Microsoft $50B Plan

....................................................................................................................

Good morning, traders.

Let's get into the game plan for today.

The markets were pretty quiet yesterday—basically a "snooze-fest" where prices didn't move much. But this morning, the futures (the bets traders make before the market actually opens) are starting to show some life. We’re seeing a small bid (buying interest), with the S&P 500 and the tech-heavy Nasdaq both up about 0.3%. The Dow is trailing slightly, up just 0.2%.

Right now, we are in a "wait-and-see" mode. Traders are sitting on their hands because the Fed (the central bank) is releasing their meeting minutes later today. Everyone is looking for "signals"—basically any hint about whether inflation is cooling down or if they plan to keep interest rates high.

The big theme is still AI disruption. It’s the main engine pushing the market higher, but it's fighting against the fear of what the Fed might do. It's a classic tug-of-war.

Don't get "chopped up" (lose money on small, random price swings) while waiting for the news. Keep your stops (automatic sell orders to protect your cash) tight. If the news is bad, prices might "flush" (drop quickly) to test lower levels. If the news is good, the tech stocks might catch a "bid" and fly.

Stay sharp and watch the tape.

📉 Tech Rout Drags Stocks as VIX Jumps Above 22

U.S. markets opened weak: S&P 500 fell 0.5%, Nasdaq Composite dropped 0.7%, and Dow Jones Industrial Average lost 188 points (0.4%). The CBOE Volatility Index jumped to 22.5 as AI fears hit software stocks.

🤖 Microsoft Plans $50B AI Push in Global South

Microsoft says it’s on track to invest $50 billion by 2030 to expand AI infrastructure across developing nations.

📊 Treasury Yields Rise Ahead of Fed Minutes

The 10-year U.S. Treasury yield climbed to 4.075%, the 30-year hit 4.7%, and the 2-year rose to 3.453% as traders waited for Fed meeting minutes.

🥇 Gold Rebounds Above $4,900 After 3% Drop

Gold rose as much as 1.3% to reclaim levels above $4,900/oz, after losing more than 3% over two sessions due to a stronger dollar.

📈 U.S. Stocks Close Slightly Higher After Tech Rebound

After early losses, the S&P 500 IT sector finished up 0.5%, helped by gains in Nvidia and Apple, easing last week’s AI-driven selloff.

🌏 Asia Stocks Rise as Japan Gains 1.2%

Asian shares climbed with Japan’s Nikkei 225 up 1.2% to 57,249, boosted by strong exports (up 17% YoY) and election optimism.

🛢️ Oil Holds Near $67 as U.S.–Iran Talks Progress

Brent crude stayed just above $67 per barrel, while WTI hovered near $62, as improving U.S.–Iran nuclear talks eased supply fears.

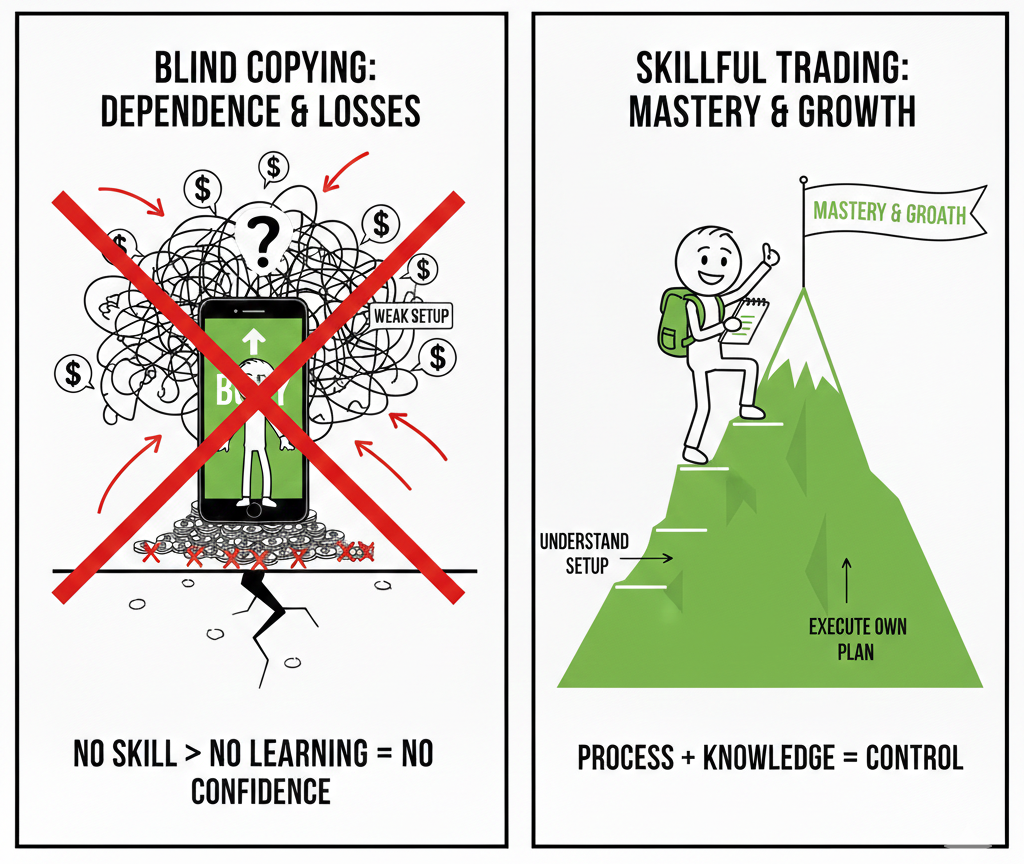

Trading Signals Without Skill Fail

Copying trades does not make you a trader. It just makes you dependent. Many traders follow signals blindly, hoping someone else’s entry will save them time and effort.

That’s where the problem starts. When the trade goes wrong, they don’t know why. When the trade goes right, they still don’t know why. There is no learning, no improvement, and no confidence. Every decision stays tied to someone else.

Strong traders learn the reasons behind a trade. They understand the setup, the risk, and the exit plan. They use ideas from others, but they make their own decisions.

When you understand what you trade, fear drops. You trust your process. You grow skill instead of chasing tips.

Knowledge builds independence.

If you want trading guidance that explains setups clearly and helps you think for yourself instead of blindly copying signals, these newsletters help. They focus on understanding, structure, and steady growth.

Aroon Indicator

Developed by Tushar Chande, the Aroon Indicator focuses on time rather than price.

It consists of two lines: Aroon Up (measuring how long it has been since a new high) and Aroon Down (measuring how long it has been since a new low).

Its primary goal is to tell you if the market is trending or in a sideways range, and more importantly, when a new trend is being born.

🛠️ The Strategy Logic

Use these logical triggers to determine the age and strength of a trend:

- IF: The Aroon Up line crosses above the Aroon Down line...

- THEN: A new bullish trend is likely beginning. This suggests that the market is making new highs more frequently than new lows.

- THEN: A new bullish trend is likely beginning. This suggests that the market is making new highs more frequently than new lows.

- IF: The Aroon Up line reaches the 100 level and stays there while Aroon Down is near zero...

- THEN: You are in a "Super Trend." This indicates an incredibly strong uptrend where new highs are being made almost every session. Do not short this market; look for pullbacks to the Middle Keltner Channel to buy.

- THEN: You are in a "Super Trend." This indicates an incredibly strong uptrend where new highs are being made almost every session. Do not short this market; look for pullbacks to the Middle Keltner Channel to buy.

- IF: Both the Aroon Up and Aroon Down lines are below the 50 level and moving sideways...

- THEN: The market is in a "Dormant" or consolidation phase. There is no clear trend. This is a signal to stay on the sidelines and wait for a breakout above 70 on either line before entering.

- THEN: The market is in a "Dormant" or consolidation phase. There is no clear trend. This is a signal to stay on the sidelines and wait for a breakout above 70 on either line before entering.

- IF: The Aroon Up line starts to drop from 100 while the Aroon Down starts to rise...

- THEN: The current uptrend is "aging" and losing its momentum. This is a primary warning to start taking profits, as the time between new highs is increasing.

- THEN: The current uptrend is "aging" and losing its momentum. This is a primary warning to start taking profits, as the time between new highs is increasing.

- IF: The Aroon Down line crosses above the Aroon Up line...

- THEN: A bearish trend reversal is confirmed. The market has begun making new lows more recently than new highs, signaling that the path of least resistance has shifted to the downside.

💡 Pro Tip

The "Parallel" Warning: Watch for when both lines move parallel to each other. If both lines are falling together, it indicates that the market is entering a "sleepy" period with very low volatility.

However, if they both spike up together, it signals a chaotic, "whipsaw" market where neither bulls nor bears have control. The best trades occur only when there is a clear "divergence" between the two—one line at the ceiling (100) and the other at the floor (0).

The Outcome Obsession

Most traders I see make the same mistake — they grade their trades like a scoreboard. Green trade = genius. Red trade = idiot.

That’s a dangerous mental model.

A winning trade can be sloppy.

A losing trade can be world-class execution.

If you reward money only, you accidentally train yourself to repeat bad behavior that just got lucky.

And you quietly abandon good process that hit normal variance.

Here’s the shift 👇

Score your trades on rules, not results:

- ✅ Did you follow your entry plan?

- ✅ Did position size match your risk rules?

- ✅ Did you respect your stop?

- ✅ Did you exit where your system said to exit?

That’s skill. That’s repeatable. That’s how pros think.

Profit is noisy. Process is clean.

Think like a trader, not a gambler 🧠

Gamblers chase outcomes. Traders build habits.

Your edge isn’t one trade — it’s consistent execution over 100.

Next time you review a trade, ask:

“Did I trade well?” — not — “Did I make money?”