Netflix High Risk

....................................................................................................................

Good morning!

The markets are waking up to a reality check.

Streaming giant Netflix just stumbled out of the gate, with shares down more than 6% in premarket after missing profit and revenue expectations. Mattel followed suit, dropping roughly 7% after weak North American sales. Not the earnings kickoff traders were hoping for.

This comes right after Tuesday’s high: strong results from General Motors, The Coca-Cola Company, and other blue chips pushed the Dow past 47,000 for the first time ever. But just as fast as the party started, gold and silver hit the brakes on their rallies and Trump’s latest comments on China trade added a new layer of market uncertainty.

All eyes now turn to Tesla, Inc. reporting after the bell. This isn’t just another earnings print. It’s the opening shot for the “Magnificent Seven” and a test of investor appetite for risk.

Meanwhile, the federal shutdown continues to freeze official economic data. Friday’s delayed inflation report looms large, likely setting the tone for the Fed’s next rate move.

Buckle up, it’s shaping up to be one of those market days.

The Crucial Update is next with the stories everyone will be watching.

🚀 Apple Hits New All-Time Highs on iPhone 17 Demand

Apple's stock soared to a record high, nearing a $4 trillion valuation, driven by strong early sales momentum for the new iPhone 17 series in the U.S. and China.

📺 Netflix Earnings Test Valuation and Ad Growth

Ahead of earnings, investors are weighing the risks posed by Netflix's high valuation and the sustainability of subscriber and ad-tier growth after shares dropped 8% from June highs.

📈 European Markets Open Higher, Led by Earnings

European stocks, including the STOXX 600, FTSE, and DAX, edged higher, continuing Monday's positive momentum as investors focused on corporate earnings reports.

🧠 Adobe Stock Rises on AI Foundry Launch

Adobe's stock climbed after the official launch of the Adobe AI Foundry, a platform that helps enterprises create and deploy custom, brand-consistent generative AI models.

💥 GSI Technology Stock Tripled

GSI Technology's stock experienced a massive surge, tripling in value due to speculative trading, though a clear fundamental catalyst was not immediately obvious.

🚀 Bitcoin Claws Back to $111,000 Milestone

Bitcoin's price returned to the $111,000 level, fueled by institutional demand and optimism over regulatory clarity in the U.S.

🛑 Gold's Record Run Pauses for Profit-Taking

Gold prices eased slightly after hitting an all-time high, as investors booked profits amid a firmer U.S. dollar and a slight pause in safe-haven demand.

Zoom Video Communications Inc. (NASDAQ: ZM) – Trade Closed At Breakeven

Price has been crawling sideways for too long, trapped between our entry and support.

Momentum dried up, and when the market stops giving energy, we don’t wait for it to take it back.

So instead of sitting through the drag, we decided to close this one early and lock in what’s left of the move.

Efficiency over ego, always.

Stop Using “Taxes” as an Excuse Not to Start Trading

Stop using “taxes” as your excuse not to start trading.

Most people don’t avoid trading because of taxes. They avoid it because they’re scared of doing something wrong. Taxes are just a convenient excuse.

You don’t need to be a tax expert to start trading. You don’t need to memorize codes or hire a fancy accountant. Most trading platforms already provide simple summaries that make tax filing straightforward. And if you ever get stuck, there are professionals who handle that part for you.

The point is, waiting until you “figure out taxes” is like waiting until you know every rule of the road before learning to drive. You’ll never start.

Take small steps. Make your first trade. Learn as you go. The real risk isn’t filing your taxes, it’s never building the skill that could change your financial future.

Want help learning from real traders who’ve been there?

Learn from the best newsletters we recommend here.

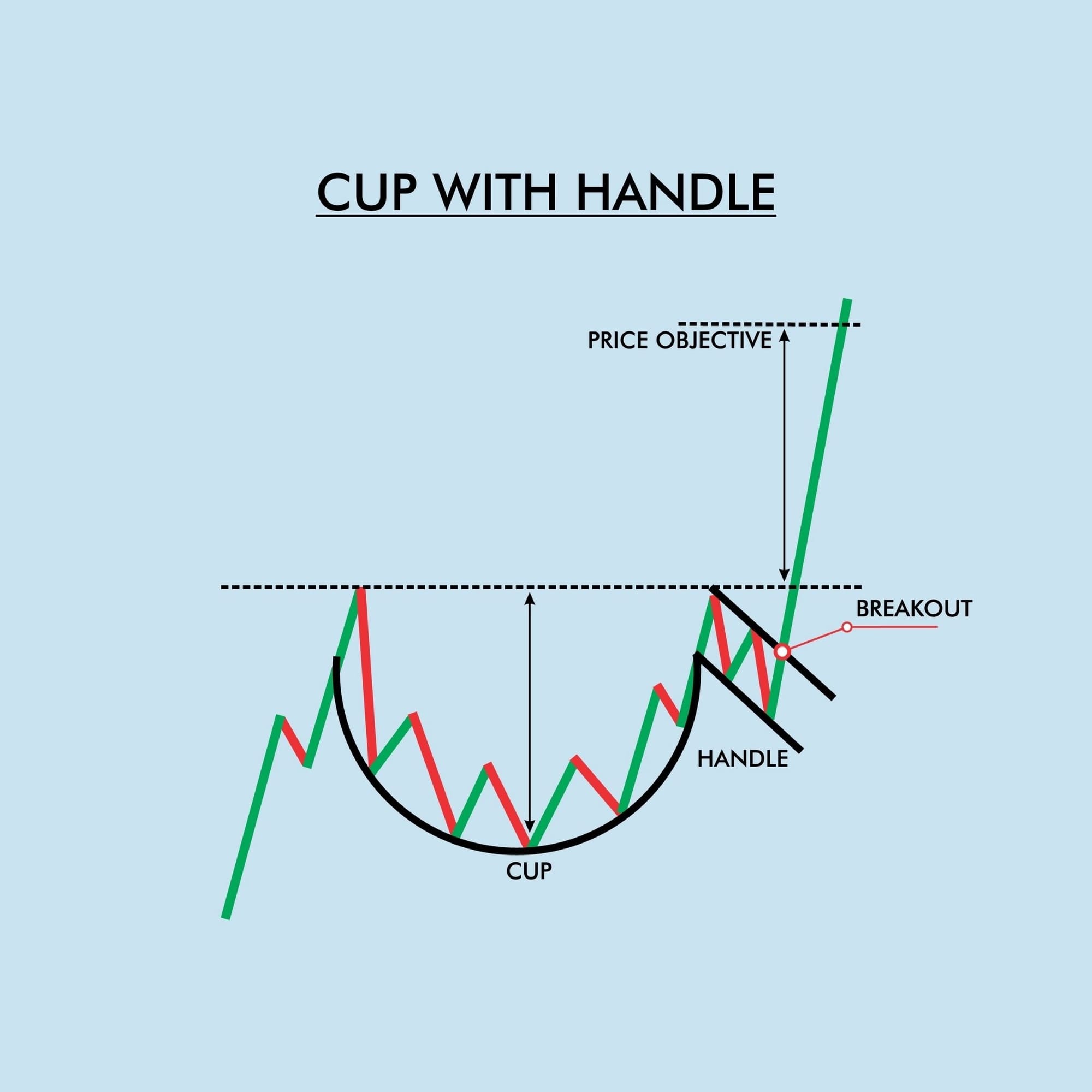

Cup and Handle

The Cup and Handle is a classic bullish continuation pattern that signals a high-probability upward move.

It was popularized by technical analyst William J. O'Neil and is typically found during an uptrend, although it can also signal the beginning of a new trend.

The pattern gets its name from its appearance on a chart: a large, rounded "cup" followed by a smaller, downward-drifting "handle" on the right side.

This formation represents a period of consolidation before the next major advance.

What to look for:

The Cup Formation:

- It should be U-shaped, resembling a bowl or a rounded bottom, not a sharp V-shape. A wide, rounded bottom indicates that the base-building (consolidation) phase was long and slow, suggesting a stronger foundation for the next move.

- The two sides of the cup should be at approximately the same high price level (the rim).

The Handle Formation:

- The handle is a small, short period of price consolidation that occurs on the right side of the cup, near the rim.

- It typically takes the form of a small flag or a pennant (a continuation pattern) or a downward-sloping channel (like a falling wedge). This slight decline or sideways movement filters out the weaker buyers.

- Ideally, the handle should not drop below the lower half of the cup and should stay entirely within the upper third of the cup structure.

Volume:

- Volume should decrease as the price forms the bottom of the cup and during the formation of the handle.

- Volume should increase significantly as the price breaks out of the handle's resistance line. This burst of buying volume confirms the breakout and the validity of the signal.

Breakout Signal: The pattern is confirmed when the price breaks above the handle's upper trend line (or the level of the cup's rim). This signal activates the buy entry.

Target Price: The price target is calculated by measuring the depth of the cup (from the rim to the bottom) and projecting that distance upward from the breakout point of the handle.

Survivorship Over Brilliance

Most traders chase brilliance.

They want the perfect entry, the flawless read, the clean sniper hit on every chart.

As history has shown, great traders don’t win because they’re the smartest in the room.

They win because they stay in the game long enough to ride the real waves.

Survivorship beats brilliance. Every time.

The trader who survives the drawdowns, the boredom, the fakeouts, and the bad weeks… is the one who’s still standing when the market finally opens the door.

You don’t need to predict everything.

You need to protect your capital.

You need to avoid blowing up on the bad days so you can collect on the good ones.

The market doesn’t care how clever you are.

It rewards those who endure.

So stop trying to be a genius every day.

Focus on staying in the fight.

The big moves will find you if you’re still around to catch them.