Nvidia Crosses $5T

....................................................................................................................

Happy Friday, market players.

We are closing the week with serious momentum as US stock futures edge higher, powered by heavy-hitting earnings from Amazon and Apple that lit up after-hours trading and injected fresh energy into Big Tech.

Nasdaq futures are leading the charge, popping over 1 percent, while the S&P 500 pushes up around 0.6 percent. The Dow is quieter, holding steady as the tech rally takes center stage.

Last night’s earnings fireworks did not disappoint. Amazon blasted more than 13 percent higher after smashing expectations, with a 20 percent revenue surge in AWS signaling serious enterprise demand. Apple followed with strong results and solid holiday guidance, sending shares up as much as 3 percent and calming recent iPhone-demand worries.

Even Netflix joined the party, up over 3 percent, thanks to a surprise 10-for-1 stock split that fired up the bulls.

This upbeat tone comes after a choppy Thursday where Meta, Microsoft, and Nvidia dragged the indexes lower as traders questioned the pace and cost of AI expansion. Meta saw its worst single-day drop in three years, a reminder that sentiment in this market can turn fast.

On the geopolitical front, President Trump and President Xi struck a one-year trade truce, including a 10 percent tariff rollback and a pause on rare-earth restrictions. A rare moment of calm between Washington and Beijing, and markets are embracing it.

And hovering over everything is the Fed’s latest rate cut, plus a divided committee that has investors listening closely as officials begin speaking today.

It is shaping up to be a high-energy finish to a high-stakes week.

Next, we move into the seven Crucial Updates, where we break down the top stories moving markets this morning.

✂️ Fed Delivers 25 bps Cut - Again

The Federal Reserve cut its benchmark rate by 25 basis points to a 3.75–4.00 % range - marking a second consecutive reduction. While markets cheered the move, Chair Jerome Powell’s stern warning that “a further reduction… is not a foregone conclusion” sent the dollar surging and trimmed bets on a December cut.

💰 Nvidia Hits $5 Trillion

Nvidia Corporation became the first company ever to breach a $5 trillion market cap, riding a blistering AI-chip boom that pushed its shares into new stratospheres.

💸 Samsung’s Q3 Snap-Back as Chips Reignite

Samsung Electronics reported third-quarter operating profit of KRW 12.2 trillion (≈ $8.5 billion), driven by record memory-chip sales - marking a strong rebound after a brutal slump.

📉 Bitcoin Dips After Fed, End of QT Signal

Bitcoin tumbled to around $109,200 as the Fed cut rates and signalled an end to quantitative tightening—highlighting that even in a rate-cut world, crypto markets remain vulnerable to policy cues and macro signals.

🔥Alphabet Clears $100B in Q3 Revenue

Alphabet Inc. posted a blockbuster third quarter—revenue hit roughly $102.3 billion, topping estimates of around $99.9 billion. The surge underscores how advertising and cloud are powering its next chapter.

⤵️ Microsoft Beats—but Stock Slips

Microsoft Corporation delivered Q1 revenue of $77.7 billion (up 18 % YoY) and Azure growth of 40 %—yet shares fell after hours. Why? The sky-high AI-capex burden and forward guidance raised eyebrow among investors.

🇺🇸🇨🇳 Gold Surges On U.S.–China Talks

The safe-haven metal rallied, with price rebounding toward $4,000/oz after a four-day slide, as easing trade-tension headlines between United States and China boosted risk-sentiment and triggered a drop in the dollar.

Trade Update 💥

Charles River Laboratories (NYSE: CRL) and Black Hills Corporation (NYSE: BKH) — Hit TP in a single day!

CRL gave us a clean breakdown straight from our entry zone at $187.93, sliding smoothly to TP.

That’s a solid 4.01% gains before leverage.

A drop that shows how timing the exhaustion zone pays off big.

Black Hills Corporation (NYSE: BKH)

Price has been climbing beautifully… but all good runs need a breather.

BKH is now in the zone, out of band, and printing red arrows.

Perfect situation for for a potential reversal.

RSI crossover adds the final piece of confirmation we needed.

🎯 Targets:

Sell: $65.35

TP1: $64.01

TP2: $63.09

We’re stepping in right where momentum slows.

Precision, patience, and timing.

Immix Biopharma Inc (NASDAQ: IMMX)

IMMX just hit our sweet spot.

Inside the zone, out of band, with red arrows confirming weakness.

The move looks ready to roll down from here.

I went in for a sell at $3.70.

🎯 Targets:

Sell: $3.70

TP1: $3.40

TP2: $3.14

Trade Update 💥

NorthWestern Energy Group (NASDAQ: NWE) - TP Hit

Smooth and steady drop right from the top of our zone.

Exactly how we planned it.

Pocketed 2.65% gains before leverage.

Strong for a 2 days trade!

Why You’re Confused (And Losing) — Too Many Mentors, Zero Direction

Ever notice how every “trading guru” online swears their method is the only one that works?

One says “trade the trend,” another says “buy the dip,” and a third one tells you to ignore charts completely.

Before you know it, you’re juggling five strategies, ten opinions, and zero confidence.

You don’t need more voices. You need the right ones. The traders who share insights grounded in experience, not hype. The ones who focus on consistency, not quick wins.

Clarity doesn’t come from following everyone. It comes from filtering wisely.

That’s why I recommend checking out curated trading newsletters on Refind - they help you discover credible voices and valuable insights without the noise.

👉 Find your next favorite newsletter on Refind here

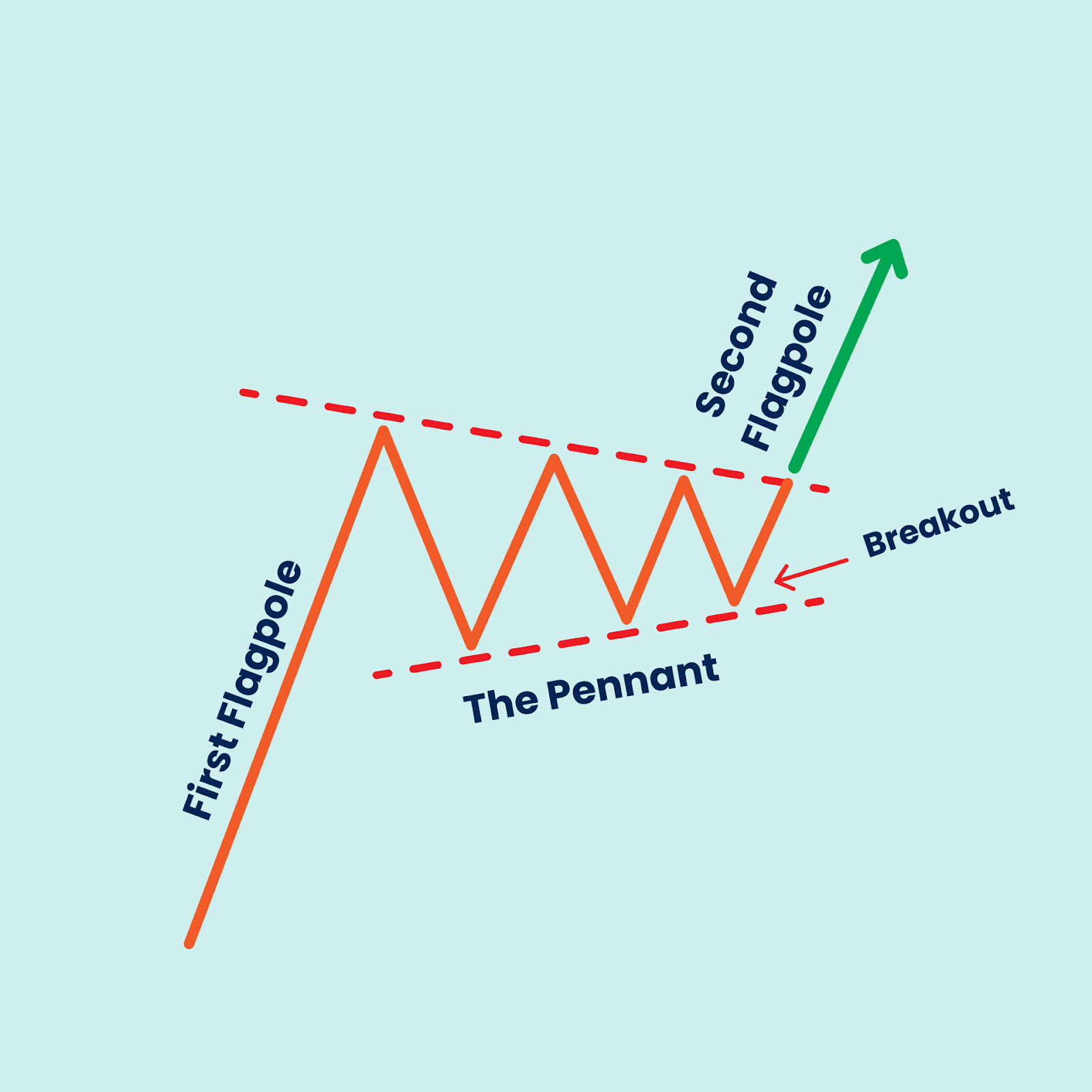

Pennant

The Pennant is a short-term, continuation pattern that signals a brief pause in a strong, rapid trend before the prior move resumes. It is structurally very similar to the Flag pattern, also consisting of a pole and a consolidation shape. The pole is the large, sharp move preceding the pattern. The pennant itself is a small, symmetrical triangle formed by converging trend lines that slope neither up nor down significantly. This pattern reflects a period of hesitation and balanced profit-taking before the trend's conviction returns and forces a breakout.

What to Look For (Key Features and Signals)

- The Pole: This is the strong, almost vertical price movement that sets the pattern up. The height of the pole is crucial, as it is used to calculate the price target.

- The Pennant (Consolidation): The price action forms a small, symmetrical triangle. The highs get lower, and the lows get higher, leading to a point where the two trend lines converge.

- In a Bull Pennant (following an up-move), the pattern resolves with a breakout to the upside.

- In a Bear Pennant (following a down-move), the pattern resolves with a breakout to the downside.

- Volume: Volume provides critical confirmation for this pattern:

- High Volume during the creation of the pole (confirming the strong initial trend).

- Low Volume during the formation of the pennant itself (confirming it is just a brief, neutral consolidation).

- High Volume Spike upon the breakout (confirming the trend resumption).

- Breakout Signal: The pattern is confirmed when the price breaks decisively out of the symmetrical triangle in the direction of the original pole.

- The breakout should occur roughly two-thirds of the way through the pennant structure. If the price continues to consolidate toward the tip of the triangle, the pattern loses reliability.

- The breakout should occur roughly two-thirds of the way through the pennant structure. If the price continues to consolidate toward the tip of the triangle, the pattern loses reliability.

- Target Price: The traditional price target is calculated by measuring the full length of the pole (from the start of the pole to the start of the pennant) and projecting that distance in the direction of the breakout from the point where the price exits the pennant.

Signal vs Story

Your brain craves meaning. It wants a narrative, a reason, a storyline that makes the market feel logical.

You see price moving a certain way and the mind instantly builds a story around it.

“It is breaking out because institutions are loading.”

“It dipped because whales are shaking out weak hands.”

It feels smart.

It feels comforting. But the market does not care about stories.

The market speaks in signals.

Most traders lose because they follow their imagination instead of the chart in front of them.

The story sounds convincing, so they hold losses longer.

They add to bad trades.

They ignore risk.

They convince themselves the market will “come back” because the story says so.

In the end, disaster!

Stories are emotional. Signals are factual.

The traders who win separate belief from behavior.

They trade signals, not fantasies. A signal says enter.

A signal says stop. A signal says wait.

They obey even when it feels boring or inconvenient, because truth lives in data, not drama.

Ask yourself before every trade:

Are you reacting to a clear signal or chasing a good story?

Stories feed ego.

Signals protect capital.

Choose signals.

It feels colder but it keeps you in the game.