Nvidia’s Big Moment

....................................................................................................................

Good morning!

Markets feel like they’re holding their breath this morning. After days of tech-heavy bleeding, US futures are basically parked in place, not falling apart, but not inspiring anyone either. It’s the classic “don’t move until Nvidia speaks” mood.

The Dow and S&P are hovering just above flat. The Nasdaq isn’t doing much of anything. Everyone’s eyes are on one ticker: NVDA.

And for good reason - tonight’s earnings could swing more than $300 billion in market value. That’s not a report… that’s an earthquake waiting for a trigger.

Bitcoin even slipped under $90K for a moment, a quiet signal that investors are dialing down their risk appetite.

Retail earnings hit before the bell, and with post-shutdown data still trickling in, big-box names might give us our best read on the consumer. Then comes Thursday’s delayed jobs report — the next big clue on the Fed’s December decision.

Let’s get ready!

💰 Nvidia Earnings Arrive Today - Stakes Sky-High

Nvidia Corporation reports its third-quarter earnings today after the bell, with analysts expecting around US $55 billion in revenue. The outcome may reshape the entire AI hardware boom.

🚀 Wall Street Upgrades Nvidia and Alphabet

Analysts from Loop Capital and others upgraded both Nvidia and Alphabet Inc., with Alphabet’s price target raised from US $260 to US $320 (≈ 19% upside).

🇸🇦🇺🇸 Saudi Crown Prince Pledges US$1 Trillion Investment

Mohammed bin Salman promised nearly US $1 trillion in U.S. investments during his visit to the White House - centered on AI infrastructure, defence and civilian nuclear tech.

🌏 Asia Shares Slip Ahead of Nvidia Profit Report

Asian stocks retreated as markets braced for Nvidia’s earnings. Major indices fell about 0.3–0.7% amid worry the AI narrative may be overheating.

⬇️ Ethereum Falls Into Buy Zone, But Traders Hesitate

Ethereum has dropped into a technical “buy zone,” yet many volatility-averse traders are sitting on the sidelines until clearer signals emerge.

🪙 Bitcoin Struggles Just Above US$91K

Bitcoin is barely holding above US $91,000 as global stocks remain muted — a reminder crypto isn’t immune to broader sentiment shifts.

🧈 Gold Steadies Near US$4,100 as Risk Aversion Returns

Gold held close to US $4,100/oz, reflecting cautious investor mood as rate-cut hopes fade and traders weigh mixed signals from stocks.

Stop Taking Advice From People Who Fear Charts.

Most people warn you about trading because they do not understand it.

They see risk because they never learned the basics. They project their fear onto your goals. That pressure slows you down and keeps you from starting.

You do not need approval from people who avoid data. You need clear rules, a plan, and consistent study. When you rely on structure instead of opinions, the noise fades. You trade with intention instead of defending your choices.

Social pressure loses its grip when you trust your process more than outside voices.

Skill beats fear every time.

If you want simple guidance that helps you build confidence and tune out unhelpful opinions, these newsletters help. They break down trading into clear steps you can follow without stress.

Triple Top

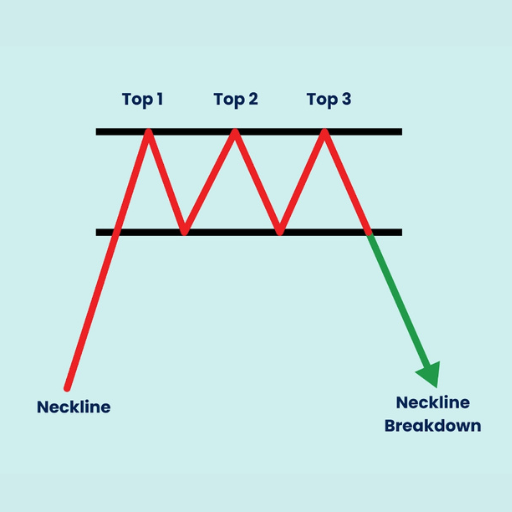

The Triple Top is a highly reliable bearish reversal chart pattern that occurs after a clear uptrend.

It signals that the sustained buying pressure has been completely exhausted and that a major reversal to the downside is imminent.

The pattern is formed when the price attempts to break a strong resistance level three consecutive times but fails each time, demonstrating that sellers (supply) are consistently entering the market at that fixed high price.

What to Look For (Key Features and Signals)

- Prior Uptrend: The pattern must follow a clear, established uptrend for it to be a valid reversal signal.

- Three Peaks (Tops): The pattern features three distinct price peaks that reach approximately the same high price level. These three failures establish the strong, horizontal resistance line.

- Two Troughs (Valleys): There are two intermediate lows (pullbacks) between the three peaks. Connecting the lowest points of these pullbacks forms the neckline, which serves as the critical support level.

- Volume Trend: Typically, the trading volume tends to decrease with each successive peak, signaling a weakening of buying interest and conviction. The highest volume should be on the initial uptrend, confirming its strength, but the rallies to the second and third tops should have noticeably lower volume.

- Bearish Confirmation (Breakout): The Triple Top pattern is only confirmed when the price decisively breaks and closes below the neckline support level after the third peak. This breakdown is the key entry signal for a short position and should ideally be accompanied by a surge in selling volume.

- Target Price: The traditional price target is calculated using the measured move technique. You measure the height of the pattern (the distance from the highest peak down to the neckline) and project that distance downward from the neckline breakout point.

Silent Confidence

The best traders do not move like performers.

They do not shout every win. They do not announce every entry.

They do not seek applause.

Their confidence stays quiet because it comes from work done in private.

Silent confidence is built through repetition.

You show up.

You study your levels.

You follow your routine.

You take your trades without trying to impress anyone.

Over time, the process gives you a calm that noise cannot touch.

Loud trading comes from insecurity.

When you broadcast every win, you start needing the validation.

When you need validation, you start forcing trades.

You start chasing moves to keep up an image that never helps your account.

Quiet trading comes from clarity.

You take clean trades.

You accept clean losses.

You let your results compound without turning them into a performance.

Your focus stays on execution, not attention.

The trader who carries silent confidence does not need to prove anything.

They know their system.

They trust their discipline.

They let the market do what it does.

And they keep growing while the loud ones burn out.