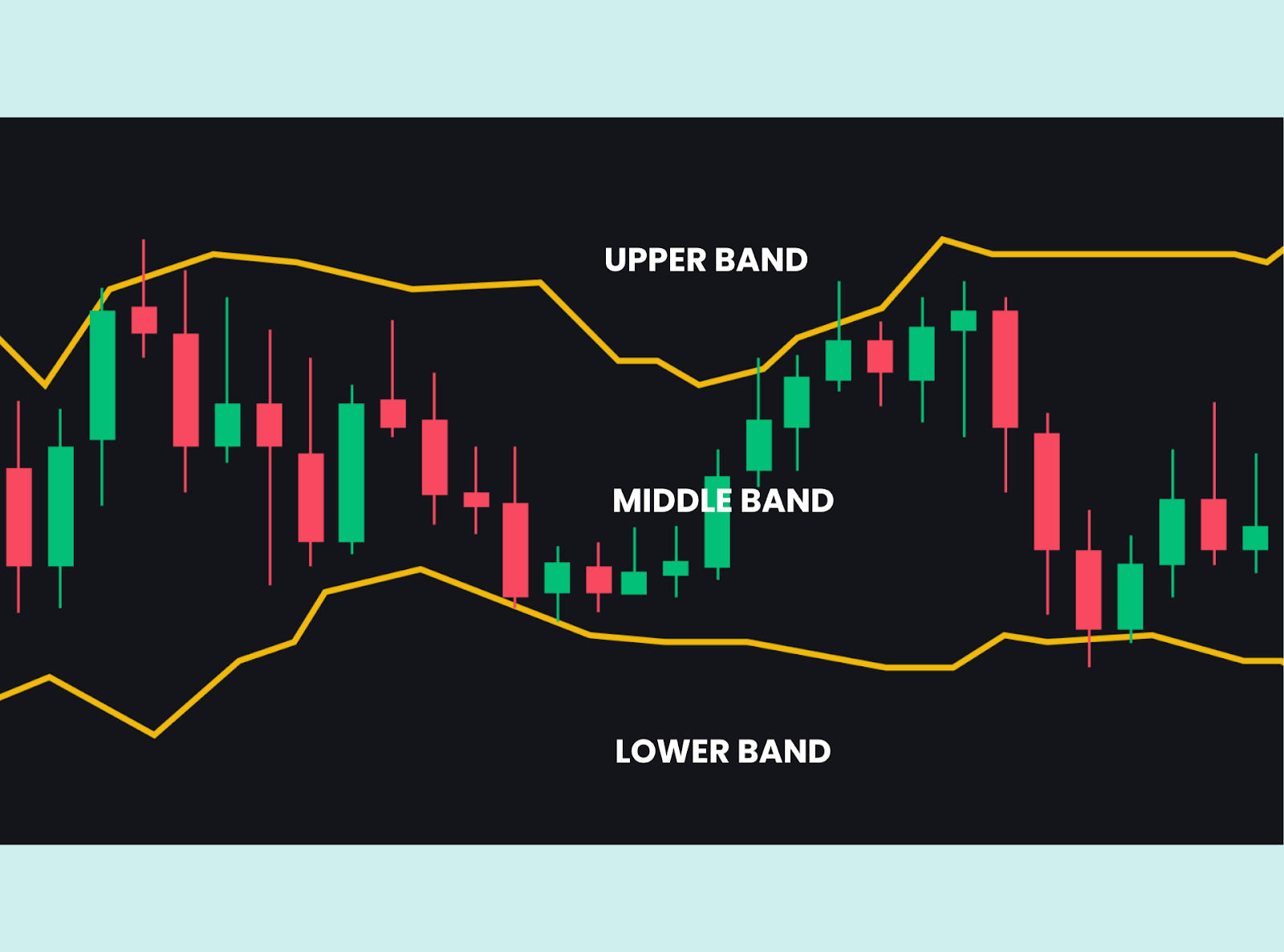

Bollinger Bands

Imagine a flexible tube that expands and contracts around the price of a stock.

That's the idea behind Bollinger Bands, a versatile tool that helps traders visualize volatility and potential price reversals.

Think of it as a dynamic envelope that wraps around the price action, giving you clues about when the market might be getting too hot or too cold.

How Do They Work?

Bollinger Bands have three lines:

- Middle Band: This is the average price over a certain period (usually 20 days).

- Upper Band: This is the upper limit of where the price might go, based on statistics.

- Lower Band: This is the lower limit of where the price might go, based on statistics.

What to Look For:

- Volatility: The wider the bands, the more volatile the market. The narrower the bands, the less volatile.

- Squeezes: When the bands get really tight, it might mean a big price move is coming.

- Breakouts: If the price breaks out of the bands, it could mean the trend will keep going or reverse.

- "W" and "M" Patterns: These patterns within the bands can mean a reversal is coming, like a double bottom or top.

Let's talk about the elephant in the room: self-doubt.

It's that nagging voice that whispers, "You're not good enough," or "This trade is going to fail."

We all experience it, but successful traders know how to manage it.

Here's the truth: self-doubt can cripple your trading performance.

It leads to hesitation, missed opportunities, and ultimately, lost profits.

But here's the good news: you can overcome it.

First, recognize that self-doubt is normal.

Everyone, even the most experienced traders, has moments of uncertainty.

It's how you respond to those doubts that matters.

Instead of letting fear paralyze you, use it as fuel to improve.

Analyze your past trades, identify your weaknesses, and actively work to address them.

Remember, trading is a skill that takes time and practice to master.

Don't expect perfection overnight.

Focus on continuous improvement, and celebrate every step forward.

And most importantly, trust yourself.

You've put in the work, you've developed your strategies, and you have the knowledge to succeed.

Don't let self-doubt rob you of your potential.

It's time to silence that inner critic and embrace the confident trader within you.

The market is waiting.