Nvidia Raises Hope

....................................................................................................................

Good morning.

Nvidia’s chasing $5 trillion. Bitcoin’s pushing $135K. And Robinhood?

Yeah, they just got left on read by the S&P 500 again.

If that sounds like your group chat on a caffeine high, welcome to midweek markets.

Traders are mostly shrugging off the tariff noise this morning because Nvidia’s back selling chips to China, and Wall Street loves a good comeback story. Cramer’s already calling the next target—$5 trillion cap🚀 and you know he won’t let us forget it.

Robinhood slipped after hours after getting snubbed (again) from the S&P 500 club.

But crypto bulls are still hopeful - with Bitcoin on fire and Washington cooking up crypto legislation, there’s room for surprises.

The dollar’s flexing, gold’s inching up, and CPI data is coming in hot tomorrow.

Could be a snoozer… or it could flip the whole script.

Either way, you’re here for the moves.

Let’s get into it.

🇨🇳 Nasdaq, S&P Futures Edge Higher on Nvidia China Boost

Markets look past tariff tensions as Nvidia resumes chip sales to China. Traders brace for CPI data and big bank earnings this week.

🍃 Robinhood Slips on S&P 500 Snub, but Crypto Week Hopes Burn Bright

Misses index inclusion again, dropping after hours. But with Bitcoin surging and DC poised for big votes, bulls see a "turbocharge" ahead.

💰 NVIDIA Hits $4 Trillion. Cramer Says the Run Isn’t Over

Jim Cramer is calling his shot: $5 trillion is next. With AI tailwinds at its back, NVDA’s climb looks far from finished.

🚀 BTC Rally Aims for $135K Target

Bitcoin’s explosive breakout has analysts calling for $135K as the next stop, driven by institutional buying and a bullish technical setup—even as a cooling phase could loom once that level is hit.

🌏 Asian Stocks Mostly Higher Despite Tariff Worries

Markets across Asia rose Tuesday even as Trump’s latest tariff threats kept traders cautious. Investors are weighing hopes of negotiations before the August deadline against signs of slowing growth in China and political uncertainty in Japan.

📈 Dollar Near 3-Week High Ahead of US Inflation Data

The greenback stayed firm Tuesday as traders awaited crucial U.S. inflation data that could influence Fed policy. Treasury yields remained elevated, and Trump’s fresh criticism of Powell added to market caution over rate cuts and Fed leadership.

🪙 Gold Edges Higher as Markets Await Inflation Clues

Prices inched toward $3,350 on Tuesday, with traders closely watching US inflation data that could steer the Fed’s next moves, while tariff tensions and dollar strength kept gains in check.

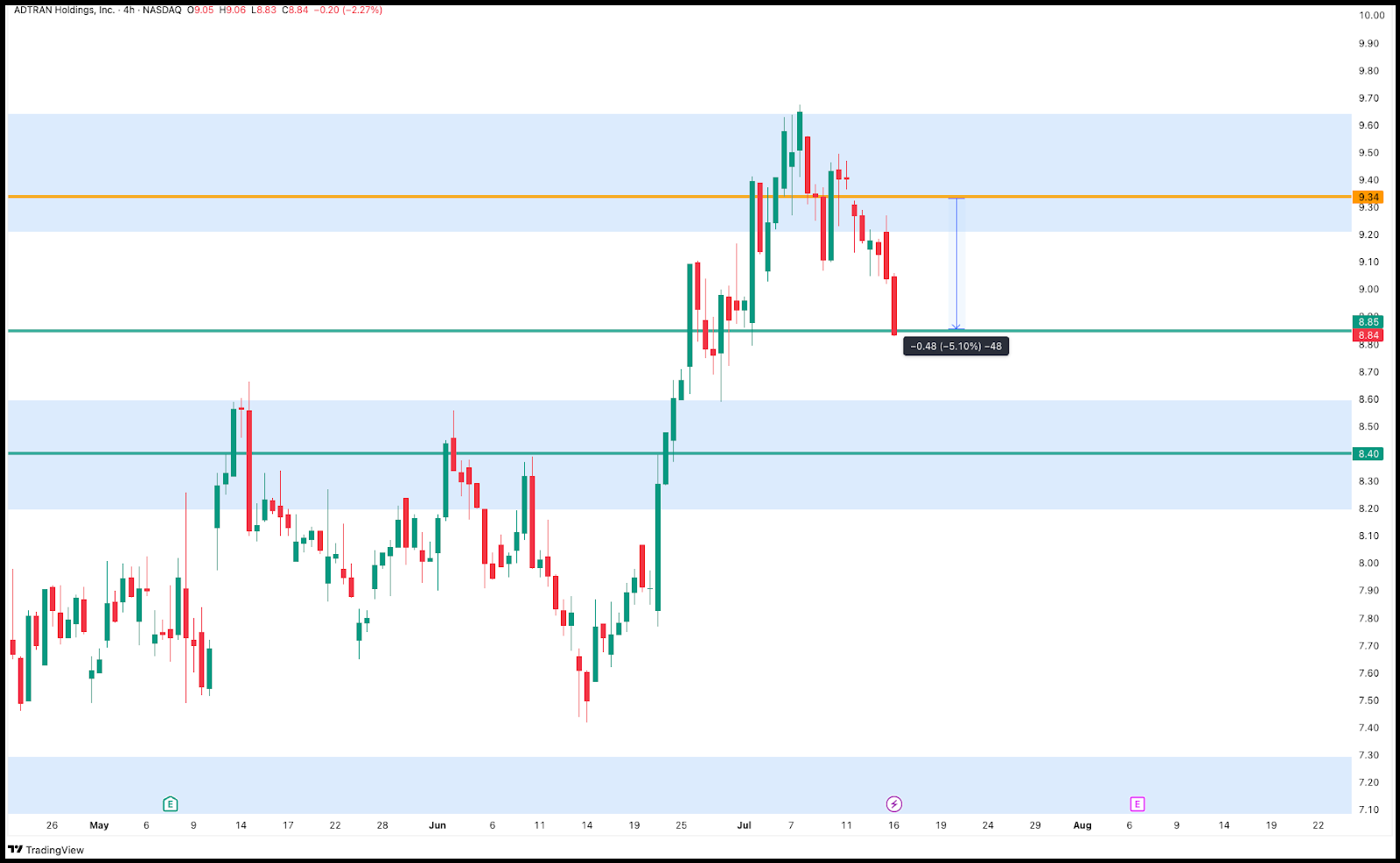

ADTRAN Holdings Inc. (ADTN · NASDAQ) - 💥TP Hit

After price climbed straight into our AV SNR zone at $9.34, it stalled — then cracked.

The pullback was clean.

The drop? Even cleaner.

TP1 was officially tagged. ✅

We’ve locked in our 5.10% gains before leverage.

Adient PLC (ADNT · NYSE) - 🔄 Trade Update

We’ve just added a second layer to our short on Adient.

Entry filled at $22.21, right within the AV SNR zone.

We are aiming for a breakeven right now at $20.56

Eyes on it.

I’ll update again.

If Everyone’s Jumping In… Maybe Wait and Check the Water First.

When the market heats up and everyone’s screaming “Buy! Buy! Buy!”

It’s tempting to dive in headfirst.

But here’s the truth: just because the crowd is jumping doesn’t mean the water’s safe. For all you know, they’re diving into shark-infested waters.

That’s how FOMO works. It lures you in with excitement, drowns you in hype, and before you know it, you’re trading based on emotion instead of a plan. The best traders don’t chase - they assess, prepare, and move with intention.

These newsletters will help you block out the noise, spot the real opportunities, and stop letting hype dictate your trades.

→ If you’re tired of being bait for market sharks, these newsletters will teach you how to swim smart and strike sharp.

Get them now!

TRIX

TRIX is a momentum oscillator that displays the percentage rate of change of a triple-smoothed Exponential Moving Average (EMA) of a security's closing price.

Its purpose is to filter out "noise" (minor price fluctuations) and identify strong trends and potential turning points.

What to Look For:

- Oscillates Around Zero Line: TRIX moves above and below a zero line.

- Above Zero: Generally indicates that the asset is in an uptrend (bullish momentum).

- Below Zero: Generally indicates that the asset is in a downtrend (bearish momentum).

- Zero Line Crossovers:

- Crossing above zero: Can be a buy signal, suggesting a new uptrend is beginning or strengthening.

- Crossing below zero: Can be a sell signal, suggesting a new downtrend is beginning or strengthening.

- Peaks and Troughs: Like other oscillators, traders look for peaks and troughs in TRIX to anticipate potential price reversals.

- Divergence: This is a key signal for TRIX.

- Bullish Divergence: If the price makes lower lows, but TRIX makes higher lows, it suggests that the selling momentum is weakening, hinting at a potential bullish reversal.

- Bearish Divergence: If the price makes higher highs, but TRIX makes lower highs, it suggests that the buying momentum is weakening, hinting at a potential bearish reversal.

- Smoothed Output: Because it's triple-smoothed, TRIX is generally very smooth and filters out much of the short-term market noise, making it useful for identifying longer-term trends.

- Lag: While smoothed, TRIX still has some lag due to its moving average components, so it may not be the fastest indicator for very short-term reversals.

- Signal Line (Optional): Some traders use a short-period moving average (e.g., 9-period EMA) of the TRIX line itself as a signal line. Crossovers between TRIX and its signal line can also generate trading signals.

The Market Isn’t Mad at You

Ever catch yourself thinking your losses are personal?

Like the market’s out to get you because of some mistake you made in life?

You miss a trade, get stopped out twice, and suddenly your brain goes:

"Maybe I’m losing because of those bad things I’ve done. Maybe this is karma. Maybe the market’s lowkey vexed with me."

It happens more than traders admit.

When things go wrong, the human mind looks for reasons.

And if the P&L is red, the imagination kicks in:

Bad trades? Must be punishment.

A drawdown? Maybe life is teaching me a lesson.

But here’s reality - the market doesn’t know you exist.

It’s not personal. It’s not spiritual. It’s not emotional.

It’s just price moving through buyers and sellers, liquidity and volatility.

If you start trading like the universe is keeping score, you’ll start hesitating, forcing trades, or avoiding setups you should take.

That’s the real problem - not the market, but the weight you put on it.

So do yourself a favor - treat this Mind Over Market section like part of your weekly strategy.

Write down where your head’s at.

Mark it in your journal.

Because keeping your mindset clean is how you stay in this game.