Snowflake Lifts Off

....................................................................................................................

Happy Friday!

The Gaza ceasefire has Wall Street exhaling, with Dow, S&P, and Nasdaq futures nudging higher.

Investors are focused on Powell’s remarks as the Fed signals two more rate cuts this year.

Costco’s strong September sales keep traders buzzing, AMD rides the chip wave, and Snowflake (SNOW) jumps on renewed cloud demand, pulling in bargain-hunters.

Gold cools, China’s reopening fuels AI optimism, and Applied Digital and Levi Strauss are making headlines.

This is the crucial update you need, scroll down for more on what’s truly trending in the market right now.

📈 S&P 500,Nasdaq Futures Take a Breather

S&P and Nasdaq futures hold flat after yesterday’s tech-fueled smash. Now all eyes on Powell’s remarks for direction

✂️ Fed Eyes More Cuts

The minutes reveal the Fed’s backing two more rate cuts this year - split debate brewing over whether that’s enough.

🛒 Costco Keeps Rolling

Strong September sales power Costco higher - traders are betting the retail giant’s momentum isn’t done.

☁️ Snowflake Clouds Clearing

SNOW stock jumps on renewed cloud demand and positive sentiment, bargain-hunters are poking in.

🇨🇳 China Reopens, Hopes Rise

Chinese markets flash back online with AI hype leading but weak consumer spending could rain on the parade.

🚀 AMD on Fire, Extends Weekly Surge

AMD extends its weekly ramp higher after the teased OpenAI tie - bulls are riding the chip wave hard.

🪙 Gold Pulls Back, Profits Taker

Gold stumbles from peak levels as traders pocket gains; safe-haven shine dimming for now.

Zoom Video Communications Inc. (NASDAQ: ZM) – Trade Closed

Sometimes, the best trades aren’t the ones that hit target.

They’re the ones we exit smart.

Price has been crawling sideways for too long, trapped between our entry and support.

Momentum dried up, and when the market stops giving energy, we don’t wait for it to take it back.

So we decided to close this one early and lock in what’s left of the move.

Locked in 3.81% gains before leverage.

Efficiency over ego - always.

There’ll be better waves to ride.

This just wasn’t the one worth waiting for.

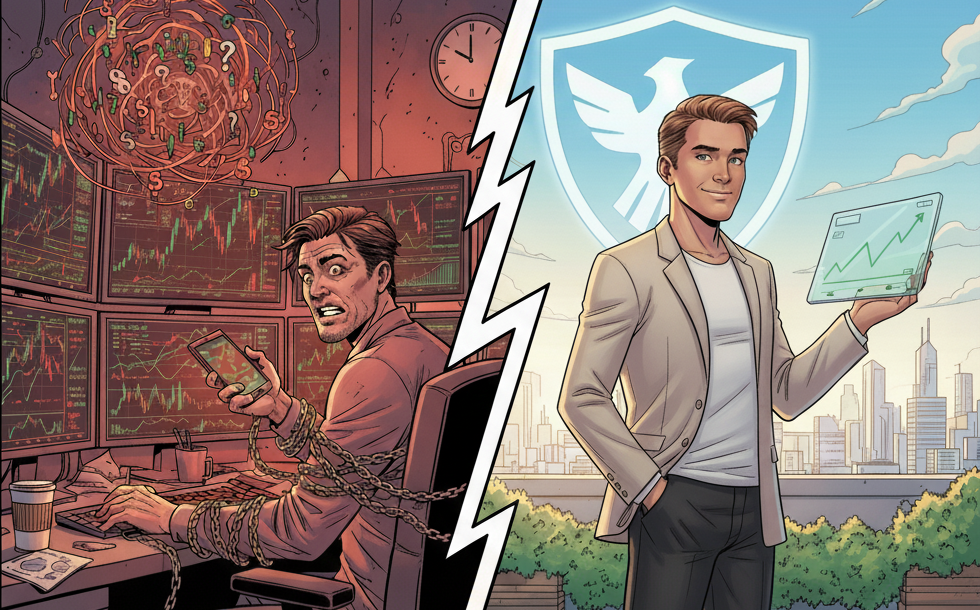

If Trading Feels Like an Obsession, You’re Doing It Wrong

If trading is keeping you up at night, refreshing charts every five minutes, or making you anxious when you’re not in a trade, then something’s off.

Trading isn’t meant to consume you.

It’s meant to free you - financially and mentally.

The problem starts when you chase every move, every tick, every candle, thinking the next one will make you whole.

That’s not trading. That’s gambling dressed up with indicators.

The best traders don’t trade all day.

They wait, they plan, and they let setups come to them.

They know the goal isn’t constant action, it’s consistent control.

If your peace depends on what the market does next, it’s time to step back. You don’t need to earn every dollar the market offers - just the ones that align with your system.

Control your trades.

Don’t let them control you.

👉 Get more smart trading insights here for free!

Inverse Head and Shoulders

The Inverse Head and Shoulders (also called "Head and Shoulders Bottom") is a powerful and popular bullish reversal chart pattern used in technical analysis.

It is the mirror image of the regular Head and Shoulders pattern and signals a potential shift from a prolonged downtrend to an uptrendWhat to Look For (Trading Signals)

The trading signal is generated upon the completion and confirmation of the pattern.

1. The Breakout (Entry Signal)

The pattern is complete and confirmed when the price decisively breaks and closes above the Neckline after the formation of the Right Shoulder.

- Entry: Traders typically buy (go long) upon a confirmed close above the neckline or wait for a retest of the neckline, which often then acts as new support before the price moves higher.

2. Volume Confirmation

Volume analysis is crucial for validating the pattern's strength:

- Head: Volume is often high as panic selling occurs at the very bottom.

- Right Shoulder: Volume is typically lower than the Left Shoulder or Head, indicating selling pressure is drying up.

- Breakout: A sharp surge in volume as the price breaks the neckline is the strongest confirmation that the reversal is genuine and sustainable. Low volume on the breakout may indicate a false signal.

3. Price Target and Risk Management

The pattern provides a clear method for setting a price target and a stop-loss:

- Price Target: Measure the vertical distance from the lowest point of the Head to the Neckline. Project this distance upward from the point where the price broke the neckline.

- Stop-Loss: A common stop-loss placement is just below the low of the Right Shoulder. This protects against the pattern failing and the original downtrend resuming.

The video below explains how to identify the pattern and where to place your entry, stop-loss, and take-profit orders.

You can learn more about how to trade this pattern, including a live trading example, by watching How To Trade The Inverse Head And Shoulders Pattern.

Progress Is Silent

There’s a stage in every trader’s journey that rarely gets the spotlight.

It’s not the flashy winning streak.

It’s not the painful wipeouts.

It’s that quiet, in-between zone - when you’re not profitable yet… but not bleeding either.

That’s growth.

This is the phase where your foundation is being laid brick by brick, even if it doesn’t feel like it.

It’s not sexy. There are no victory screenshots to post.

But behind the stillness, your mindset, discipline, and edge are quietly being forged.

At this point, you need to be laser focused.

Most people panic here.

They assume they need a new strategy, a better signal, or a magic indicator.

But that’s not what gets you over the hump.

What you really need is to drill these four truths into your mindset until they become second nature:

- Patience isn’t passive — it’s strategic waiting.

- Consistency compounds — every disciplined trade is a brick in your base.

- Emotions are data, not directions — feel them, don’t follow them.

- Process beats outcome — your edge shows up over time, not overnight.

Master these, and the market stops being a battlefield…It becomes a game you know how to play.

This is where the quiet grind turns into momentum.

This is where survival becomes mastery.