Trump Revives Tariffs

....................................................................................................................

Good morning, it’s Wednesday, and the market’s feeling as unpredictable as a cat on a hot tin roof.

This week surprise Trump tariff blitz on Japan and South Korea sent the S&P 500 reeling nearly 1%, tech giants wobbled, and even Tesla got knocked for a nearly 7% loss as Musk’s new “America Party” plans hit rough waters.

But it’s not all chaos:

Goldman Sachs just lifted its S&P target to 6,900 on renewed Fed‑easing hopes, while Bitcoin whales are gobbling up BTC near $112K, signaling big‑money confidence.

Meanwhile, Nissan shares plunged 6% on bond dilution fears, Samsung’s AI chip battle cut profits in half, and gold’s clinging near $3,333 as traders weigh safe havens.

Buckle up - today’s setups are all about survival and seizing opportunity in the glare of trade‑war headlines.

🔴 US Stocks Suffer Worst Day in Weeks on Surprise Trump Tariff Blitz

S&P 500 falls nearly 1% as President Trump rolls out 25–40% tariffs on Japan, South Korea and others. Market optimism turns to panic over new trade war flare-up, pressuring automakers and tech shares.

🎯 Goldman Sachs Raises S&P Targets, Predicts Rally on Fed Easing

With rate cuts back in play and tech giants staying strong, the bank sets a 6,900 target for next year. But they warn: don’t rule out surprises as Q2 earnings season tests market conviction.

🚗 Nissan Shares Tank 6% as Bond Move Sparks Dilution Fears

The automaker boosted its convertible bond issue to ¥200 billion after strong demand, but stock investors recoiled. Struggling with losses and junk-rated debt, Nissan is racing to raise cash for electrification and refinancing.

🤖 Samsung Stumbles in AI Chip War, Profits Halved

Q2 operating profit tumbles to $3.3B as HBM shipment delays bite. Hynix races ahead as Nvidia’s top supplier, forcing Samsung to bet big on a second-half comeback with its next-gen memory tech.

🇺🇸 Tariffs Jolt Wall St as Musk’s New Party Tanks Tesla

Stocks tumbled after Trump announced sweeping 25% tariffs on Japan and South Korea. Tesla plunged nearly 7% as Musk unveiled the “America Party,” adding fresh drama to markets already spooked by trade tensions.

🐳 Bitcoin Whales Double Down as BTC Nears All-Time High

Big-money investors are scooping up BTC even with prices hovering just below $112,000. Their aggressive buying signals smart money is betting on even more upside ahead while smaller holders cash out.

🪙 Gold Holds Steady as Trump Plays Tariff Poker

Prices hover near $3,333 as markets digest Trump’s latest tariff blitz and watch for negotiation fallout. With uncertainty rising but deadlines delayed, gold’s safe-haven appeal isn’t fading just yet.

New setup on the radar 👀

📉 ADTRAN Holdings Inc. (NASDAQ: ADTN)

ADTRAN just gave us a beautiful lower high bounce right into structure — and it’s doing what weak charts do best.

Fizzle.

We’re taking a sell position at $9.34, right where sellers stepped in before.

🎯 Targets:

Sell: $9.34

TP1: $8.85

TP2: $8.40

Let’s catch the slip while others are still waiting for the bounce.

Overthinking Is the Most Expensive Strategy That Never Works.

Endless research. Ten tabs open. Three conflicting YouTube gurus. Sound familiar?

When traders fall into the trap of “analysis paralysis,” they start believing that one more article, one more indicator, or one more opinion will magically guarantee success.

Spoiler: it doesn’t.

Great trading isn’t about knowing everything—it’s about knowing enough to take action.

That’s where the right trading newsletters come in.

They simplify your decisions, cut through the noise, and give you digestible insights you can actually use - without spending hours second-guessing.

If your mouse hovers over the buy button longer than your coffee stays hot, these newsletters will give you the clarity (and confidence) to finally make a move.

👉 If you’re tired of letting hesitation kill your momentum, start here!

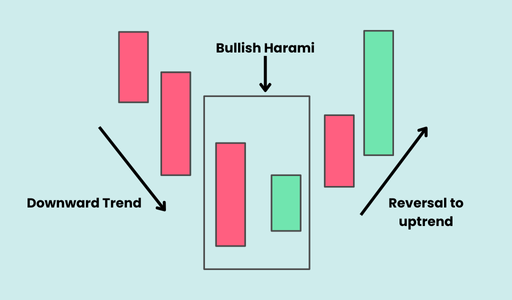

Bullish Harami

The Bullish Harami is a two-candlestick bullish reversal pattern that appears after a downtrend.

It signals that the selling pressure is slowing down and buyers might be starting to take control.

What to Look For:

- Two Candlesticks: The pattern consists of two candles.

- First Candle (Bearish): A large bearish (red or black) candle, confirming the existing downtrend.

- Second Candle (Small Bullish/Bearish): A small-bodied candle (either green/white or red/black) that is completely contained within the body of the first candle. This means its open and close are both within the previous large candle's body.

- The second candle indicates indecision and a potential loss of momentum for the sellers. A bullish (green/white) small candle is generally preferred but not strictly necessary for the pattern.

- The second candle indicates indecision and a potential loss of momentum for the sellers. A bullish (green/white) small candle is generally preferred but not strictly necessary for the pattern.

- Appearance After a Downtrend: For it to be a valid reversal signal, it must appear after a clear downtrend.

- "Pregnant" Shape: The pattern resembles a pregnant woman, where the large first candle is the "mother" and the small second candle is the "baby" within its body.

- Volume: Volume often decreases on the second candle, confirming indecision.

- Confirmation: The Bullish Harami is a warning sign, not a strong reversal signal on its own. Confirmation from the next candle (e.g., a strong bullish candle, a gap up) or other technical indicators (like an RSI turning up or a support level holding) is crucial.

🎯 Most traders don’t lose because they’re lazy… they lose because they’re everywhere.

Every chart.

Every pair.

Every strategy they saw on Instagram last night.

But know this;

Focus is a superpower.

📌 One setup you know like your heartbeat.

📌 One pair you’ve mastered inside out.

📌 One risk model that keeps you disciplined.

That’s how consistency is built.

That’s how accounts grow.

Every candle isn’t your signal.

Every move isn’t your trade.

The more you cut the noise, the louder your results get.

Want to level up?

Simplify.

Want mastery?

And if you’re serious about trading with clarity, keep riding with Trading TLDR - where we don’t just watch markets, we train minds.