Trump Tariffs Lit Europe

....................................................................................................................

Monday opens with a jolt out of Europe.

Global markets are starting the week on edge after a sharp escalation in trade tensions between the US and Europe.

European stocks slid from near-record levels as investors reacted to President Trump’s surprise tariff announcement tied to Greenland, reviving fears of a renewed transatlantic trade war.

Sectors most exposed to US demand — particularly automakers and luxury names — led the sell-off, while defense stocks moved sharply higher as geopolitical risk jumped.

The sudden shift in tone caught markets off guard after a strong start to the year, reminding investors how quickly policy headlines can flip sentiment.

US equity futures softened in response, though the cash market is closed for a public holiday, muting immediate spillover.

Still, the message heading into the week is clear: geopolitics is back in the driver’s seat, and volatility may not stay confined to Europe for long.

🥇 Gold and Silver Surge to All-Time Highs as Trump’s Greenland Tariff Threat Sparks Safe-Haven Rush

Gold climbed near $4,670/oz and silver hit record highs above $93/oz as investors piled into precious metals amid fears of a widening U.S.–Europe trade conflict triggered by tariff threats.

📉 Tariff Threat Looms as Trump Aims Higher Duties at Europe, Weighing on Risk Assets

President Trump’s announcement of escalating tariffs on eight European nations rattled markets, sending stocks and Bitcoin lower while fueling safe-haven demand.

🌍 Global Markets Wobble Under Fresh Trade Tensions with World Stocks and Currencies Swinging

World markets are facing volatility with equity futures sliding and the euro and yen reacting sharply as Trump’s proposed Greenland-linked tariffs stoke risk-off sentiment.

🪙 Trump’s Greenland Tariff Threat Ripples Through Crypto, Bitcoin Dips Below $93K

Bitcoin slid toward $92,000 as tariff-induced trade war fears spurred a risk-off mood that hit cryptocurrencies alongside equities.

💰 Bitcoin Down and Gold Futures Up as Europe Threatens Trade ‘Bazooka’ Retaliation

As Trump’s Greenland tariff dispute escalates, Bitcoin slipped under $92,500 while gold and silver futures climbed with safe-haven buying.

💵 Dollar Slides as Trump Tariff Pressure Grows, Safe-Havens Like Yen and Franc Strengthen

The U.S. dollar weakened against major rivals as investors sought safety in the yen and Swiss franc amid rising geopolitical and trade tensions from Trump’s tariff threats.

🛢️ Oil Firms Slightly as Iranian Supply Risk Eases and Market Focus Shifts to Tariff Fallout

Oil prices held firmer after talks of reduced Iranian supply concerns, even as broader markets faced uncertainty from escalating U.S.–Europe tariff risks.

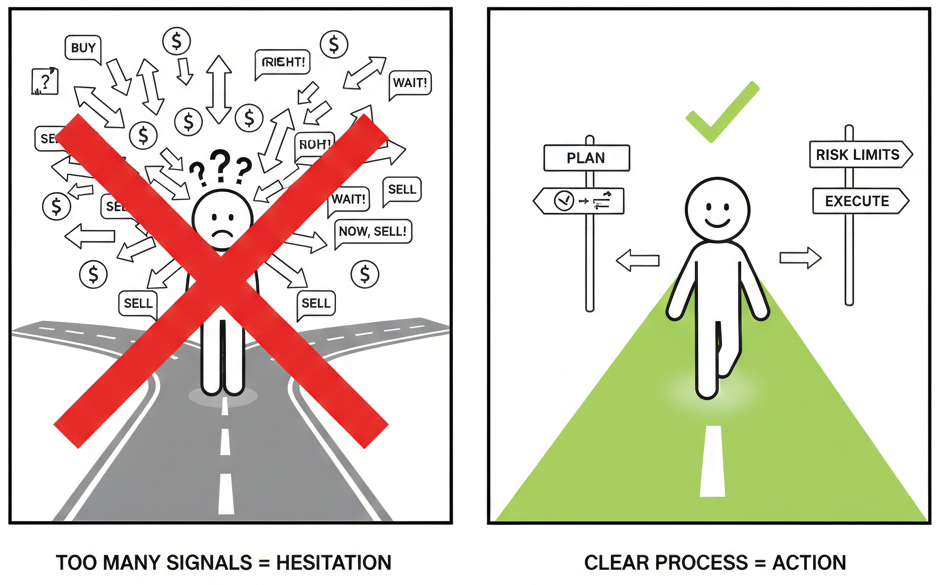

It’s Not Fake Signals — It’s Too Many of Them

The charts aren’t lying. The overload is. When every indicator flashes something different, confidence collapses.

One says buy. Another screams sell. Suddenly, doing nothing feels safer than being wrong.

Most traders don’t lose because signals are fake. They lose because they stack tools without understanding what problem each one solves. More indicators don’t create clarity — they create hesitation. And hesitation kills execution.

Legit signals are simple, repeatable, and grounded in price behavior. They don’t predict. They frame probabilities. When you understand why a tool works, doubt disappears. You stop second-guessing and start executing with intent.

Action doesn’t come from certainty. It comes from trust in a process.

One setup. One logic. One reason for entering and exiting.

The moment you stop hunting for the “perfect” indicator, clarity returns. And clarity is what turns hesitation into movement.

If you want guidance that cuts through indicator noise and focuses on proven, simple market logic, these newsletters help. They teach how to identify real signals, build trust in your setups, and act without doubt.

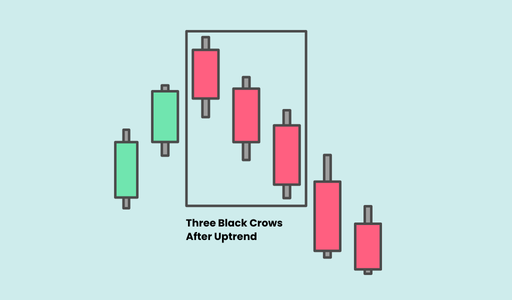

Three Black Crows

The Three Black Crows is a high-conviction bearish reversal pattern. It consists of three consecutive long-bodied red candles that "stair-step" downward.

It visualizes a total collapse in buyer confidence, where sellers are so aggressive that they prevent any intraday recovery, signaling a major trend shift from bullish to bearish.

🛠️ The Strategy Logic

Use these logical triggers to identify when a major uptrend has ended and a deep correction is starting:

- IF: You see three consecutive red candles with large bodies and very short lower wicks...

- THEN: The bearish conviction is extreme. Small lower wicks indicate that the bears pushed the price down and kept it there until the very end of the session, leaving no room for a bounce.

- THEN: The bearish conviction is extreme. Small lower wicks indicate that the bears pushed the price down and kept it there until the very end of the session, leaving no room for a bounce.

- IF: Each candle in the sequence opens within the body of the previous candle...

- THEN: The decline is orderly and powerful. This shows that even when the market tries to open slightly higher, it is immediately met with a wall of selling pressure that "engulfs" the previous gains.

- THEN: The decline is orderly and powerful. This shows that even when the market tries to open slightly higher, it is immediately met with a wall of selling pressure that "engulfs" the previous gains.

- IF: The pattern forms after a parabolic (near vertical) move upward...

- THEN: This is a "Trend Exhaustion" signal. It often marks the exact moment the "bubble" bursts, and the subsequent move lower is likely to be fast and aggressive.

- THEN: This is a "Trend Exhaustion" signal. It often marks the exact moment the "bubble" bursts, and the subsequent move lower is likely to be fast and aggressive.

- IF: The bodies of the candles get progressively larger as the pattern develops...

- THEN: The panic is accelerating. Increasing candle size shows that more sellers are rushing for the exit, which often leads to a sustained downtrend rather than a brief pullback.

- THEN: The panic is accelerating. Increasing candle size shows that more sellers are rushing for the exit, which often leads to a sustained downtrend rather than a brief pullback.

- IF: The third candle breaks below a major moving average (like the 50-day SMA) or the Middle Keltner Channel...

- THEN: You have a "Structural Breakdown." The pattern hasn't just reversed the trend; it has broken the support levels that were keeping the uptrend alive.

💡 Pro Tip

The "Oversold" Trap: Because Three Black Crows involves three big down days, the market can often look "oversold" by the time the pattern is finished. Do not buy the dip immediately. While you might see a small relief bounce, the "Crows" indicate that the long-term trend has changed. Use any small bounce back toward the middle of the pattern as an opportunity to exit longs or enter shorts, rather than a signal to go long.

Confidence Inflation

Wins don’t just grow your account — they quietly expand your ego.

After a few green days, certainty creeps in. Your reads feel sharper. Your instincts feel cleaner.

And without realizing it, position size starts answering to confidence instead of logic.

Not because you’re reckless — but because success makes risk feel smaller than it is.

That’s confidence inflation.

It shows up subtly:

- “This setup feels obvious”

- “I can size a bit more”

- “I’m in sync with the market right now”

But the market doesn’t reward confidence. It rewards alignment with risk. When size grows faster than edge, probability turns against you — fast.

The irony?

Confidence isn’t the enemy. Unmeasured confidence is.

Real confidence is boring. It keeps size consistent after wins. It respects limits even when you feel unstoppable.

If your sizing changes because you feel better — not because your system improved — inflation has already started.

Anchor rule:

Let rules scale risk, not emotions.

Because the market has a brutal way of deflating egos that float too high.