Starbucks Hits Sell

....................................................................................................................

Good morning, traders.

This week feels like standing in front of a loaded buffet with one hand on the plate and the other checking for landmines.

We’ve got big tech earnings on deck.

Alphabet, Tesla, Intel, IBM- all reporting this week. And you know how that goes.

If AI stocks keep the rocket fuel burning, the indices could blast higher. But if any of these giants stumble, expect fireworks - especially in options land.

Then there’s the tariff tension simmering in the background. Trump’s “Liberation Day” tariffs deadline came and went, but the market is still twitchy.

Traders are watching China, Europe, Japan - waiting to see if we get a soft deal or a hard slap. Either way, the next move could shift inflation, corporate profits, and the Fed’s mood.

Speaking of the Fed, Powell’s up this week too.

A few words from him could tilt rate-cut bets in minutes, and nobody wants to be caught flat-footed.

Add in CPI, jobless claims, and market technicals flashing caution signs and you’ve got the recipe for a fast and loud week.

🏆 Wall Street Keeps Winning

Another day, another high. Traders keep buying as rate cut hopes and Trump’s business-friendly playbook fuel the rally. The big question now? Can this streak survive next week’s tech earnings?

🧋Starbucks Hits Sell List

Jefferies just downgraded Starbucks, warning the buzz is too big for the actual results. But with China deals brewing and a CEO shakeup in play, most investors are still hanging around for the next cup.

📺 Netflix Prints Big, But…

Retail traders love the beat-and-raise - but Wall Street’s sweating Netflix’s content costs. More hits = more cash burn, and not everyone’s ready to stream that risk.

🚀 $155K Bitcoin Next?

Bitcoin just flashed the golden cross signal Wall Street watches for. Last time it did? BTC didn’t stop until it went vertical.

🌪️ Calm Before Earnings Data Storm?

Equities stayed flat while bond yields slid, as traders weighed tariff threats and prepped for a flood of tech earnings. FOMO’s lurking - but so is caution.

☕ London Stocks Wake Up

After years in the doghouse, UK stocks are suddenly hot again. Foreign investors are piling in, chasing cheap valuations and post-Brexit bargains.

📉 Gold Flatlines, Bears Lurk

With the dollar flexing and U.S. data flashing strength, gold bulls are tapping the brakes. Prices are holding steady today but sliding for the week.

✅ No new stock recommendations today.

We’re sitting tight. No clean setups that meet our standards just yet.

Patience is part of the strategy — no trade is better than a bad trade.

We’ll be back in the next issue if a new opportunity lines up.

Scam-Proof Your Trading Journey - Know What to Watch For

Trading has a trust problem. Everywhere you turn, there’s someone flashing profits, selling a dream, or promoting a “guaranteed system.”

It’s no wonder you’re skeptical.

And honestly? You should be. Because blind trust in the wrong people can cost you more than just money - it can kill your motivation to learn the right way.

That’s why we recommend newsletters from Refindads’ trusted trading creators.

These aren’t hype machines.

They’re built by real traders with real skin in the game - people who’ve been burned before and now focus on teaching, not selling fantasies.

You’ll get practical insights, honest breakdowns, and zero pressure to “buy the dip” because some influencer said so.

🔍 Start learning from sources that earn your trust—not demand it.

👉 Explore recommended trading newsletters on Refindads

Because once you know what to watch for, you won’t fall for the noise again.

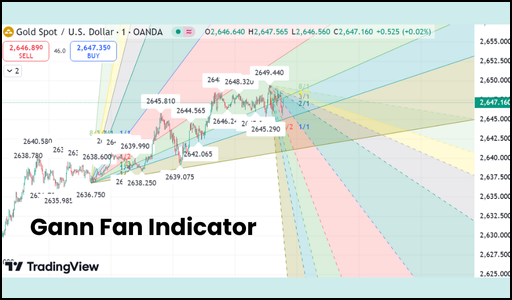

Gann Fan

Gann Fan is a charting tool that draws special angled lines from a key price point. These lines are believed to predict future areas where price might find support or resistance.

What to Look For:

- Angled Lines: It's a bunch of lines spreading out from a major high or low point on the chart.

- 45-Degree Line is Key: The most important line is the 45-degree angle (called 1x1). It's seen as a balanced movement of price over time.

- Support & Resistance: These angled lines act like dynamic support (price bounces up) and resistance (price bounces down) levels.

- Breaking a Line = Change: If the price crosses a Gann line decisively, especially the main ones, it often signals a change in the trend's strength or even a reversal. Price tends to then move towards the next line.

- Price Follows Lines: Often, price will travel along these lines before breaking through or bouncing off.

Imagine this:

You’re 26 years old.

You walk into your trading desk on Wall Street.

And by lunchtime, you’ve already made $300 million in profits in just one year.

That was Bill Lipschutz at Salomon Brothers in the 1980s.

But here’s the twist: He wasn’t always the guy printing millions.

Lipschutz actually started by blowing up his first trading account - a $12,000 inheritance from his grandmother - while he was still in college.

Wiped it clean. Gone.

So, what changed?

He didn’t quit. He studied harder. He learned to trade less, not more.

He focused on risk management first, profits second.

When he finally made it to the big leagues, Lipschutz wasn’t chasing setups all day.

He was patient.

He’d sometimes wait weeks for one trade and when it came, he’d size it right and protect his downside.

His motto?

"The real money is made in the waiting."

It’s not about getting into more trades.

It’s about getting into the right trade, at the right size, with the right mindset.

So ask yourself today:

Are you trading to feed your FOMO, or are you trading to build a legacy?

That’s your Mind Over Market moment.

Write it down. Review it weekly.

We’ll be back next issue - same time, same focus.