🤑 Is This Money Real?

THIS is Where the REAL Money is Being Made....

Everyone is focused on the usual suspects: big tech, crypto, etc. But the real profit is being made elsewhere.

We've done the research and we identified a new group of stocks, primed for growth but overlooked by most investors.

Forget the hype – this is about smart, calculated investment.

Are you ready to leave the amateurs behind and join the big leagues? This is your invitation.

📈 Rising Stocks To Watch Out For!

Google (GOOGL), Arista Networks (ANET), and Royal Caribbean (RCL) are in the stock spotlight, with analysts eyeing their performance and growth prospects, as these companies navigate the evolving tech and travel landscapes.

🤖 Nvidia is Promising A Whooping 700% ROI on AI Investment

Is a 700% return on investment even possible in the AI industry? Nvidia's GPUs might just be the catalyst for a revolution.

👨🦲 These Eight Companies Are Projected Make Investors Richer in 2024

Which stocks should you have in your portfolio for maximum growth in 2024? Jim Cramer unveils his top eight picks for investors seeking massive returns.

🚇 Light at the End of the Tunnel As US Inflation Cools Off

A sigh of relief for Americans as inflation continues to cool down, potentially opening the door for the Federal Reserve to cut interest rates. What does this mean for consumers,and the economy?

💄 How A Beauty Brand Fell Apart, Taking Almost $700 Million Dollars With It

This is the story of how a beloved brand lost its way, leaving investors with a $700 million loss and consumers questioning the integrity of the clean beauty movement.

📱 Samsung Workers Revolt, Declares Indefinite Strike

As workers threaten to disrupt production, what far-reaching implications can this have for the entire tech industry in South Korea?

🚘 "Tesla Has Become a Meme Stock!" Investor Cries Out

PIMCO founder Bill Gross declares Tesla has joined the ranks of meme stocks, likening it to the frenzy around GameStop and AMC. Is this the end of Tesla's meteoric rise, or just another bump in the road?

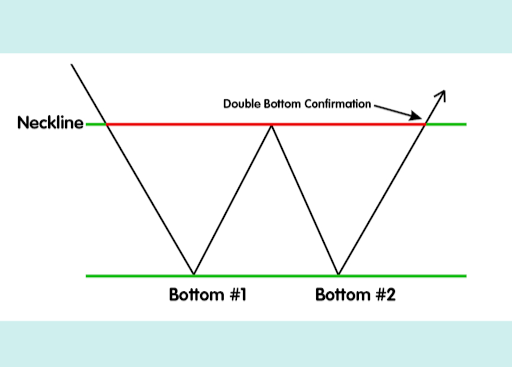

Double Bottom

Imagine a market on a downward spiral, But then, it hits a low point, bounces back up, falls again, and then bounces back up once more. This W-shaped pattern is called a "double bottom".

Why Does it Matter?

The double bottom is a sign that the market might be turning around. It's like the market is testing a price, finding support, and deciding to go up again.

What to Look For:

- Two Low Points: The pattern should have two clear low points at the same price level.

- A Middle Peak: The price should rally between the two lows, forming a peak.

- Neckline Breakout: The price should break above the "neckline" (the high point of the peak) after the second low. This confirms the pattern and often means the market will keep going up.

Today, let's shift our focus from the trading and the stock market to something even more valuable: our lives.

You see, we all have three precious resources that we can use to create the life we truly want. These resources are our health, wealth, and time.

Ever noticed how these resources are interconnected?

You can invest time to earn wealth, or use wealth to buy back some of your time.

You can use time and wealth to improve your health, and good health can lead to more time on this planet.

The Catch: Time is the one resource we can't get more of. It's the most limited, and perhaps, the most valuable asset we have.

This got me thinking: What if we approached our lives like we approach our investment portfolios?

What if we made intentional decisions about how we spend our health, wealth, and time, just like we do with our money?

Now, I'm not saying you need a near-death experience to wake up to this (like some people who quit their jobs or kick bad habits after a health scare).

But maybe, just maybe, we can all benefit from pausing and reflecting on how we're investing in these three key areas.

After all, wouldn't it be awesome to look back on our lives and say we truly lived them to the fullest?

Food for thought, my friends.

Keep investing wisely, in every sense of the word.