Nestlé Fires 16,000

....................................................................................................................

Good morning and happy Friday!

Stock futures are sliding this morning as investors react to regional bank loan troubles and JPMorgan CEO Jamie Dimon’s “cockroach” warning. Dow futures are down 0.3%, S&P 500 off 0.4%, and Nasdaq 100 slipping 0.5% after a week of market jitters.

Safe-haven assets are in demand: Gold just topped $4,300/oz, and the 10-year Treasury yield fell below 4%, as traders seek shelter from credit concerns.

Global tensions flare: China imposes fresh export controls amid Trump’s tariff threats, while the U.S. government shutdown drags on, threatening federal paychecks.

Earnings remain in focus: American Express reports pre-market, while big banks extend Thursday’s regional lender losses.

💼 Nestlé Update: The company beats Q3 sales expectations but announces 16,000 job cuts - a clear signal leadership is prioritizing shareholder value over workforce growth.

Markets are nervous but opportunities are everywhere.

Stick around, we’ve got the Crucial Updates section next, featuring three trending stories you don’t want to miss.

🇹🇼 TSMC Q3 Profit Jumps 39% on AI Chip Demand

The chip king just confirmed the AI frenzy with a 39.1% profit surge that crushed estimates. TSMC is printing money, proving the AI build-out is accelerating, not slowing.

⚪ Gold Crosses $4,300 as Silver's 80% Rally Signals Further Gains

With gold now above $4,200 and silver up over 80% this year, Wall Street analysts see a clear path for prices to continue their historic ascent.

💼 Nestlé Announces 16,000 Job Cuts After Q3 Sales Beat

Sales volumes are up, but the 16,000 headcount reduction is the main event. It's a clear signal that the new leadership prioritizes boosting shareholder value fast.

📉 Nio Shares Fall on GIC Revenue Inflation Lawsuit

Singapore's Sovereign Wealth Fund GIC just filed a lawsuit alleging NIO inflated revenue. The stock plunged 10% on fears that its battery-swap model accounting is fraudulent.

🐋 ETFs and Whales Lock Up 40% of Ethereum's Supply

A historic scarcity event driven by institutional ETFs, staking, and dormant wallets has locked up 40% of Ethereum's supply, pushing the liquid float to its smallest ever and fueling predictions of a massive new all-time high.

🪙 Gold Hits Record $4,225 Peak on Rate Cut Bet

The precious metal's historic 61% annual rally culminated in a new high of $4,225.69, as investors seek refuge amid a weakening dollar, high expectations for Fed rate cuts, and escalating global trade and political tensions.

📈 Asian Stocks Soar as Wall Street's Gains

Asian markets surged, with South Korea's KOSPI hitting a record high and Australia breaching 9,000, as investors cheered Wall Street's rebound and growing expectations for more interest rate cuts from the U.S. and local central banks.

Impatience Is the Real Account Killer

Impatience is the reason many traders never make it past their first year. You want the big wins now.

You want proof that your strategy works today. So you rush trades, force setups, and abandon plans too soon.

Every time you jump in early or quit too soon, you reset your progress. You never give your system time to prove itself.

You never give yourself time to grow.

Trading rewards those who can wait.

Not those who can react fast but those who can endure the quiet, the drawdowns, and the boredom without losing focus.

If you treat every trade like a test of patience, you’ll stop making emotional moves and start building consistency.

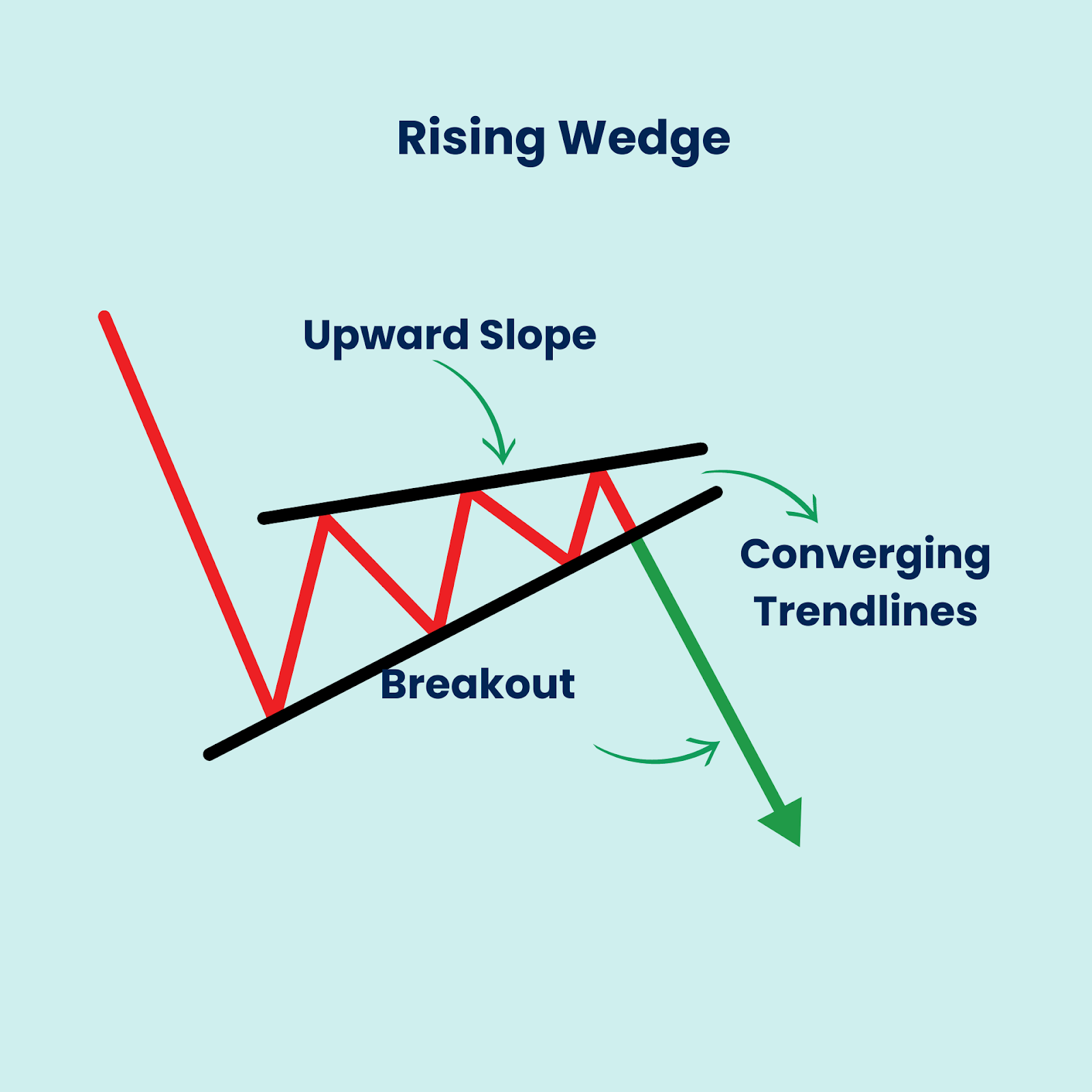

Rising Wedge

The Rising Wedge is a bearish chart pattern that can signal a potential reversal from an uptrend or a continuation of a downtrend.

It is formed when price action is bound by two converging, upward-sloping trend lines. ‘

This pattern indicates that while the asset's price is still rising, the buying momentum is gradually diminishing.

The higher highs and higher lows are being made at a slower pace, showing exhaustion among buyers.

What to look for:

- Pattern Shape: The wedge is defined by two trend lines that both slope upward but are converging (getting closer together).

- Price Movement: The price makes higher highs and higher lows, but the angle of the lower support line is generally steeper than the upper resistance line. This is the visual cue that the trend is running out of steam.

- Volume: Look for decreasing volume as the price consolidates within the wedge. Declining volume alongside rising prices is a common sign of bearish divergence and waning conviction.

- Breakout Signal: The pattern is confirmed when the price breaks below the lower trend line. This is the key entry signal for a short position.

- Target Price: The traditional price target is typically set by measuring the height of the wedge at its widest point (the start of the pattern) and projecting that distance downward from the breakout point.

- Stop-Loss Placement: A common place to set a stop-loss is just above the last major swing high within the wedge, or just above the broken lower trend line to protect against a false breakout.

- Implied Direction: Although it slopes upward, the Rising Wedge is predominantly a bearish signal. It usually leads to a strong move down.

The moment you decide to truly focus on winning, your mind starts noticing opportunities everywhere.

It’s like a switch flips, you begin to see paths, people, and possibilities that were always there but went unnoticed.

What you pay attention to grows, and your life naturally starts following the direction of your strongest thoughts.

Right now, the world feels messy.

Markets are unpredictable, inflation headlines are constant, and the news can make it seem like nothing is in your control.

But this is exactly when you need to be deliberately focused almost stubbornly on your own growth, your own actions, your own wins.

Just yesterday, I met someone who made over $20,000 in profit from their business last month. That’s real.

That’s happening. People are winning all around you while many stay glued to things they cannot control.

You can’t dictate oil prices or global events but you can dictate your effort, your mindset, and the results you chase.

Detach from the noise.

Focus on what you can control.

Others are winning.

Step into that energy.

Do the work.

Make your own wins happen.