Intel Stock Explodes 7%

....................................................................................................................

Good morning and happy Monday. ☕

Wall Street is gearing up for a massive week filled with high-stakes events. The Federal Reserve’s expected rate cut, a crucial Trump–Xi meeting, and a flood of Big Tech earnings are setting the stage for serious market action.

US stock futures are in the green, with the Dow up 0.6%, the S&P 500 rising 0.8%, and the Nasdaq edging 0.1% higher. All three indexes closed at record highs Friday, setting an upbeat tone for the week.

Across Asia, markets rallied as Japan’s Nikkei topped 50,000 for the first time, joined by gains in South Korea and China. Optimism is building around a potential US–China trade breakthrough after weekend talks saw both sides claim “substantial progress.”

Gold prices slipped as investors rotated out of havens, while Intel shares popped after a strong Q3 showing, powered by a rebound in PC demand and growing AI chip momentum.

It’s a packed week ahead.

The markets are alive.

And we’ve got you covered - next up, The Crucial Update, featuring seven trending stories to set the tone for your trading day.

⚡ Intel Stock Jumps as Q3 Earnings Beat Expectations, AI Drives Chip Demand

Intel's stock jumped after the company reported third-quarter revenue and profit that beat Wall Street estimates, driven by a recovering PC market and strong institutional demand for its AI-enabling chips.

💸 CPI Near 3% as Tariffs Cloud Fed's Rate Path

September's Consumer Price Index (CPI) data is expected to show inflation holding stubbornly near 3%, with rising shelter costs and trade tariffs complicating the Federal Reserve's debate on further interest rate cuts.

🤝 Google and Anthropic Announce Multi-Billion Dollar Cloud Deal

AI startup Anthropic announced a multi-billion dollar agreement with Google Cloud, securing access to up to one million Tensor Processing Units (TPUs) to fuel the training of its next-generation Claude models.

📈Microsoft Earnings to Break Stock’s Stagnation

Microsoft's stock has traded flat since its July earnings report, but analysts predict its upcoming fiscal first-quarter results, driven by Azure cloud and the Copilot AI rollout, will be the catalyst for a major move.

🌏 Tech Stocks Surge as Trump-Xi Meeting Confirmed

Global stocks and US equity futures climbed after the White House confirmed President Trump will meet Xi Jinping next week, easing trade war tensions and sparking a blistering rally in Asian tech stocks, led by chipmakers like SK Hynix.

🇰🇷 South Korea's Kospi hits record high as Asia stocks gain

South Korea's Kospi index surged 2% to an all-time high amid broad regional gains after the White House confirmed U.S. President Donald Trump and China’s President Xi Jinping are scheduled to hold talks next Thursday, easing trade tensions.

🪙 Gold Loses $2.5 Trillion as Bitcoin Holds the Line

Gold, the traditional safe-haven, suffered a massive market capitalization loss of $2.5 trillion more than the entire value of Bitcoin while the crypto asset showed surprising resilience, leading analysts to speculate on a capital rotation toward BTC.

The Real Loss Happens When You Never Start

The real loss in trading doesn’t come from a bad trade. It comes from hesitation.

Most people spend years waiting - waiting for the perfect moment, waiting to have “enough” savings, waiting until they feel completely ready.

But the truth is, no one ever feels ready. The market rewards those who learn by doing, not those who stay frozen by fear.

Losing small while learning is part of the process.

It teaches you how risk feels, how to adapt, and how to protect your capital. Waiting, on the other hand, teaches you nothing. You stay on the sidelines while the people who started small keep improving.

If you’ve been holding back because you’re scared of losing your savings, flip your perspective.

The goal isn’t to gamble - it’s to learn how to control risk.

And the only way to do that is by stepping in.

👉 Find trading newsletters worth reading here!

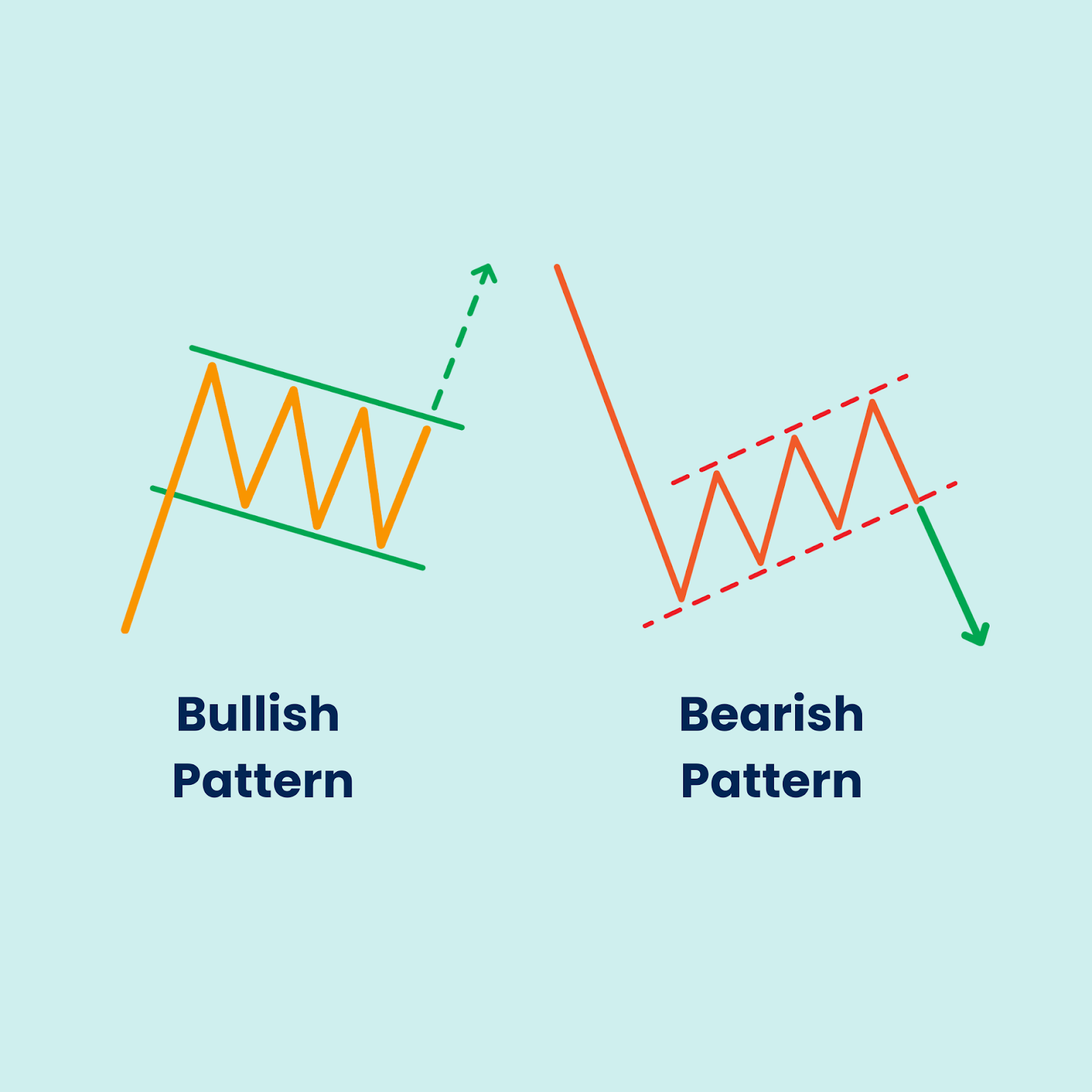

Flag Pattern

The Flag Pattern is a powerful continuation pattern that occurs frequently in all financial markets and timeframes.

It signals that a strong, rapid trend is pausing temporarily before resuming its aggressive movement. The pattern consists of two parts: the pole and the flag.

The pole is the sharp, near-vertical price movement that precedes the pattern, and the flag is the small, tight, rectangular consolidation area that follows. Because it usually lasts only one to three weeks, it is often viewed as a brief, healthy period of profit-taking before the trend continues

What to Look For (Key Features and Signals)

- The Pole: This is the initial, large, and almost vertical price surge that marks the beginning of the powerful trend. It is the initial aggressive leg of the move.

- The Flag (Consolidation): The price moves sideways and slightly counter to the prevailing trend, forming a tight, small channel. This channel is bound by two parallel, sloping trend lines.

- In a Bull Flag (seen in an uptrend), the flag slopes downward against the up-move.

- In a Bear Flag (seen in a downtrend), the flag slopes upward against the down-move.

- Volume: Look for key volume characteristics:

- High Volume during the formation of the pole (confirming strong conviction).

- Low Volume during the formation of the flag (confirming that it is only a temporary pause).

- High Volume Spike upon the breakout (confirming the trend resumption).

- Breakout Signal: The pattern is confirmed when the price breaks decisively out of the flag channel in the direction of the original pole.

- For a Bull Flag, the breakout is above the upper channel line (buy signal).

- For a Bear Flag, the breakout is below the lower channel line (sell/short signal).

- Target Price: The traditional price target is calculated by measuring the height of the pole (from the start of the pole to the start of the flag) and projecting that distance in the direction of the breakout from the point where the price exits the flag channel.

Identity Risk

When your self-worth gets tied to your profit and loss, you stop trading the market and start trading your ego.

Every win feels like proof that you are skilled and capable.

Every loss feels like a personal failure.

The charts lose meaning.

The data stops being data.

Everything becomes about you.

This is the danger of identity risk. It is not in trading books, but it quietly destroys many traders.

When your confidence depends on how your account performs, your decisions lose objectivity.

You hold onto losing trades because closing them feels like admitting defeat.

You double down to make back losses because your pride cannot stand being wrong.

You protect your image instead of your capital.

Real growth in trading happens when you separate who you are from what you make.

A loss is not a reflection of your worth.

A win does not prove your superiority.

Both are information. Both are lessons.

The market is indifferent to emotion.

It rewards those who stay calm, disciplined, and grounded.

When you stop letting your results define you, you gain clarity.

That is when you start trading with freedom and precision.

You are not your PnL.

You are the trader who learns from it.