Silver Falls as Tariff Hold

....................................................................................................................

It's Friday!

US stock futures are pushing higher this morning as Wall Street tries to close out a choppy week on firmer footing.

After reversing a two-day slide on Thursday, markets are leaning on strength from financials and renewed momentum in big tech to keep weekly gains within reach.

Chipmakers are back in focus after TSMC helped reignite optimism around the AI trade, supported by news of a massive US-Taiwan investment push in domestic semiconductor manufacturing.

At the same time, upbeat earnings from Goldman Sachs and Morgan Stanley gave financial stocks a lift, helping restore balance after a week defined by sharp swings and headline risk.

Still, this isn’t a victory lap. Political tension, geopolitical uncertainty, and lingering questions around the Federal Reserve continue to hang over sentiment.

Even with Friday’s rebound, the major indexes remain on track to finish the week modestly lower.

📈 Wall Street Ends Higher as Banks and Chip Stocks Surge After Strong Earnings

U.S. stocks rallied Thursday with the Dow up 292.8 points to 49,442.44, as standout quarterly results from Morgan Stanley (+5.8%) and Goldman Sachs (+4.6%) fueled gains while TSMC’s blockbuster earnings lifted semiconductor stocks.

🥈 Silver Retreats After Trump Delays Critical Mineral Tariffs, Profit-Taking Hits Rally

Silver prices slid as much as 7.3% after reaching a record high near $93.75/oz, as investors booked profits and the U.S. held off imposing sweeping tariffs on critical mineral import.

🌏 Asian Shares Mixed and U.S. Futures Lifted by Tech Strength After Wall Street Steadies

Asian markets showed a mixed performance while U.S. futures climbed as Wall Street snapped a two-day slide, helped by tech earnings optimism led by chipmakers including TSMC.

💰 Bitcoin Holds Above $95,000 Despite Crypto Bill Delay, Analysts Eye $100K Move

Bitcoin steadied above $95,000 even after a delay in crypto market structure legislation, with analysts saying continued support could propel it toward the $100,000 mark.

🤖 AI Trade Ignites as TSMC Earnings Blowout Reignites Chip Market Rally

A blowout earnings report from TSMC — showing robust demand and capital spending plans — has reignited bullish sentiment in the AI trade and boosted investors’ confidence in chip and tech stocks.

⚡ Mitsubishi to Buy U.S. Shale Gas Assets in $7.53 Billion Deal to Expand Energy Footprint

Japan’s Mitsubishi Corporation agreed to acquire U.S. shale gas and related infrastructure assets for $7.53 billion, marking a major strategic expansion into North American energy.

🛢️ Oil Prices Extend Losses as Odds of U.S. Strike on Iran Recede, Brent near $63.55

Oil prices declined with Brent crude down to $63.55 per barrel and U.S. West Texas Intermediate to $59.04, as fears of a U.S. strike on Iran eased and supply concerns softened.

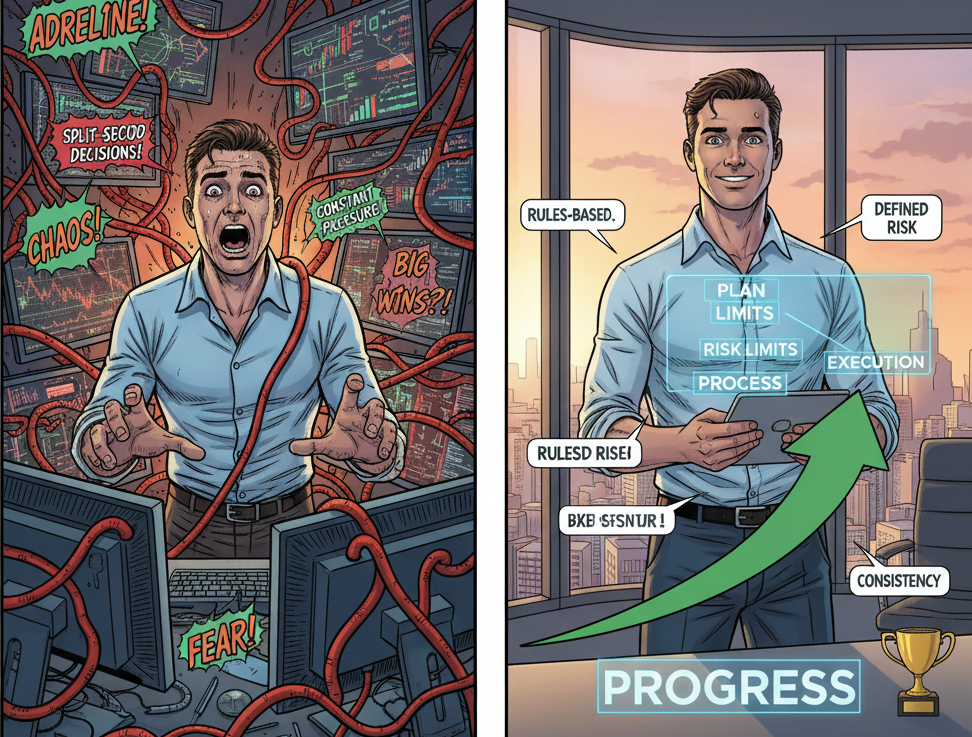

Trading Isn’t as Stressful as You Think

From the outside, trading looks like nonstop adrenaline. Flashing charts. Split-second decisions. Constant pressure. That image scares off people who actually want calm, stable progress.

The truth is the opposite. Stress doesn’t come from trading — it comes from trading without rules. Chaos shows up when there’s no plan, no risk limits, and no process to fall back on. That’s not trading. That’s gambling.

Professional traders aren’t chasing excitement. They’re reducing decisions. Entries are planned. Risk is capped. Outcomes are accepted before the trade is placed. Once structure is in place, emotion drops out of the equation.

Stability comes from repetition, not adrenaline. When you know exactly what you’re looking for and exactly how much you can lose, pressure disappears. Calm replaces noise. Process replaces panic.

Trading only feels high stress when it’s approached without structure. Done properly, it’s one of the most controlled decision-making environments there is.

If you want guidance that shows how trading can be calm, structured, and sustainable, these newsletters help. They focus on process, discipline, and stress-free execution.

Ultimate Oscillator

Developed by Larry Williams, the Ultimate Oscillator is a momentum tool that combines three different timeframes (typically 7, 14, and 28 periods) into a single value. By using a weighted average of these three cycles,

🛠️ The Strategy Logic

Use these logical triggers to identify high-probability reversal points while filtering out market noise:

- IF: The price makes a lower low, but the UO makes a higher low (Bullish Divergence)...

- THEN: A powerful buy signal is brewing. This shows that despite the price drop, the underlying momentum is actually strengthening.

- IF: A Bullish Divergence is present AND the UO line breaks above its recent "peak" (the high between the two lows)...

- THEN: The buy signal is confirmed. This is the official "trigger" point to enter a long position, as it proves momentum has shifted back to the upside.

- IF: The UO rises above 70 and then crosses back below it...

- THEN: The market has reached an overbought extreme and is starting to cool off. This is a signal to take profits or move stop-losses tighter, as a correction is likely.

- IF: Price makes a higher high, but the UO makes a lower high (Bearish Divergence)...

- THEN: The uptrend is losing its internal support. The "ultimate" nature of this oscillator makes this a very heavy warning that a major top is being formed.

- IF: The UO is fluctuating around the 50 centerline...

- THEN: The market is in a "neutral" or sideways state. In this zone, the oscillator provides very little value; wait for a move toward the 30 or 70 extremes before looking for a trade setup.

💡 Pro Tip

The Three-Step Trigger: Larry Williams designed this specifically to be used in three steps: 1. Spot the Divergence. 2. Wait for the oscillator to reach a threshold (below 30 for longs, above 70 for shorts). 3. Wait for the Breakout of the oscillator's previous peak/trough. Only when all three occur is the signal truly "Ultimate." Using just the divergence alone often leads to early entries.

Risk Tolerance Drift

The trade didn’t just boost your P&L — it rewired your comfort zone.

After a big win, nothing seems reckless. Position size feels reasonable. Stops feel negotiable. The rules you swore by yesterday suddenly feel… flexible. Not because you decided to break them — but because your perception of risk quietly shifted.

That’s the danger.

Risk tolerance drift doesn’t announce itself. There’s no adrenaline spike. No red flag. Just subtle adjustments:

- Slightly larger size

- Slightly wider stop

- Slightly more confidence than data supports

And suddenly, you’re no longer trading your system — you’re trading the afterglow of a win.

The market punishes this fast. Not because winning was wrong, but because rules only work when they’re followed at emotional extremes — especially after success.

Big wins test discipline more than losses ever will. If your rules can’t survive a good day, they won’t survive the next bad one.

Check yourself:

If this trade was lost, would you still respect it?

That question exposes drift instantly.