Where Is The Next 100 Bagger?

The future of investing and trading is here, and it's powered by AI.

The future of investing and trading is here, and it's powered by AI.

It's not just transforming industries but creating MASSIVE opportunities for traders and investors alike.

Are you ready to ride the wave to wealth, or will you be left behind?

McKinsey's latest research reveals the jobs most vulnerable to the AI revolution.

But it also shows where the BIGGEST gains are to be made.

Savvy investors are already positioning themselves for the AI boom. Are you?

In this issue, we recommend articles that break down the data, reveal the stocks set to soar, and arm you with the knowledge to make smart, informed decisions.

Bitcoin takes a breather as speculation cools. Is this a sign of a healthier market or the calm before the next storm? Dive in to understand the implications for your crypto portfolio.

🏙️ The AI Takeover That Will Change Everything

Which jobs in New York City are most vulnerable to the AI revolution? McKinsey's research in this exclusive Forbes article provides a detailed look at the occupations facing the biggest disruption by 2030.

🏡 The Housing Market Is Overheating, But Will It Crash?

Real Estate Experts are warning that a perfect storm of factors could trigger a crash. Discover the red flags and learn how to protect your investments.

🤑 What Does It Really Mean to Be Rich?

Dave Ramsey's Eye-Opening Perspective on What It Means to Be Rich. It’s all right here!

↕️ US Inflation Drop Sparks Hope For A September Bounce Back

US inflation drops for the first time since the pandemic, could falling inflation signal a rate cut and economic relief?

🪦 Billionaire’s Crazy Plan to Outsmart Death

Can the super rich cheat death? Discover the crazy plan some billionaires are using to outsmart the Grim Reaper.

🇨🇳 Will China's Economy Ever Overtake the US

It’s not looking good for this big player; China's economic miracle is losing steam. Could this be the turning point for global markets?

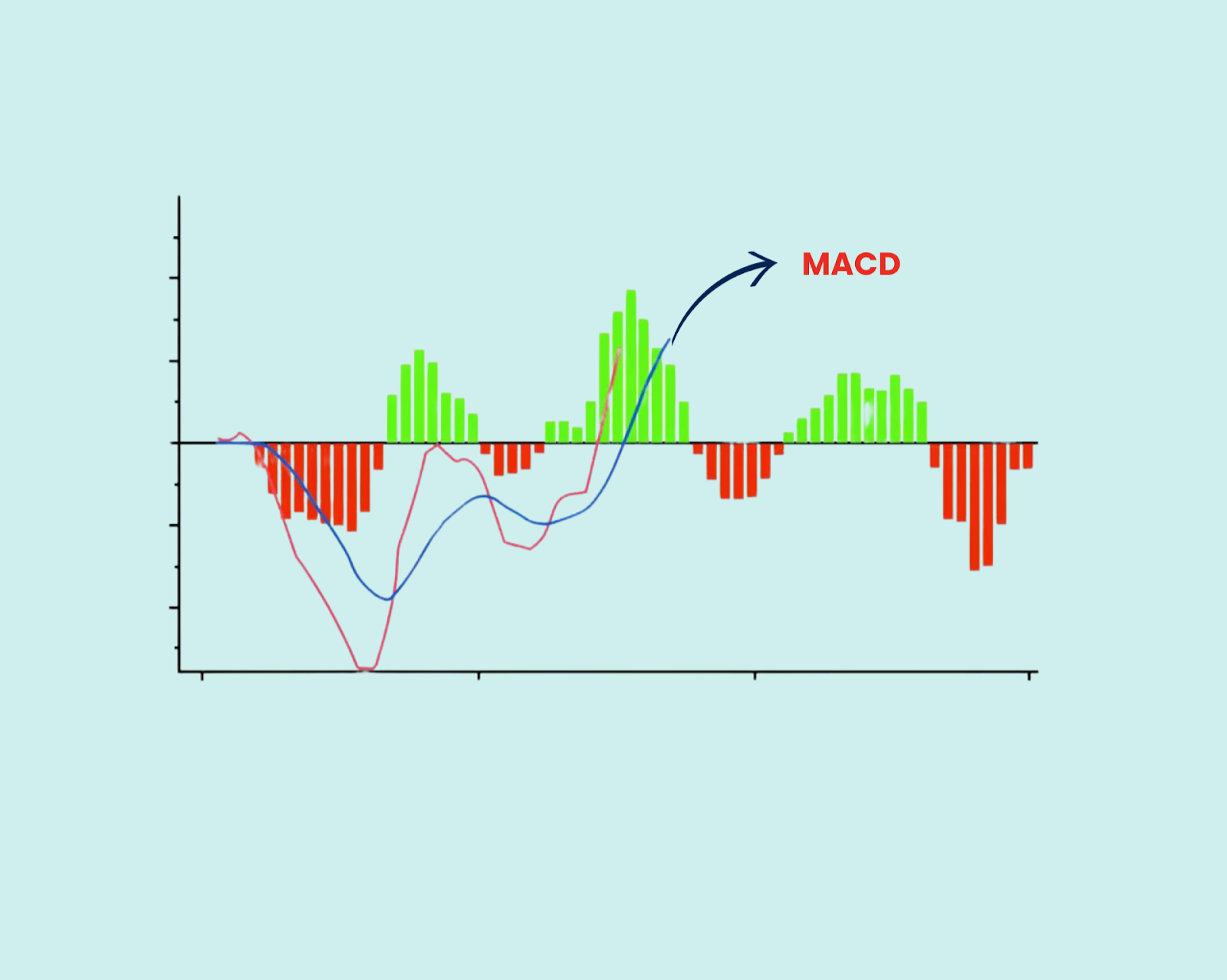

Moving Average Convergence Divergence (MACD)

The MACD is a handy tool for spotting changes in market trends.

It uses two moving averages to measure the strength and direction of a trend, helping you find potential buying or selling opportunities.

How Does it Work?

The MACD has two lines:

- MACD Line: This line shows the difference between two moving averages (one short-term and one long-term). It moves up and down around zero.

- Signal Line: This line smooths out the MACD line, making it easier to read.

What Does it Mean?

The MACD is like a connection between short-term and long-term trends. When the lines come together, the trend might be weakening. When they move apart, the trend is getting stronger.

Let's chat about something that's got everyone buzzing: Artificial Intelligence (AI).

It's not just changing the way we order pizza, it's transforming the world of investing too.

Now, some of you might be thinking, "Is AI going to take over my job?" Honestly, it might change it.

But here's the thing, smart investors and traders don't fear change, they embrace it. They see it as an opportunity.

AI can analyze massive amounts of data at lightning speed, spot trends we might miss, and even help us manage risk more effectively.

Think of it as having a super-smart research assistant working 24/7 for you.

But here's the real secret: AI can't replace human intuition, creativity, and that gut feeling that tells you when a deal is too good to be true.

Those are the skills that will set you apart in this new era.

So, what's the lesson here?

Embrace AI, learn how to use it to your advantage, but never forget that your unique human insights are your most valuable asset.

And hey, that's not just a good investment strategy, it's a pretty good life strategy too, wouldn't you agree?

Keep learning, keep growing, and keep investing wisely (with a little help from our AI friends).