Tax Bill Brings Chaos

....................................................................................................................

Good morning. It’s Friday. Finally.

The House just passed Trump’s “One Big Beautiful Bill” by a single vote - and Wall Street’s not clapping.

Why?

Because this “beauty” could blow a $3.3 trillion crater in the federal budget. Moody’s already downgraded us.

Yields are still screaming past 5%. And traders?

They’re standing like statues, watching it all unfold.

In other words: vibes are... chaotic neutral.

But don’t worry - we’ve got the crucial update you need to know below.

⛔ Markets Stall as Trump’s Tax Bomb Looms

“Trump’s ‘big, beautiful’ tax bill could blow a trillion-dollar hole in the deficit — and Wall Street’s holding its breath. Futures tiptoe higher after Wednesday’s sharp selloff, but Moody’s credit downgrade is still echoing through the market.

👟 Nike’s Back. Prices Are Up. Game On.

Nike just made a power move - it's back on Amazon and raising prices next week. After years of solo play, the retail giant is rejoining forces with Amazon to reclaim its market edge.

🤏 5% Yields Rattle Wall Street as Debt Fears Mount

Yields just pierced 5%, and investors aren’t cheering — they’re fleeing. With Trump’s $3.8 trillion tax bill looming and Moody’s downgrade still fresh, markets are gripped by fiscal fear.

Bitcoin Blasts Past $110K in Historic Surge

Bitcoin just shattered another all-time high, breaking $110K with a 3% daily jump and a 47% rally since April’s tariff dip. But this isn’t retail FOMO — it’s big money stepping in, with $1.1 billion leveraged trades and predictions of $160K by year-end.

🌏 Global Stocks Slide on U.S. Debt News

Markets from Tokyo to Frankfurt are tumbling as investors sound the alarm on U.S. debt and surging Treasury yields. A weak 20-year bond auction forced yields above 5%, sparking a sharp sell-off across Wall Street and now rippling through Asia and Europe.

🛢️ Oil Trouble on the Horizon?

Oil is piling up- on land and at sea - and that’s a flashing red light for prices. With inventories hitting their highest levels since the pandemic, and China stockpiling like it’s bracing for winter, traders are bracing for a deeper downturn.

🪙 Gold Surges as U.S. Debt Fears Grow

Gold just hit a two-week high - and it’s not just the dollar that's weakening. Investors are piling into the yellow metal as jitters grow over the U.S. debt load and sluggish demand for Treasury bonds.

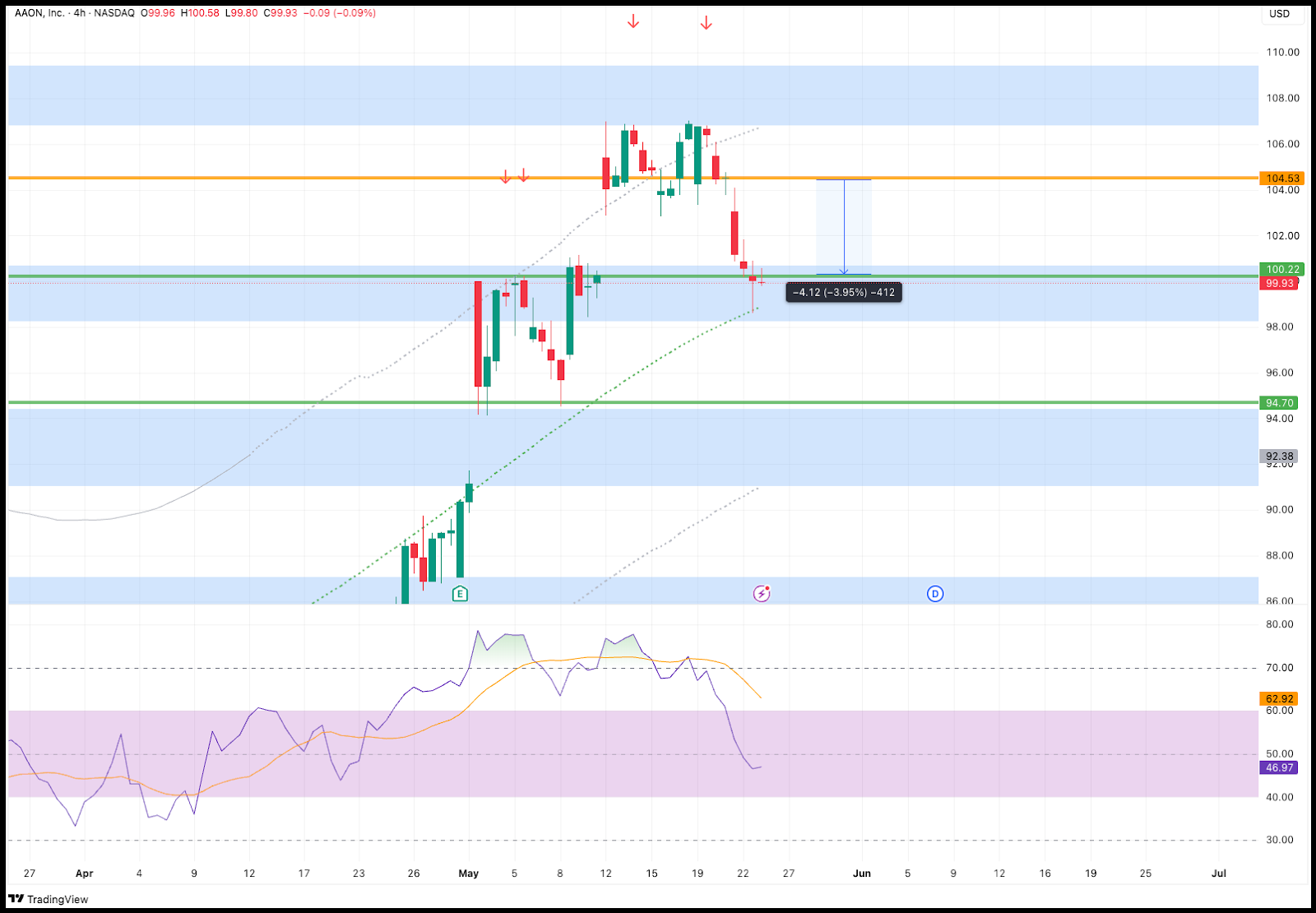

AAON Inc. (NASDAQ: AAON) – Trade Closed

We took a sell at $104.53, right as AAON was losing grip near a key resistance zone.

The chart showed weakness creeping in - momentum fading.

RSI tipping over - and we acted on it.

Price dropped smoothly, I closed the full position at $100.22.

That locks in a 3.95% gain before leverage.

Not every trade needs to hit the final target.

Sometimes the smart move is knowing when to step out early and secure the win.

Executed. Booked. Done. 📉✅

You Could Win This Trade... If You’d Just Pull the Trigger

Second-guessing every move?

You’re not alone - many traders freeze up right when the market’s calling for action.

It’s not because you’re bad at trading... it’s because you’re trading without a playbook.

When you lack structure, feedback, and real-world insight, doubt creeps in fast - and kills your confidence.

These curated newsletters cut through the noise.

They’re built to help you make clear, confident decisions by showing you exactly what seasoned traders are watching, thinking, and acting on - every day.

From market psychology to tactical setups, they hand you the tools (and the mindset) you need to trust your trades again.

👉 If you’re tired of doubting yourself every time you see a setup, these newsletters will help you pull the trigger with conviction.

Rounding Top

A Rounding Top, also known as a saucer top, is a long-term bearish reversal chart pattern that signals a potential shift from an uptrend to a downtrend.

It forms as the price gradually rises, reaches a high, and then slowly declines in a rounded, inverted saucer-like shape.

What to Look For:

- Prolonged Uptrend: The pattern typically forms after a significant uptrend.

- Gradual Price Increase: The initial increase is smooth and gradual, forming the left curve of the inverted saucer.

- Extended Consolidation High: The price reaches a high point and trades sideways for a period, forming the top of the inverted saucer. This high is often not a sharp V-top but a more gradual rounding.

- Gradual Price Decrease: Following the high, the price slowly starts to decline, forming the right curve of the inverted saucer, mirroring the initial increase.

- Breakdown Below Support: The pattern is confirmed when the price breaks below the support level formed by the lowest point of the previous uptrend or the low point at the beginning of the rounding formation.

- Increased Volume on Breakdown: A noticeable increase in trading volume during the breakdown adds validity to the bearish signal.

- Long Formation Time: Rounding tops are typically long-term patterns, taking weeks, months, or even years to fully develop.

- Potential Measured Move: The potential price target after the breakdown can be estimated by measuring the depth of the rounding top and projecting that distance downwards from the breakdown point.

Let’s talk about rules - yeah, those annoying things you swear are holding you back.

When you’re new, trading rules feel like seatbelts on a rollercoaster.

You want the thrill.

You want to go fast.

You want to hit buy 10 times a day.

But the experienced trader?

He knows better.

The whole point of rules is to slow you down.

Not because markets reward inactivity... But because random trades = random results.

And you’re not here to gamble - you’re here to grow.

“More trades don’t mean more profits.

They just mean more risk, more fees, and more emotional burnout.”

Want to blow up your account faster?

Trade every setup that looks “kinda good.” Want to actually stay in the game?

Get ruthless with your entries.

Every trade you skip that doesn’t meet your rules?

That’s a win. That’s discipline.

That’s how pros print longevity - not just lucky wins.

So today’s mantra is simple: Fewer trades. Better trades. Bigger peace of mind.

Now go channel that sniper energy.

🎯 One bullet, one kill.