Nvidia Meets Rival

....................................................................................................................

Good morning and a happy new month!

It’s Labor Day in the U.S., which means the markets are taking a breather.

But before the closing bell rang for the long weekend, there was plenty of action worth your attention.

From the Dow quietly flexing to fresh highs, to an AI darling in China giving Nvidia run for their money, and even gold getting a political boost - the stories that matter most didn’t take the day off.

Stick around - we’ve got the highlights packed and ready for you.

🚀 Dow Sets New Peak

Even with Nvidia wobbling, blue chips edged higher—traders calling it a “quiet flex” for the bulls.

📉 Cambricon Cools Fast

China’s Nvidia rival warned investors not to get drunk on the AI buzz—shares tumbled after the reality check.

📉 Gap Winning Streak Hit Pause

Shares cooled off as Wall Street weighed tariff risks - viral denim ads couldn’t keep the streak alive.

🪙 Crypto Market to Unlock $4.5B in Tokens in September

September’s set to flood the market as cliff and linear unlocks unleash billions in new supply.

Wall St. Keeps Rolling, Asian Stocks Mixed

S&P notched another record, with Big Tech holding the wheel even as Nvidia slipped post-earnings.

😬 Polish Investors Burned Once, Twice Shy

Decades of stock pain left Poles on the sidelines—watching a historic rally pass them by.

🏦 Fed Drama Boosts Gold

Waller backs the September cut, but Trump’s push to oust Fed officials adds political fuel to the haven bid.

No Stock Recommendation

The U.S. stock market is closed today for Labor Day. 🇺🇸

That means no trading activity.

We’ll be back when the market reopens.

Watching closely as our current open positions continue to develop.

Enjoy the holiday, and we’ll pick it up again when it's time to.

Think Less, Trade More: Progress Beats Perfection

Ever open a trading platform and feel like you’re staring at the cockpit of a Boeing 747 airplane?

Too many charts, too many strategies, too many tools and instead of trading, you freeze.

That’s information overload. And it kills momentum faster than a losing trade.

The fix isn’t to study harder. It’s to simplify. Start small, cut the noise, and focus on progress, not perfection.

That’s where trading newsletters come in.

They break down the chaos into clear, actionable insights so you can move forward with confidence instead of getting stuck at the starting line.

🚀 Think less, trade more. Progress always beats perfection.

👉 Check out these trading newsletters here

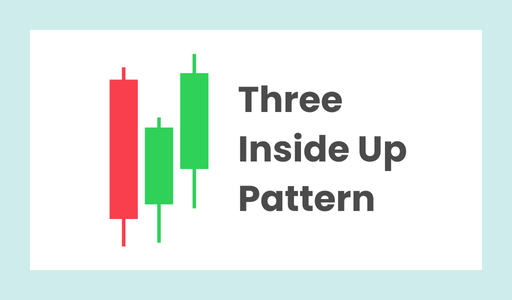

Three Inside Up

The Three Inside Up is a three-candlestick bullish reversal pattern that appears after a downtrend.

It's considered a more reliable signal than the two-candle Bullish Harami pattern because the third candle acts as a confirmation of the trend reversal.

It shows a clear shift in momentum from sellers to buyers.

What to Look For

- First Candle (Bearish): A long bearish (red or black) candle, which confirms the existing downtrend.

- Second Candle (Bullish): A smaller bullish (green or white) candle that is completely contained within the body of the first candle. This candle signals a pause or indecision, as the selling pressure has stalled. The first two candles form a Bullish Harami pattern.

- Third Candle (Bullish): A strong bullish (green or white) candle that closes above the high of the first bearish candle. This is the key confirmation candle, as it shows that buyers have decisively taken control and overcome the previous selling pressure.

- Appearance After a Downtrend: For it to be a valid reversal signal, it must appear at the end of a clear downtrend. The longer the preceding downtrend, the more significant the pattern.

- Psychology: The pattern reflects a shift in market sentiment. The first candle shows sellers are in control. The second candle shows buyers are beginning to enter the market and halt the decline. The third candle is a decisive victory for the buyers, signaling a new potential uptrend.

- Volume: An increase in volume on the third candle can add more weight to the reversal signal, indicating that the buying pressure is strong and sustainable.

One of the biggest traps new traders fall into isn’t bad setups or poor strategies - it’s hesitation.

You see the chart lining up, your indicators flashing the signal, and then… you freeze.

You start thinking, “What if this fails? What if I lose? Maybe I should wait for one more confirmation.”

By the time you decide, the move is gone.

The truth?

Markets reward action, not overthinking.

Every time you hesitate, you hand your edge over to fear.

Here’s what to remember:

- Hesitation trains regret. You replay missed trades in your head instead of building experience.

- Execution trains confidence. Even when you’re wrong, you gain data, patterns, and trust in your process.

- No decision is worse than a wrong one. A losing trade teaches you something. A missed trade teaches you nothing.

If you’re just starting out, don’t aim for perfection. Aim for action. Take the setups you’ve planned, stick to your stop-loss, and let the trade play out.

You’ll make mistakes, yes - but mistakes compound into lessons, and lessons compound into confidence.

This new month, September, ask yourself: are you letting hesitation rob you of progress?

Or are you willing to trust your plan and actually take the shot?

Because in trading, the real risk isn’t losing money- it’s never starting.