UK Stocks Crush Wall Street

....................................................................................................................

Monday energy is back — and it’s a cautious one.

U.S. stock futures are edging higher as Wall Street eases into a holiday-shortened week, with traders shaking off the weekend and sizing up whether tech has enough fuel for a late-year push.

Last week ended on a mixed note, but a late bounce in AI names helped keep the S&P 500 and Nasdaq in the green, even as the Dow finally took a breather after weeks of outperformance.

This doesn’t feel like a rip-higher kind of Monday. It’s more of a positioning session — lighter volume, tighter moves, and investors watching who shows leadership as the year winds down.

With early closes ahead and the Santa rally still unconfirmed, the week is starting with a question mark rather than a conviction trade.

⛔ Stocks Enter Final Stretch of 2025 Just Off Record Highs

U.S. stocks are closing out 2025 hovering near all-time highs, with investors watching economic data, holiday-thin trading, and positioning for clues on whether the year ends with a final push higher — or a pause.

8️⃣ 8 Lessons for Investors From 2025

From why market timing failed again to how patience quietly paid off, 2025 offered investors hard lessons about risk, expectations, and staying invested during volatility.

💸 S&P 500 Caps Rare Three-Year Run of Outperformance

The S&P 500 is wrapping up its third consecutive year of gains, marking a rare stretch of sustained outperformance driven by strong earnings, resilient growth, and persistent risk appetite.

🪙 XRP, Solana Spot ETFs Lead Inflows as Bitcoin and Ethereum See Outflows

Investor flows shifted across crypto ETFs last week, with XRP and Solana products attracting fresh capital while Bitcoin and Ethereum funds recorded net outflows.

⬆️ Gold and Silver Hit Record Highs as Peter Schiff Tests Bitcoin Conviction

Precious metals climbed to new record levels, but Bitcoin still dominated investor sentiment — prompting gold advocate Peter Schiff to put his long-standing skepticism to the test.

🇬🇧 FTSE 100 Outperformed the S&P 500 in 2025 — Is There More Upside in 2026?

UK stocks beat U.S. equities this year, and strategists say valuations, dividends, and shifting global capital flows could keep the FTSE 100 competitive heading into 2026.

🌏 Asia Shares Extend Tech Rally as Yen Remains Under PressureAsian markets advanced as technology stocks continued to lead gains, while a weakening yen kept currency markets in focus across the region.

Most Strategies Fail Because Traders Quit Early

Many traders believe a strategy stopped working when results turn rough.

They jump to a new approach after a few losses. That cycle creates doubt and confusion. Nothing has time to prove itself.

Every strategy goes through drawdowns. Losses do not mean failure.

They mean the plan needs time and proper execution. When you quit early, you reset your learning and repeat the same mistakes.

Progress comes from sticking with one approach long enough to collect real data.

Consistency reveals what works. Switching hides it.

If you want guidance that helps you stay consistent and evaluate a strategy the right way, these newsletters break down clear systems and realistic expectations.

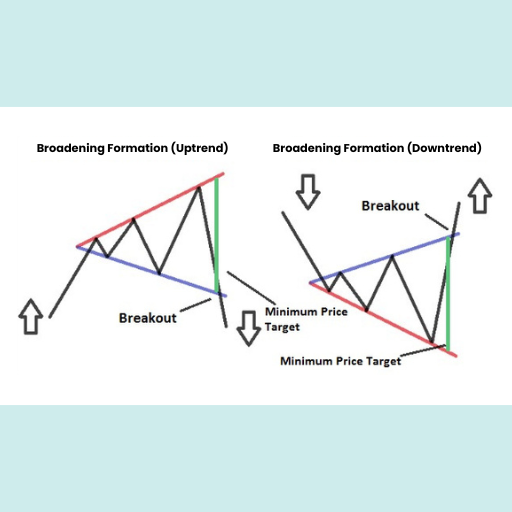

Broadening Formation

The Broadening Formation is a high-volatility chart pattern that signals intense disagreement between buyers and sellers. Unlike most patterns that contract as they develop (like Triangles), this pattern expands, making higher highs and lower lows over time.

Visually, it looks like a Megaphone or a funnel opening to the right. It typically occurs at market tops or during periods of extreme economic uncertainty, representing a "choppy" market where investors are reacting emotionally to news.

It is generally considered a bearish reversal pattern, though it can sometimes act as a continuation.

What to Look For (Key Features and Signals)

The Broadening Formation is one of the most difficult patterns to trade because it lacks a clear "coiling" of price, instead showing increasing chaos.

- Pattern Shape: The pattern is formed by two diverging trend lines. The upper trend line slopes upward (connecting at least two higher highs), and the lower trend line slopes downward (connecting at least two lower lows).

- Increasing Volatility: Each successive price swing is larger than the last. This indicates that the market is becoming less disciplined and more emotional, with "smart money" often sitting on the sidelines while retail traders battle it out.

- Volume Profile: Volume usually remains high or irregular throughout the pattern. Unlike a triangle where volume dries up, the megaphone shape often sees volume spikes on both the highs and the lows, confirming the lack of consensus.

- Partial Declines and Peaks: A common "hint" that a breakout is coming is when the price fails to reach the opposite trend line.

- If price starts falling but turns back up before hitting the bottom line, an upside breakout may be coming.

- If price starts rising but turns back down before hitting the top line, a downside breakdown is likely.

- Breakout Confirmation: The pattern is confirmed when the price breaks decisively outside of one of the diverging trend lines.

- A break below the lower trend line is a strong bearish signal.

- A break above the upper trend line is a bullish signal, though these are often "blow-off tops" that can quickly reverse.

- Target Price: Traders often measure the height of the widest part of the formation and project that distance from the breakout point in the direction of the break.

Emotional Expiration

Losses do not end when the trade closes.

They end when you process them.

When you don’t, they linger. Quietly. Invisibly. And they leak into the next trade.

You hesitate on entries you would normally take.

You tighten stops for no technical reason.

You grab profits early, not because price told you to, but because relief feels safer than discipline.

This is emotional expiration. A trade that is finished on the chart but still open in your head.

Unprocessed losses distort judgment.

They shrink your risk tolerance without you noticing. You start trading to avoid pain instead of trading your plan.

This is how good strategies stop working for people who once trusted them.

The fix is not revenge trading. It is not forcing confidence. It is giving losses a proper ending.

Review the trade.

Name the mistake, or confirm there wasn’t one.

Accept the outcome without rewriting the story.

Once a loss is understood, it loses its power.

Once it is accepted, it stops whispering into the next decision.

Clean trades require a clean mental slate.

If you don’t clear it, the market will keep charging interest.