Rate Cut Delivered

....................................................................................................................

Happy Friday, traders.

Futures are treading water near record highs as Wall Street braces for a high-stakes Trump-Xi call that could shape trade talks and finalize a TikTok deal.

This comes on the heels of Powell’s first rate cut of 2025, a 25 bps trim that sparked little market fireworks but set the stage for more cuts ahead.

Meta unveiled $799 AI-powered Ray-Bans, Nio extended its hot streak, and gold cooled as the dollar firmed.

Meanwhile, crypto hype shows no signs of slowing.

The Crucial Updates section below gives you the full picture.

🏦 Fed Cuts Rate for the First Time in 2025

Powell trimmed rates 25 bps, marking the first cut of the year. Traders now eye the dot plot hinting at two more cuts ahead.

📉 No Fireworks after Fed Rate Cut

Markets popped on the cut, then fizzled as traders called Powell’s move political. Nasdaq futures tried to claw back overnight.

👓 Meta Drops $799 AI Specs, Stock Nudges Up

Zuck showed off Ray-Ban Displays - AI, cameras, speakers, and full-color screen packed in one. Traders call it “best bang for the buck.”

🚗 Nio Rockets to 1-Year High, Hits Five-Day Streak

Stock ripped +6% to $7.43 after a $1.16B share sale—underwriters took it all, fueling rare post-offering strength.

✂️ Goldman Doubles Down on Cuts

Markets shook after Powell hinted at deeper labor market weakness, yet Goldman Sachs doubled down. The bank is betting big on multiple rate cuts

💰 HYPE Smashes New PeakFresh off its BitGet listing, HYPE ripped toward $60. Whales are piling in, calling this just the start of its growth arc.

🪙 Dollar Stings Gold, Eases Off Record

Spot gold slipped 0.2% as Fed signals sent the greenback higher. Traders wonder: is this just consolidation after a record high, or the end of momentum.

Arcosa Inc. (NYSE: ACA) – Trade Closed ✅

Another clean trade!

Price gave us the move we were looking for, sliding down right from the zone and into profit territory.

Locked in 3.50% gains before leverage.

Another trade wrapped up and booked. 📚

Now we sit back, reset, and wait for the next opportunity to line up perfectly.

…………………

No new stock setups for today.

We’re staying patient and letting the market show its hand before jumping in again.

Sometimes the best move is to sit tight, stay disciplined, and keep the cash ready for the next high-probability setup.

Let’s wait for the next clean entry signal to appear.

Quality over quantity always wins.

You Don’t Have to Figure It Out by Yourself

Jumping into trading without guidance feels like wandering in a maze.

Charts, strategies, and platforms can overwhelm anyone, and without someone to show the path, it’s easy to get stuck or give up entirely.

Mentorship isn’t about hand-holding - it’s about learning from someone who’s already navigated the bumps and pitfalls.

A good mentor or reliable source shows what matters, what to ignore, and how to act with confidence.

Trading newsletters can fill that gap. They deliver clear insights, explain the setups, and break down strategies so you don’t waste time guessing.

They guide you step by step, helping you move forward without feeling lost.

👉 You don’t have to figure it out by yourself.

Start learning from the right guidance here.

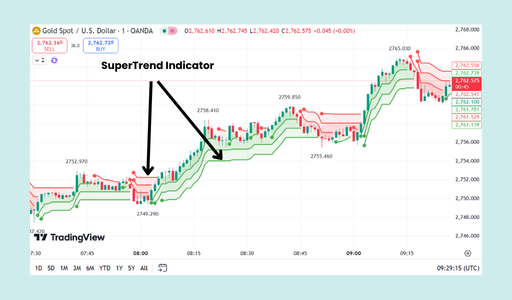

SuperTrend Indicator

The SuperTrend Indicator is a trend-following tool that is overlaid directly on a price chart. It uses price and volatility to generate clear buy and sell signals.

What to Look For

- A Single Colored Line: The SuperTrend indicator is presented as a single line that follows the price. The color of this line is the primary signal.

- Color-Coded Signals:

- Green Line: When the SuperTrend line is green and is below the price, it signals a bullish trend and a potential buy signal. This line can be used as a trailing stop-loss for long positions.

- Red Line: When the SuperTrend line is red and is above the price, it signals a bearish trend and a potential sell signal. This line can be used as a trailing stop-loss for short positions.

- Price Crossovers: The most significant signal from the SuperTrend is when the price crosses over the indicator line.

- A buy signal is generated when the price crosses above the red SuperTrend line and the line turns green.

- A sell signal is generated when the price crosses below the green SuperTrend line and the line turns red.

- Dynamic Support and Resistance: The SuperTrend line acts as a dynamic support level in an uptrend (when it's green) and a dynamic resistance level in a downtrend (when it's red).

- Limitations: The SuperTrend works best in trending markets. It can produce frequent false signals, or "whipsaws," during sideways or ranging markets. It is a lagging indicator and is most effective when used with other indicators for confirmation, such as the RSI or a moving average.

5 Rules for Weekend Trades

However sadly, the weekend is where a lot of traders trip up.

Friday rolls around, markets slow down, and instead of locking in gains, people convince themselves they can outsmart weekend liquidity.

They hold too many trades, too much size, and wake up Monday wondering what went wrong.

If you’re going to trade into the weekend, fine but do it with discipline.

Here are five rules that keep your account and your head intact:

- Cut your exposure. One or two positions are manageable. Five or six? That’s not confidence, that’s gambling with your weekend peace.

- Shrink your size. The market moves thinner on weekends. Smaller positions keep losses from spiraling when a sudden dump hits.

- Set stops. A weekend candle doesn’t wait for you to roll out of bed. Protect yourself while you sleep.

- Take profits. Don’t fall in love with an open position. Bank some gains - partial or full - so you’ve got something to show for the week.

- Touch grass. Walk away from the charts. Go outside. Be with your partner, your family, or just yourself. The market never closes for good, but your mind does need rest.

Weekend trades are less about skill and more about discipline.

The edge isn’t in holding through the noise - it’s in protecting your capital so you’re sharp, ready, and fully loaded when Monday’s real setups come.