JPMorgan Rattles Investors

....................................................................................................................

Good morning,

Wednesday arrives with pressure from all sides.

US stock futures are sliding this morning as Wall Street digests a reality check after record highs. The early pullback isn’t about one headline — it’s about everything hitting at once.

Bank earnings are rolling in, inflation data is back on deck, and Washington is once again sitting at the center of market risk.

Big banks take the spotlight today, with Bank of America, Wells Fargo, and Citigroup reporting before the bell.

That follows JPMorgan’s underwhelming kickoff to earnings season, which rattled financials and reminded investors that strong markets don’t guarantee strong results.

Add December’s producer price index to the mix, and traders are recalibrating expectations on inflation just as confidence had begun to rebuild.

But the real overhang isn’t earnings — it’s policy. Markets are still waiting on a Supreme Court ruling that could reshape President Trump’s tariff authority, while tensions escalate around the Federal Reserve after the Justice Department opened a criminal investigation into Chair Jerome Powell.

The message is clear: political risk is no longer background noise.

Layer in fresh pressure on financial stocks from Trump’s proposed credit card rate cap, and Wednesday feels less like a pause and more like a stress test.

📉 U.S. Stocks Stall Near Records as Bank Earnings and Inflation Data Loom Large

Stock futures were flat after the S&P 500 pulled back from record highs and the Dow dropped 398 points to 49,191.99, with traders bracing for earnings from Bank of America, Wells Fargo and Citi while softer inflation bolsters Fed rate-cut bets.

💵 U.S. Dollar Bounces on CPI Data

The dollar rebounded after U.S. CPI data came in line with expectations and central bankers publicly backed Fed Chair Powell.

🎬 Netflix Shares Wobble as $82.7B Warner Bros Deal Faces Rising Skepticism

Netflix’s stock is under pressure amid ongoing concern over its proposed $82.7 billion bid for Warner Bros. Discovery assets, with analysts flagging regulatory hurdles and risk to shareholder value.

🏯 Japan Stocks Hit Fresh Record Highs as Snap Election Bets Fuel Rally

Japanese equities climbed to record levels with the Nikkei topping fresh peaks as speculation of a February snap election bolstered investor optimism for fiscal stimulus and further gains.

🌏 Asian Markets Climb Despite Wall Street Pullback

Asian benchmarks mostly rose after Wall Street retreated from record highs, with Japan’s Nikkei jumping 1.5% to 54,341.23, South Korea’s Kospi gaining 0.7%, and China’s $1.2 trillion trade surplus

🥈 Silver Surges Past $90/oz and Gold Climbs as Precious Metals Rally Intensifies

Silver broke above $90.59 an ounce for the first time ever and gold hit new all-time highs near $4,639.42/oz as safe-haven demand accelerated on soft U.S. inflation and rate-cut expectations.

🛡️ Gold Holds Near Record Highs Around $4,640/oz on Safe-Haven Flows and Rate-Cut Bets

Gold stayed close to its peak around $4,640 per ounce, drawing strong demand as geopolitical tensions and expectations of Federal Reserve rate cuts drove investors into bullion.

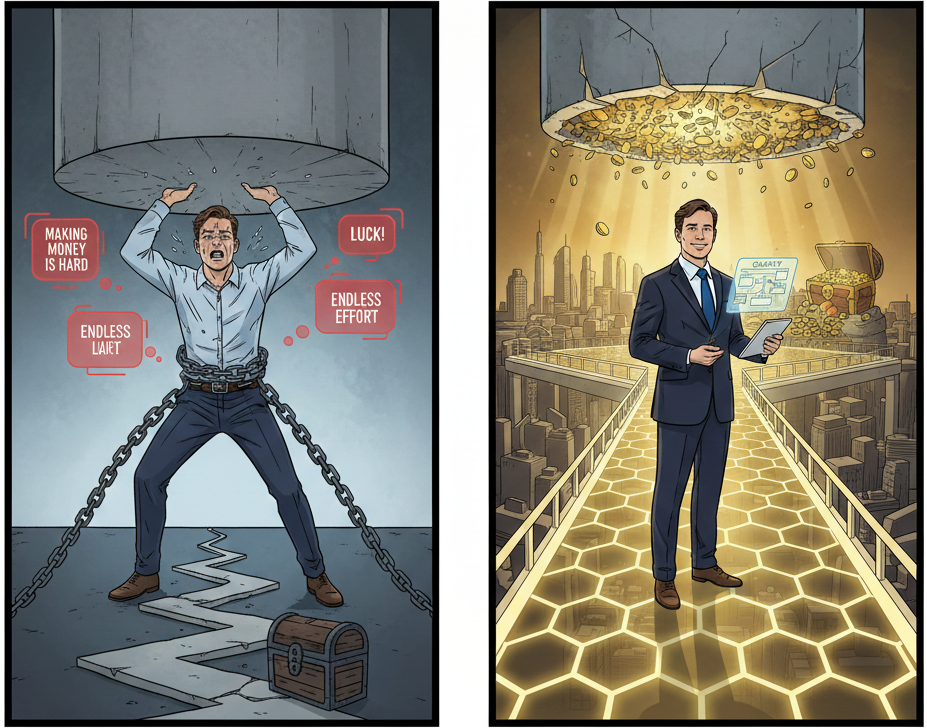

Making Money Isn’t Hard — Your Beliefs Are

“Making money is hard” sounds like wisdom. In reality, it’s a mental ceiling disguised as truth. The moment you accept it, you stop looking for leverage, systems, and repeatable actions that actually work.

Money doesn’t respond to effort alone. It responds to clarity, positioning, and consistency. People who grow wealth aren’t smarter or luckier — they’ve simply replaced struggle-thinking with process-thinking.

When you believe money must be painful, you unconsciously choose complicated paths, delay action, or quit too early. That belief keeps you busy, not profitable. And busy feels productive… until the results never show up.

Shift the mindset and behavior follows. You start asking better questions. You simplify. You build skills that compound instead of chasing shortcuts that exhaust you.

Money isn’t hard. Confusion is. Lack of structure is. The moment you stop fighting money and start understanding it, progress accelerates.

If you want guidance that breaks limiting money beliefs and replaces them with clear systems and repeatable strategies, these newsletters help. They focus on mindset, structure, and actions that make money feel achievable.

Three White Soldiers

The Three White Soldiers is a powerful bullish reversal pattern consisting of three consecutive long-bodied green candles.

It represents a steady, methodical advance where buyers have decisively overwhelmed sellers over several sessions, signaling the start of a major new uptrend.

🛠️ The Strategy Logic

Use these logical triggers to identify high-conviction trend reversals and momentum shifts:

- IF: You see three consecutive green candles with large bodies and very short "wicks" (shadows)...

- THEN: The pattern is strong. Short wicks indicate that bulls maintained control throughout the entire session and closed the price near the daily high.

- IF: Each candle in the sequence opens within the body of the previous candle...

- THEN: The advance is healthy and stable. This "stair-step" opening shows that even when bears try to push back at the open, buyers immediately step in to drive the price higher.

- IF: The pattern forms after a prolonged downtrend or a period of low-volatility consolidation...

- THEN: This is a "Breakout" signal. It confirms that the previous bearish sentiment has been completely broken and a new bullish cycle has begun.

- IF: The second and third candles are significantly smaller than the first candle...

- THEN: Beware of "Overextension." If the candles get smaller as the price goes up, it suggests the bulls are losing steam and the move may be reaching a temporary climax.

- IF: The pattern is confirmed by a rising Volume Oscillator...

- THEN: The move is supported by "smart money." Rising volume across all three days proves that the reversal is not just a short-lived bounce, but a sustained accumulation phase.

💡 Pro Tip

The "Advance Block" Filter: Watch out for "weak" soldiers. If the second or third candles have very long upper wicks, the pattern is actually an Advance Block, not Three White Soldiers. This means sellers are successfully pushing the price back down from the highs each day, and the "reversal" is likely to fail. A true Three White Soldier pattern should look like a solid wall of green.

The Loss You Never Took

The trades you miss stay louder than the ones you lose.

A small red trade ends. You log it. You move on.

A missed move keeps replaying.

You imagine perfect entries. Perfect exits. Easy money.

That imagination is the damage.

Missed trades create fake PnL in your head.

You start trading against a version of profit that never existed.

That pressure leaks into the next setup.

You chase. You enter late. You size wrong.

Invisible losses feel personal because they never resolve.

There is no stop hit. No rule broken.

Just the thought that you should have been there.

Markets do not pay for regret. They pay for execution.

Every missed trade is information, not failure.

It tells you where your rules were, where your focus was, and where your patience stood.

Treat it like data, not a mistake.

If you let missed trades haunt you, they will control your next decision. If you accept them, they lose power.

Protect your mindset the same way you protect capital.