Profit Taking Closes 2025

....................................................................................................................

It’s New Year’s Eve!

The year is ending the way it often does on Wall Street — a little restless, a little reflective, and lighter on conviction.

Stocks edged lower on Tuesday as traders continued to unwind crowded tech trades in the final stretch of 2025.

The pullback wasn’t dramatic, but it was deliberate. Nvidia and Tesla led megacaps lower, extending a quiet rotation out of tech as investors lock in gains and clean up positions before the calendar flips.

This isn’t panic selling. It’s portfolio housekeeping. Add in mixed signals from the Fed’s latest meeting minutes — where policymakers made it clear inflation still holds the keys — and you get a market that’s choosing caution over aggression.

With rate-cut odds cooling and conviction thinning, Wall Street is less focused on chasing upside and more focused on how it wants to show up in the new year.

📉 Dow, S&P 500, Nasdaq Struggle for Gains in Final Days of 2025

U.S. stock markets gave back slight gains as Wall Street tried to stabilize through a tech-led pullback in the final stretch of 2025, with major indexes treading water amid subdued holiday trading and lingering valuation concerns.

👟 Nike Stock Rises After Hours as CEO Elliott Hill Joins Tim Cook in Buying

Nike shares climbed nearly 2% in after-hours trading after a regulatory filing showed CEO Elliott Hill made an open-market purchase of roughly 16,388 shares — adding to earlier insider buying by Apple’s Tim Cook.

₿ Bitcoin, Ethereum Rise as Short Liquidations Fuel Late-Session Bounce

Bitcoin and Ethereum posted gains as leveraged short positions were forced to cover, sparking a late session bounce — ETH traded around $2,970, and heavy short liquidations underscored that the move was driven by market positioning rather than a clear trend break.

🤖 SoftBank Completes Massive $41B Investment in OpenAI

SoftBank Group finalized its $41 billion investment into OpenAI, closing one of the largest tech deals ever and deepening its bet on artificial intelligence — a move that reinforces AI’s central role in global technology investment.

📈 Stocks Poised for Strong End to Year; Silver, Gold Stabilise After Slump

Global markets looked set to finish 2025 on a strong note with European equities near record highs, while precious metals like gold and silver stabilised after recent volatilty — gold regained ground near $4,361/oz after a pullback, even as thin holiday trading amplified price swings.

🌏 Asian Shares Trade Mixed as Holiday Closures Thin Year-End Markets

Asian markets were mixed as several major exchanges — including Tokyo and Seoul — closed ahead of New Year’s holidays, leaving light trading in the region. China’s Hang Seng slipped 0.9%, while Shanghai edged higher and Taiwan’s Taiex jumped 0.9%, as investors wrapped up a year marked by strong gains in global equities.

🛢️ Oil Slips as Brent Heads for Longest Annual Loss on Record

Crude prices edged lower as Brent crude was poised to post its third consecutive annual decline — the longest losing streak on record — amid ongoing supply surplus and resilient output, with wider energy market pressure offsetting geopolitical risk factors.

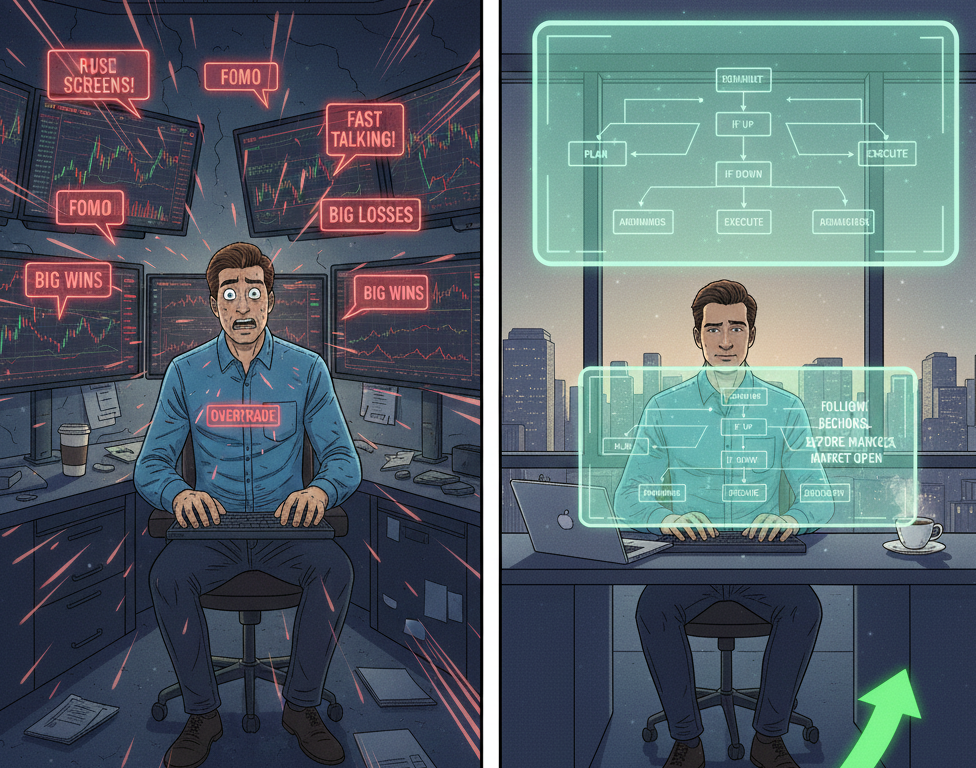

Trading Looks Stressful From the Outside

Most people judge trading by the noise. Flashing screens. Fast talking. Big wins. Big losses. That image creates fear. It makes trading look chaotic and exhausting.

Real trading looks different. It runs on rules. It follows routines. Decisions happen before the market opens. Execution stays calm because the work is already done. Stress shows up when there is no plan.

Pressure comes from guessing. Stability comes from structure. When you trade with rules, the noise fades. The process feels steady. The emotions stay quiet.

If you want trading guidance that emphasizes structure, routines, and calm decision making, these newsletters help. They show how disciplined traders reduce stress through preparation and clear rules.

Bearish Engulfing

The Bearish Engulfing is a two-candle reversal pattern that signals a sudden and violent shift in power. It occurs when a large "down" candle completely swallows the body of the previous "up" candle, showing that the sellers have totally overwhelmed the buyers.

🛠️ The Strategy Logic

Use these triggers to identify when a market top is forming and a reversal is likely:

- IF: The second (red) candle's body completely covers the first (green) candle's body...

- THEN: The pattern is valid. This shows that the market opened higher but was met with such aggressive selling that it wiped out all of the previous day's gains.

- IF: The pattern forms after a long, overextended uptrend...

- THEN: The probability of a reversal is at its highest. This suggests that the "last" buyers have entered the market and are now being trapped by professional sellers.

- IF: The Bearish Engulfing candle occurs on significantly higher volume than the previous day...

- THEN: The signal is high-conviction. Large volume on a down-day indicates that institutions and "big money" are exiting their positions.

- IF: The pattern forms exactly at a known resistance level or the Upper Keltner Channel...

- THEN: This is a "Confluence Signal." The resistance level acts as a ceiling, and the engulfing candle is the proof that the ceiling is holding.

- IF: The next candle after the pattern closes below the engulfing candle's low...

- THEN: The reversal is confirmed. This "third candle confirmation" is often the safest point for conservative traders to enter a short position.

💡 Pro Tip

Size Matters: The most powerful Bearish Engulfing patterns are the ones where the second candle engulfs multiple previous candles, not just one. If one red candle swallows three or four days of previous price action, it signals a massive "liquidation" event, and the resulting downtrend is usually much faster and deeper.

Decision Bandwidth

Every trading day gives you a limited supply of good decisions.

Not unlimited focus.

Not endless patience.

A finite amount of clear judgment.

Most traders spend it too early.

They scan every market. Tweak levels. Adjust bias.

Enter trades that are almost right. Defend small positions that never mattered.

By the time a real setup appears, their mind is already tired.

Overtrading is not only about risk. It is about depletion.

Each decision pulls from the same mental reserve.

Entry. Exit. Hold. Cut. Add. Wait.

These choices stack up.

The more you make, the weaker each one becomes.

This is when rules bend. Stops tighten. Targets shrink. Impulse sneaks in wearing logic as a mask.

Strong traders protect their decision bandwidth.

They reduce noise.

They limit sessions.

They trade fewer markets. They pass on anything that requires convincing.

They save their best thinking for the moments that matter.

You do not need more opportunities.

You need more clarity when the right one shows up.