Google Thinks The REAL Money Is Here

Google just made the BIGGEST cybersecurity acquisition in history. 🤯

Google just made the BIGGEST cybersecurity acquisition in history. 🤯

This isn't just about protecting your data – it's about a massive shift in where the REAL money is being made.

In this issue, we'll not only delve into this groundbreaking acquisition but also explore the broader trends shaping the market.

From AI to defense to dividend stocks, we've got your complete guide to navigating this new financial frontier.

🛡️ Google Bets Big on Cloud Security with $23 Billion Wiz Acquisition

What's behind the biggest cybersecurity deal in history? Get the inside scoop behind Google's massive investment in Wiz.

🤖 Top AI Stocks to Invest in Now with $1000

It’s time for AI! Discover the best AI stocks to buy now with $1000 and potentially reap huge returns.

📈 Best Dow Jones Dividend Stocks for Your 2024 Portfolio

Find out which Dow Jones stocks are the top picks for income-focused investors and how to build a diversified dividend portfolio.

🪖 3 Top Defense Stocks to Buy Now

Don't miss out on these high-growth defense stocks! Find out which three companies are poised to benefit from global security concerns.

💾 TSMC Q2 Profit Expected to Soar As AI Chip Demand Surges

TSMC is riding the artificial intelligence wave to potentially record-breaking profits. Could this be the most profitable quarter in chipmaking history?

💶 ECB Under Pressure as Bitcoin Surges and Euro Tumbles

Which asset will reign supreme? Find out why the euro is weakening, bitcoin is strengthening, and what the ECB's next move means for your portfolio!

🌋 Nvidia: How Much Stock is Too Much for Your Portfolio?

Nvidia's shares have soared 785% since 2023, but will the AI darling's luck run out? Find out the hidden risks and potential rewards before adding in more stock.

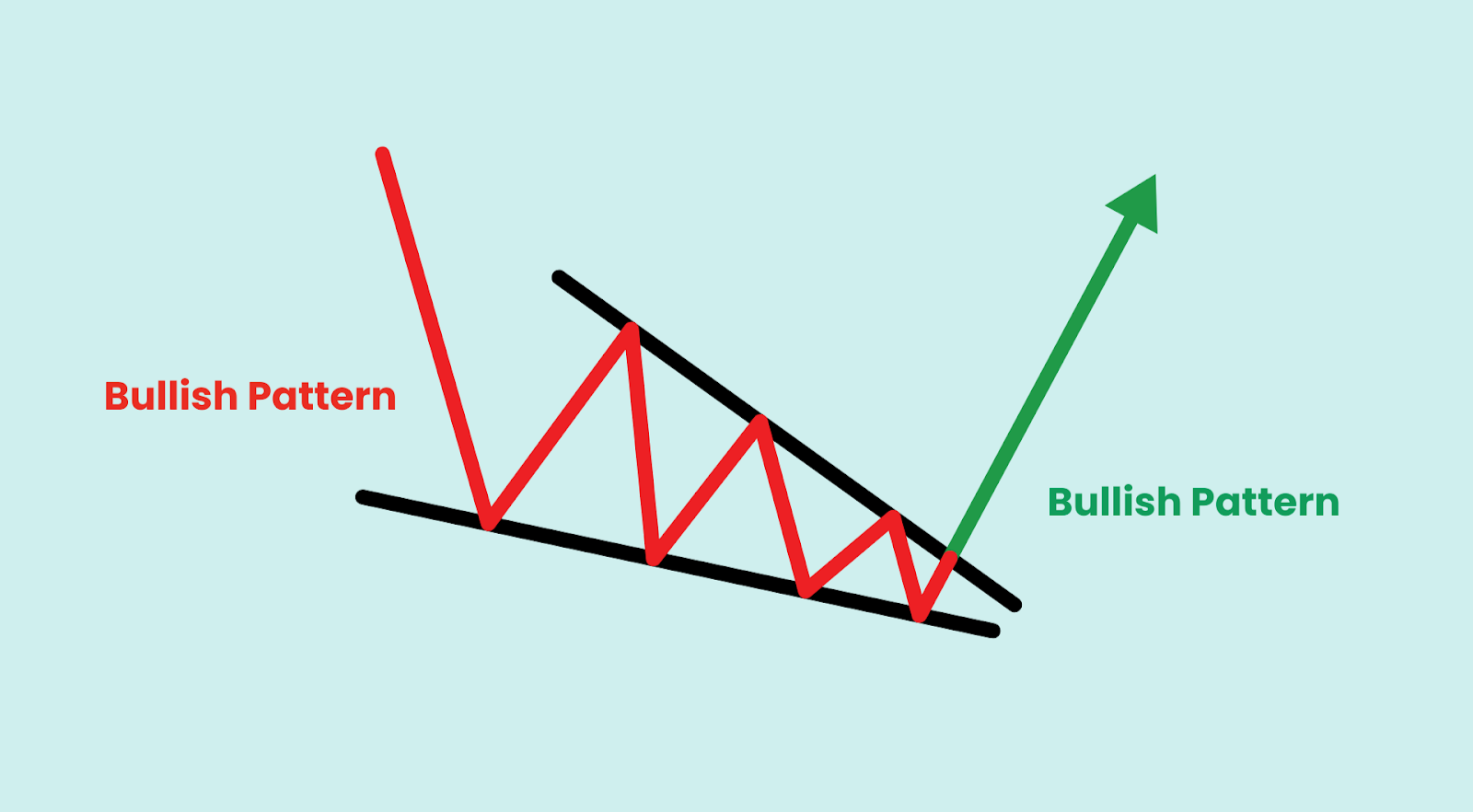

Falling Wedge

The falling wedge is a bullish reversal pattern, suggesting that the selling pressure is weakening and buyers are stepping in.

It's like a compressed spring, building up energy for a potential upward move.

What to Look For:

- Downward Slope: The overall trend is going down.

- Converging Trendlines: The two trend lines are getting closer together, forming a wedge shape.

- Breakout: If the price breaks above the upper trendline with strong volume, it's a bullish sign. This could mean the start of a new uptrend!

Ever feel like your emotions are the biggest obstacle to trading success? You're not alone.

The market is a rollercoaster, and our minds often play tricks on us.

But here's the game-changer: Successful trading isn't just about strategies and technical analysis.

It's about mastering your emotions and developing a resilient mindset.

Think of it like this: your mind is the most powerful tool in your trading arsenal.

When you learn to control your emotions – the fear, the greed, the doubt – you unlock the potential for consistent profits.

This is where discipline and self-awareness come in. Stick to your trading plan, even when things get tough.

Don't chase losses or let winning streaks go to your head.

Remember, every trade is a learning opportunity.

Analyze your mistakes, celebrate your successes, and keep growing as a trader. It's a marathon, not a sprint.

So, take a deep breath, cultivate a calm and focused mindset, and watch your trading performance soar.