😱 Samsung's Stock Stunner!

How many times have you checked your portfolio today?

Be honest—was it just once? Or twice? Maybe… ten times?

We get it.

It’s hard not to when the market’s buzzing like a busy beehive.

But here’s the thing: obsessing over every tick won’t make the candles climb faster. It might just give you a headache.

So, what’s the play here?

Well, patience, strategy, and maybe stepping away for a coffee while your setups work their “magic”.

Let’s talk about how to trade smarter this week.

Are you in?

🧭📈 Asian Stocks Bounce Back!

Asian stocks climb after Wall Street's post-election boom slows, with Tokyo's Nikkei 225 index up 0.8% and Hong Kong's Hang Seng adding 0.3%. Will the market find its footing, or is a correction on the horizon?

🌕 Dogecoin to the Moon?

Elon Musk and Vivek Ramaswamy team up for a new government initiative, boosting Dogecoin's value. Should you jump on the bandwagon, or is it too risky?

🕰️ Dow Pauses as Retail Sales Near!

Stock market cools off after strong gains, with investors eyeing key economic data. Will retail sales data spark another rally, or is a deeper correction on the horizon?

📱 Samsung Soars! Bargain Hunters Rejoice!

Samsung's stock price leaps as investors see value after a steep decline. Is the South Korean titan back on track?

🧮 3 Reasons Cisco Stock Could Be a Winner Despite Mixed Earnings Report

The tech giant's recent earnings report offers clues, with strong recurring revenue and expanding margins offsetting concerns about AI-related orders.

🛢️ Oil Prices Dip as Demand Wavers!

China's slowing demand and a resurgent dollar push oil prices toward a weekly decline. Dive in to see what is causing the fall.

🦃 Bitcoin Bulls Eye $100K Thanksgiving Feast!

Bitcoin price surges, with bulls targeting $100K by Thanksgiving, as the cryptocurrency holds a key level above $85k. Is this target feasible?

Last Friday, I shared a short position on Workday (WDAY).

The entry was at $271.49, and as soon as the market opened, it gapped down and continued to drop throughout the night, hitting a low of $258.70.

I’ve now closed the trade with a solid 4.60% profit. A fantastic trade all around using TAD Formula.

If you want to know about TAD, go to the bottom of this email.

We’re on fire with a 7 out of 7 winning streak since launching our winning stock section!

Let’s keep the momentum going! 🚀

Today’s pick is JP Morgan (JPM).

Using the TAD Formula, this stock checks all the boxes for a short position.

- Short Entry: $245.39

- Take Profit 1 (TP1): $239.55

- Take Profit 2 (TP2): $232.20

Let’s aim for another win! 🎯

Feeling Like a Mad Scientist with Trading Formulas? Here’s the Straight Shot!

If trading feels like a messy lab experiment with endless charts, formulas, and strategies that are more confusing than helpful, it’s time to simplify.

Constantly trying to piece it all together can leave you drained and second-guessing every move.

But there’s a way out—these newsletters break trading down to what actually works, cutting through the complex theories and delivering clear steps.

Click here to see how straightforward trading can be—no mad science required.

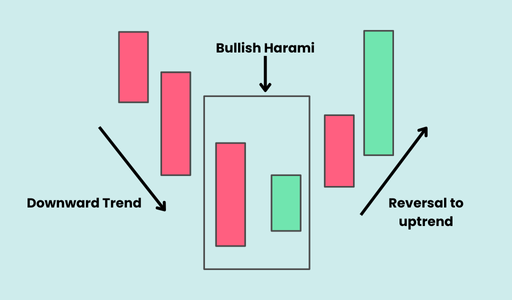

Bullish Harami

A Bullish Harami is a reversal candlestick pattern that signals a potential uptrend after a downtrend.

It consists of two candles: a large bearish candle followed by a small bullish candle that is completely engulfed by the body of the bearish candle.

What to Look For:

- Two Candles: A Bullish Harami pattern consists of two candles.

- Bearish Candle: The first candle is a large bearish candle, indicating a downtrend.

- Bullish Candle: The second candle is a small bullish candle that is completely enclosed within the body of the bearish candle.

Meet Ed Seykota—a trader with some legendary wins under his belt. But what really sets him apart?

His mindset.

Seykota famously said, “Everybody gets what they want out of the market.”

And here’s the twist: sometimes, what we “want” isn't profit but the thrill, distraction, or even comfort of sticking to old habits.

So, next time you’re tempted to dive into a risky trade, ask yourself: What am I really after?

If it's just a quick rush, maybe pause.

Seykota teaches that trading success is rooted in self-awareness.

Recognize your real motives, and you might find yourself making smarter, calmer choices.

You’ve been staring at charts, chasing trades, and maybe even hoping for that “one big win” to turn things around.

But instead, it feels like the market keeps throwing curveballs.

One bad trade leads to another, and suddenly, the excitement you once felt for trading?

Gone.

What if I told you there’s a system—a way to trade smarter, not harder?

A way to see consistent opportunities, like clockwork, that could give you up to 10% profit a day?

This isn’t about luck or some mystery formula.

It’s about a clear, straightforward strategy that puts you back in control.

Imagine waking up tomorrow with a new sense of direction, a plan that actually works.

Watch this video now to see what it is and how you can get started TODAY.

And hey, the year isn’t over yet.

You’ve still got time to rewrite your story, to finish strong, and maybe even rekindle that passion you had for trading.