Markets Watch For Jobs Report

....................................................................................................................

Friday arrives with the market in wait-and-see mode — and for good reason.

US stock futures are marking time as Wall Street heads into one of the most consequential Fridays of the young year, with two heavyweight catalysts on deck: December’s jobs report and a potential Supreme Court ruling on President Trump’s sweeping “Liberation Day” tariffs.

The Dow, S&P 500, and Nasdaq are all hovering near flat levels, signaling hesitation rather than conviction after a mixed Thursday session and a cooling appetite for tech.

The labor report takes center stage first. After shutdown delays scrambled recent data, today’s payrolls number is expected to bring clarity to a job market that’s sending conflicting signals. With the Fed’s next rate decision less than three weeks away, every datapoint matters — especially one expected to show slower hiring and a still-tight unemployment picture.

Layered on top is legal risk. The Supreme Court could weigh in on the legality of Trump’s tariffs, a ruling that could reshape trade policy, inflation expectations, and global markets in one stroke.

It’s a classic Friday setup: light positioning, big consequences, and plenty at stake — even as stocks head toward a solid first full week of 2026.

📉 Wall Street Ends Mixed as Tech Pulls Back, Defense Stocks Rally

Wall Street finished unevenly as major tech names like Nvidia (-2.2%), Broadcom (-3.2%), and Microsoft (-1.1%) eased amid rising valuations concerns — while defense contractors climbed after President Trump called for a $1.5 trillion military budget, rotating gains into defense from technology.

⛏️ Rio Tinto and Glencore Resume Talks on Potential Mining Mega-Merger

Mining giants Rio Tinto and Glencore have restarted merger discussions that could create the world’s largest mining company, combining forces in critical metals like copper and iron ore — though terms and structure remain early and far from guaranteed.

📈 China CPI Rises to Highest in Nearly 3 Years as PPI Deflation Continues

December inflation in China climbed 0.8% year-on-year, marking the fastest pace since early 2023, but producer prices stayed in deflation — illustrating persistent weak domestic demand despite headline price gains.

🚀 Solana Rallies While Bitcoin Stalls Near $91,000 Ahead of Tariff Ruling

Solana outperformed with gains above $139, even as Bitcoin hovered near $91,000 and broader crypto markets awaited a U.S. tariff-related Supreme Court ruling and key jobs data that could shift sentiment.

💡 Intel Shares Rise After Trump Praises Company Post CEO Meeting

Intel stock jumped nearly 2% in after-hours trading after President Trump publicly praised the company following a meeting with CEO Lip-Bu Tan, boosting sentiment around the semiconductor maker’s leadership and outlook.

🌏 Asian Shares Rise as U.S. Futures Flat After Defense Rally

Asian equities mostly climbed after U.S. markets showed mixed performance, buoyed by defense stock strength on Trump’s defense spending talk; Tokyo’s Nikkei 225 added 1.6%, and Fast Retailing surged over 10% on strong profit and upgraded forecasts.

🛢️ Oil Extends Gains as Traders Eye Iran Unrest and Venezuela Policy

Crude prices pushed higher — WTI above $58 and Brent near $62 — as markets weighed heightened geopolitical risks from Iran unrest, Trump’s tougher stance, and potential Venezuelan export shifts, with commodity index rebalancing set to channel more capital into oil.

You Do Not Need to React to Every Story

Markets produce headlines every hour. Most exist to explain moves after they happen. Reacting to each one pulls you out of your plan and into emotion.

Strong traders decide in advance what matters. They follow price behavior and predefined levels. News becomes background information, not a trigger. This keeps decisions consistent and stress low.

When you stop reacting, clarity returns. You trade the plan instead of the headline. Consistency replaces confusion.

If you want guidance that helps filter market noise and focus on what matters, these newsletters help. They reinforce structured thinking and disciplined decision making.

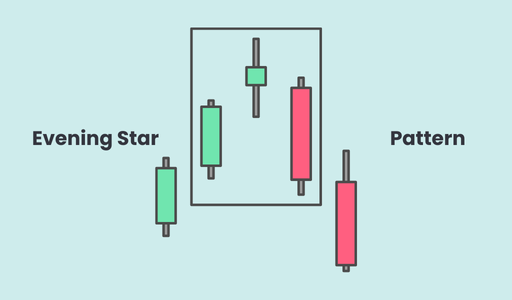

Evening Star

The Evening Star is a three-candle bearish reversal pattern that represents the "sunset" of an uptrend. It visualizes a transition where buyers lose their grip, the market stalls in indecision, and sellers finally seize control to drive the price downward.

🛠️ The Strategy Logic

Use these logical triggers to identify market tops and time your exits or short entries:

- IF: A small-bodied candle (the "Star") gaps above a large green candle...

- THEN: The first stage of the reversal is in place. This indicates that while the price reached a new high, the buyers no longer have the strength to maintain a large expansion, leading to a "stall."

- IF: The third candle is a large red candle that closes at least halfway into the body of the first green candle...

- THEN: The bearish reversal is confirmed. This shows that the sellers have successfully erased the majority of the bulls' previous progress, shifting the path of least resistance to the downside.

- IF: The middle "Star" is a Doji or a Shooting Star (long upper wick)...

- THEN: The signal is high-conviction. A Shooting Star at the peak of the pattern shows that buyers tried to push higher but were violently rejected, leaving a "trap" for anyone who bought the top.

- IF: The pattern forms at a major resistance zone or touches the Upper Keltner Channel...

- THEN: You have a "Confluence" signal. The channel or resistance acts as a hard ceiling, and the Evening Star acts as the proof that the market is falling away from that ceiling.

- IF: Volume is lower on the middle "Star" but spikes significantly on the third (red) candle...

- THEN: The move is backed by institutional distribution. The surge in volume on the final candle confirms that professional traders are dumping their positions.

💡 Pro Tip

The "Island" Peak: The most devastating Evening Stars are those where the middle candle is completely isolated by gaps on both sides (an "Island Top"). These gaps act as psychological barriers; the people who bought during that isolated "Star" period are now "trapped" and will likely sell in a panic as price drops, fueling a much faster and deeper decline.

Cognitive Rust: When Sharp Turns Soft

Edges don’t vanish overnight. They dull slowly.

You stop reviewing because things feel fine.

You skip journaling because the setup looks familiar.

You trust instinct a little more than process.

That’s how cognitive rust sets in.

Nothing breaks all at once.

Entries get a bit late.

Exits get a bit sloppy.

Risk creeps up without you noticing.

The edge you once executed cleanly now feels harder to access.

The market hasn’t changed. You have.

Sharpness needs upkeep.

Reviewing past trades keeps your standards clear. Journaling keeps your mistakes visible.

Repetition keeps your execution tight.

When traders say their edge “stopped working,” most of the time the edge is still there.

Their attention just isn’t.

Skills decay when they aren’t checked.

Discipline fades when it isn’t practiced.

Clarity disappears when reflection stops.

Maintenance is not optional in trading.

It is part of the job.

Staying sharp takes less effort than rebuilding an edge you allowed to rust.