🎲 Investors Betting Big on…

......................................................................................................................................................

Hope you all had a wonderful Thanksgiving! 🦃

This week’s wildest plot twist? Take your pick—Trump’s tariff talk rattling markets, Bitcoin flirting with $100K before ghosting us, or traders locked in a debate: bull run or buy-the-dip?

While Wall Street straightens its tie for record highs, the Nikkei’s sweating over tariffs, and crypto folks are still planning the six-figure Bitcoin party.

Investors are betting big on a gold rush, and our first feature article on our crucial update section tells you why.

It’s a Friday with enough market drama to fill a weekend binge-watch.

✨ Gold Glows as Dollar Dips—Eyes on Inflation!

A weakening dollar nudged gold higher, glimmering with promise. Investors await critical inflation data that could steer the Fed's next move. Will gold stay hot or lose its shine?

🚀 Wall Street Rockets Up—New Record Set!

The Dow defied expectations, soaring despite tariff tremors from the White House. Fed signals of rate cuts lit a fire under investors, boosting the S&P and Nasdaq. Confidence reigns, but will it last?

⛩️ Tokyo Tumbles! Yen Strength & Tariff Fears Hit Hard

Japan’s Nikkei slid as the yen’s rally and looming US tariffs spooked traders. Auto giants bore the brunt, driving markets down. Can the Land of the Rising Sun rebound?

💥 Sterling Punches Back—Tariff Turbulence No Match!

The pound bounced back, ending slightly higher after Trump's tariff threats. Currency markets remain volatile amid ongoing trade tensions.

🔗 Copper Holds Firm as Market Awaits New Spark

Copper prices stayed steady, supported by a soft dollar. Traders are on edge, waiting for fresh signals to ignite movement. Will the metal’s momentum build or fizzle?

🪫 Bitcoin Struggles Near $90k: Bull Run or Buy Dip?

After teasing $100,000, Bitcoin slipped back toward $90K. Traders are split: is this the end of the bull run or a golden buying opportunity? Crypto drama continues!

🌓 $100K Bitcoin? Traders Split!

Half of Bitcoin option traders are betting big on a $100K breakthrough by year-end. Some even dream of $150K! Are we in for a crypto climax or a disappointing flop?

On Friday of last week, I recommended taking a short position on Tesla at $339.56, which has proven profitable as Tesla dropped to $326.59 by Wednesday.

I've taken partial profits by closing half the position at a 3.36% gain and protected the remaining position by moving the stop loss to break-even, eliminating any downside risk.

Based on TAD 4-hour timeframe, Tesla appears likely to continue its downward movement until it fills the gap at $322, where I plan to close the remaining position.

With markets closed yesterday for Thanksgiving and only a half-day session today, trading volume will be significantly reduced.

Given these quiet market conditions, I'll hold off on making new stock recommendations until Monday when normal trading activity resumes.

Terrified of Watching Your Money Vanish Like a Magician’s Trick? Here’s How to Keep It Safe!

Starting to trade can feel like handing your wallet to a magician—you’re not sure if your money will reappear or disappear for good.

It’s a valid fear, but the truth is, trading doesn’t have to be a gamble.

The right knowledge can turn anxiety into confidence.

That’s why these newsletters are a must-read.

They focus on practical strategies, risk management tips, and insights to protect your capital while you grow it.

Click here to see how you can start trading smart without the fear of seeing your money vanish.

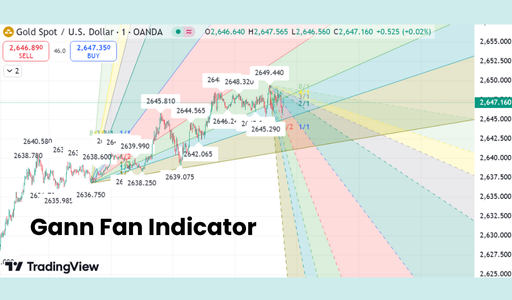

Gann Fan

A Gann Fan is a technical analysis tool that uses a series of angled lines to identify potential support and resistance levels.

Developed by W.D. Gann, this tool is based on the idea that markets move in predictable patterns and that these patterns can be identified through geometric angles.

What to Look For:

- Angled Lines: Gann Fans consist of a series of angled lines that radiate from a specific point on the price chart, often a significant high or low.

- Support and Resistance Levels: These angled lines can act as potential support and resistance levels for price movements.

- Trend Identification: Gann Fans can help identify the overall trend direction and potential trend reversals.

- Price Targets and Stop-Loss Levels: Traders often use Gann Fans to set price targets and stop-loss levels.

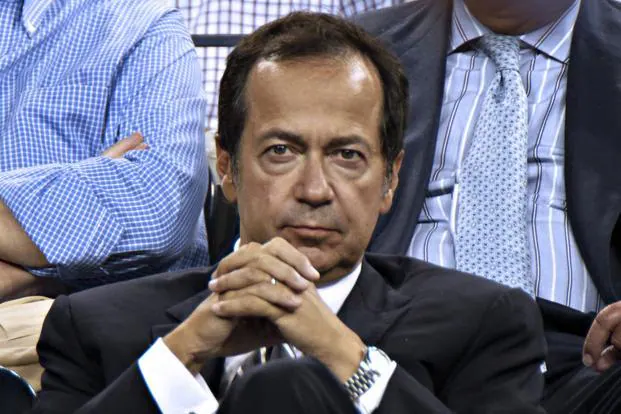

Lessons from John Paulson

Photo: Bloomberg

Let’s talk about the man who turned Wall Street upside down.

John Paulson didn’t just win—he made history.

In 2008, while the world was drunk on real estate dreams, Paulson looked at the housing market and saw a ticking time bomb.

So, what did he do? He bet against it. Hard. Result? $15 billion.

Yeah, you read that right.

How is that even possible??

Maybe???

Lol, far from it; It wasn’t some form of dark arts or MAGIC.

It was meticulous research, unshakeable discipline, and guts of steel.

Paulson’s first lesson? Do your homework.

He dove deep into the subprime mortgage mess, uncovering the cracks everyone else ignored.

No shortcuts, no guesswork.

Are you digging that deep? Because, let me tell you, the market rewards those who know more than the crowd.

Then there’s his secret weapon: contrarian thinking. When the world screamed “Buy! Buy! Buy!” he whispered, “Sell.”

It wasn’t popular. It wasn’t easy. But it was RIGHT.

Are you brave enough to go against the herd when the data tells you to?

And let’s talk about risk.

Paulson’s trades weren’t wild gambles—they were calculated, hedged, and controlled.

He knew the downside, and he played the long game. That’s the difference between a reckless bet and a strategic win.

So, here’s the question: Are you ready to trade like Paulson?

Dig deeper. Think sharper. Risk smarter.

Because in this game, playing it safe isn’t always safe.

And following the crowd?

That’s the fastest road to nowhere.

Let’s be real—how often do you feel stuck, wondering if you’ll ever crack the code to consistent trading?

Maybe you’ve seen the success stories of traders predicting the market like John Paulson did, but replicating that seems impossible.

Here’s the truth: success isn’t luck; it’s a strategy.

Paulson's meticulous research, risk management, and contrarian thinking were game-changers.

That’s why we’re introducing the 10 Percent a Day course—a step-by-step guide to mastering strategies that aim for daily consistency.

Watch the video and see how you can start making smarter moves today