Netflix on roll

....................................................................................................................

It’s Friday - let’s land this plane.

Netflix dropped big numbers last night, but Wall Street’s still side-eyeing the stock like “Is this too good?”

Chip stocks?

They tripped hard after ASML’s warning while the dollar is flexing after a brief freak-out over Powell.

And retail sales?

Hot enough to keep the rally talk going but not without a little sweat.

One more trading day, then it’s screens off.

Let’s finish strong.

📉 US Stock Futures On Edge as Retail & Netflix Loom

After a record run for the Nasdaq and S&P 500, futures are slipping this morning as traders brace for retail sales data and Netflix earnings.

📺 Netflix Beats, Raises Forecast - But Stock Slips

Netflix crushed earnings estimates and lifted its full-year revenue outlook, but Wall Street wasn’t fully impressed. Shares dipped after hours as traders debated Netflix’s high valuation.

💵 Dollar Jumps on Strong Economic Signals

The greenback gained as investors bet on U.S. resilience, with jobless claims dropping and consumer spending staying hot despite tariff worries.

💻 Chip Stocks Slam Europe After ASML Warning

ASML tumbled 11%, dragging chipmakers lower after warning it may not grow in 2026. The STOXX 600 logged its fourth straight loss.

🚀 Bitcoin Confirms $160K Breakout Pattern

BTC smashed through neckline resistance, confirming an inverse head and shoulders that could send prices to $160K by Q3.

🧂 Wall Street Takes Powell Threat With a Grain of Salt

Markets have grown numb to Washington noise, betting that Trump’s Powell threats are more posturing than policy.

🪙 Gold Slips as Dollar Firms After Powell Comments

Spot gold edged down to $3,340 as Trump’s “highly unlikely” Powell firing remark eased market jitters, boosting the dollar.

💼 💼 New Setup: ANSYS Inc. (ANSS · NASDAQ)

ANSYS just walked into a trap.

Price rallied straight into a key resistance zone — then lost steam.

The candles are showing hesitation.

Buyers look tired. And we’re stepping in to take advantage of that.

We entered a short at $384.54, right as price got rejected from the zone.

🎯 Targets:

Sell: $384.54

TP1: $374.48

TP2: $368.13

Let’s see if gravity does its job.

Not Sure If You’re Cut Out for Trading? Here’s the Clear Path Forward!

If you're questioning whether trading fits your personality, goals, or lifestyle - you're not alone.

Most people hesitate not because they’re lazy, but because they’re uncertain. And that uncertainty becomes paralysis.

These newsletters give you a front-row seat to how real traders think, what their day-to-day looks like, and the mindset shifts they’ve made to succeed.

By following them, you’ll begin to recognize what resonates and what doesn’t.

That self-awareness is the first step to clarity.

👉 Start here and explore newsletters that help you decide if this journey is truly for you.

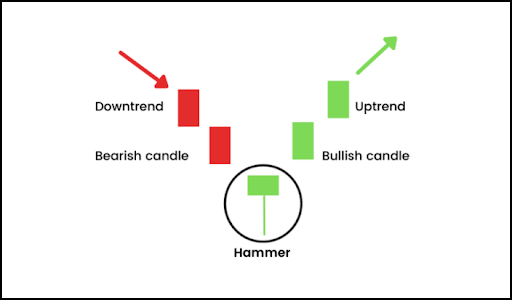

Hammer

The Hammer is a bullish reversal candlestick pattern that appears during a downtrend.

It signals that selling pressure was rejected, and buyers may be starting to take control, indicating a potential bottom.

What to Look For:

- Small Real Body: The main part of the candle (between open and close) is very short. It can be green/white (bullish) or red/black (bearish), but a bullish body is slightly more positive.

- Long Lower Shadow: This is the most crucial feature. There's a significantly long "tail" extending downwards from the real body. This lower shadow should be at least two or three times the length of the real body. It shows that sellers pushed prices much lower, but buyers strongly pushed them back up before the close.

- Little or No Upper Shadow: Ideally, there should be no upper "tail" or a very tiny one. This indicates that the price closed near its high for that period.

- Appears After a Downtrend: For the Hammer to be a valid reversal signal, it must form after a clear period of falling prices. It suggests the downtrend might be exhausted.

- Volume: Increased volume on the Hammer candle can add more conviction to the pattern, showing strong buying interest at the low.

- Confirmation: The Hammer is a warning sign of a potential reversal. Confirmation from the next candle (e.g., a strong bullish candle, a gap up, or a close above the Hammer's high) is important to confirm the shift in sentiment.

- Psychology: It represents sellers attempting to drive the price down, but strong buying interest emerges and pushes the price back up, closing near the opening or even higher, signaling a potential shift in momentum.

Don’t Rush the Levels That Matter

If you’re new to trading, it’s easy to fall into one trap:

Trying to sprint through a marathon.

You see screenshots. You see payouts. You want it fast.

But here’s the truth nobody likes to say out loud - the game only works when you slow down and do it right.

Before you think about flipping accounts or passing prop firm challenges, check your foundation:

Do you actually understand how the market moves, or are you just clicking buttons and hoping?

Do you have one strategy you’ve mastered—or are you switching systems every weekend?

Do you control your risk, or do you chase the highs until you blow the account?

And most important: Are you trading to build a career, or trading to win a jackpot?

The traders who last longest are the ones who stop rushing.

They treat this like a skill, not a scratch card.

So here’s the Friday reminder - start with structure, not ego.

Get consistent on demo first.

Then move to small live capital.

Then scale when you’re ready.

Mark this down in your trading journal.

Mind Over Market is part of the weekly routine now.

See you next week.