Most Undervalued Stock In The World?

While everyone is chasing after the latest tech trends, this overlooked company is quietly dominating its niche and set for massive expansion.

While everyone is chasing after the latest tech trends, this overlooked company is quietly dominating its niche and set for massive expansion.

In this issue, we'll reveal this undervalued investment opportunity, along with other opportunities like promising semiconductor penny stocks.

Whether you're a seasoned investor or just starting out, this is your chance to get ahead of the curve and discover the stocks that could make you rich.

🏆 1 Soaring Growth Stock to Buy and Hold for 10 Years

This growth stock has the potential to deliver massive returns over the next decade. See article to find out.

📱 Can Meta Reach A $1000 Valuation?

Meta's stock has already doubled this year, but some analysts believe it's just getting started. Could $1,000 per share be within reach?

💽 3 Semiconductor Penny Stocks Analysts Are Bullish On

Analysts are betting on these 3 underdog chipmakers. Discover why they could be the next big thing.

⚠️ Don't Fall for the Investment Hype

High returns often come with high risks. Analyze the numbers and discover why this investment might not be worth the gamble.

💻 Super MicroComputer Is Joining the Nasdaq 100

The Nasdaq 100 has a new member. See the stock it is replacing and explore the implications of this change for investors and the tech industry.

💼 3 Stocks That Could Profit from Job Losses

Investing in AI could be lucrative, but it's important to understand the risks. Discover 3 AI stocks with massive potential and potential consequences for the job market.

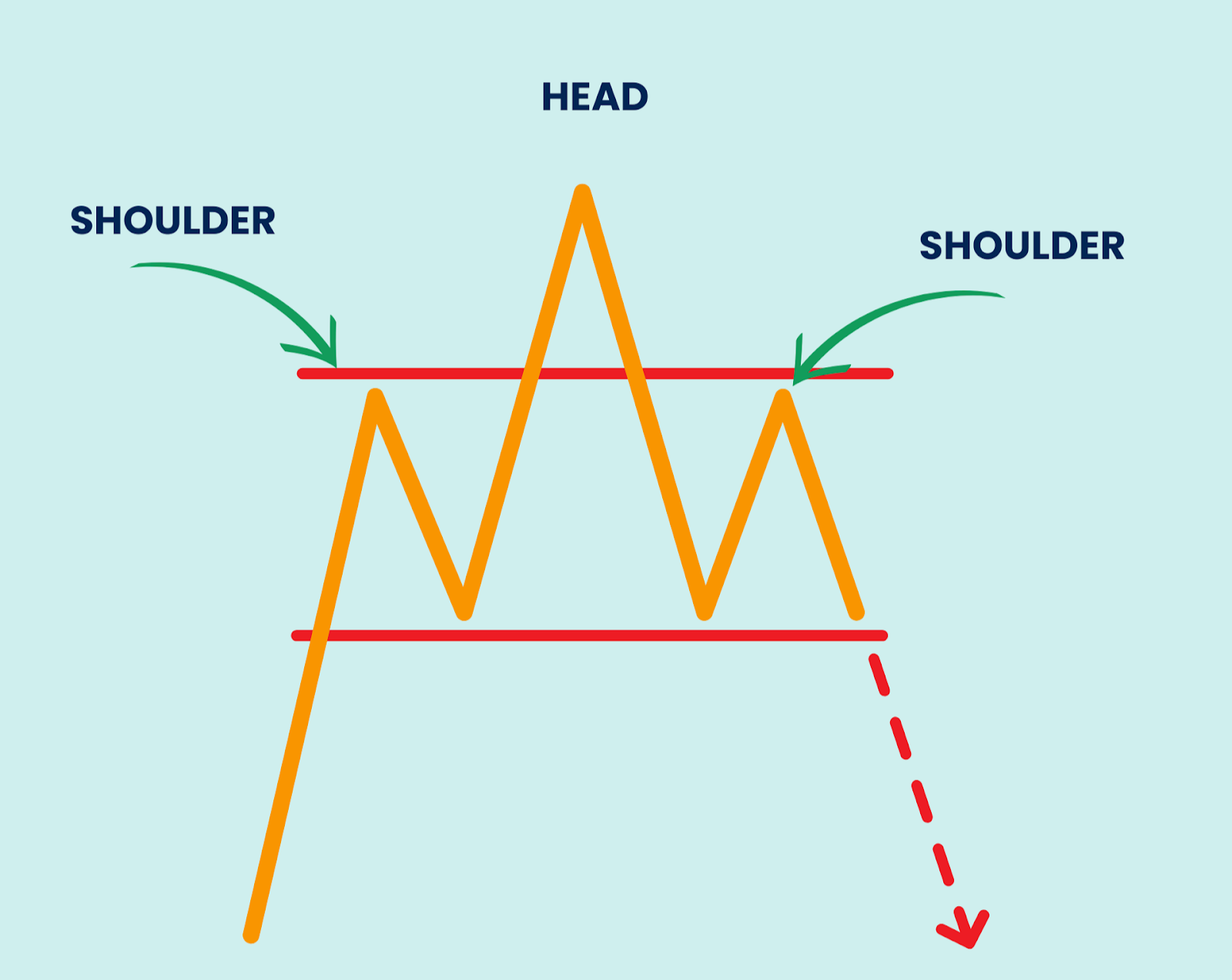

Head and Shoulders

The head and shoulders pattern is one of the most reliable reversal patterns, indicating that an uptrend (bullish head and shoulders) or a downtrend (bearish head and shoulders) could be coming to an end.

It's like the market is trying to continue its previous move but is running out of steam and could be getting ready to change direction..

What to Look For:

- Three Peaks: The pattern has three peaks, with the middle one (the "head") being the highest and the two outside peaks (the "shoulders") being about the same height.

- Two Valleys (Neckline): The lows between the peaks form a support level called the "neckline".

- Neckline Break: If the price falls below the neckline after the second shoulder, it's a bearish sign. If it rises above the neckline, it's a bullish sign.

Ever feel the pressure to "keep up with the Joneses?" To buy that flashy car, upgrade to the bigger house, or splurge on designer clothes?

We all have those moments, right?

But here's the thing: true wealth isn't about showing off.

It's about building a life you love, a future you can be proud of.

It's about having the freedom to make choices that align with your values and goals, not just the latest trends.

Take a moment to think about what truly matters to you.

Is it financial security? Traveling the world? Supporting your family?

Whatever it is, remember that those dreams are worth more than any material possession.

So, let's shift our focus from the "have-to-haves" to the "want-to-haves."

Let's invest in experiences, relationships, and personal growth.

Let's build a life that's rich in meaning, not just in stuff.

Because at the end of the day, the true measure of success isn't the size of your bank account, but the depth of your happiness and the impact you make on the world.

And that, my friends, is something no luxury car can ever buy.