Golds Smashes $5K

....................................................................................................................

Good morning,

Wall Street heads into a heavyweight week on the defensive.

US stock futures are sliding as markets reopen, with traders bracing for a packed stretch that could set the tone for the weeks ahead.

After a choppy, geopolitics-driven pullback last week, risk appetite is thinning as investors prepare for a flood of major earnings and the Federal Reserve’s first policy decision of the year.

This is one of those “everything matters” weeks. Big Tech earnings from Apple, Microsoft, and Meta will test whether profit growth can keep justifying lofty valuations, even as recent examples show that beating estimates isn’t always enough to calm sellers.

At the same time, the Fed’s midweek decision looms large — not for what it does, but for what it signals about the path to rate cuts.

Markets ended last week lower despite easing geopolitical tension around Greenland, reminding traders that relief rallies can be fragile.

With stocks already on edge and volatility lurking beneath the surface, this week’s combination of earnings and central bank guidance could decide whether Wall Street regains its footing — or slips further into caution mode.

🥇 Gold Smashes $5,000 as ‘Debasement Trade’ Sparks Alarming Safe-Haven Frenzy

Gold surged past $5,000 an ounce far sooner than expected, fueling fears that investors are rushing to hedge against ballooning global debt and eroding purchasing power.

🏦 Goldman Sachs Sees Calm Fed Meeting, Still Bets on June Rate Cut

Goldman Sachs expects the Fed to hold rates steady this week with no surprises from Chair Powell, while maintaining its outlook for two rate cuts later this year.

🌏 Asian Stocks Slide as Yen Surge Hammers Japan’s Exporters

Asian markets mostly declined after the yen strengthened sharply, dragging Japan’s Nikkei lower as heavyweight exporters like Toyota sold off.

📈 Wall Street Eyes 2026 Earnings Boom as Profit Growth Takes Center Stage

U.S. markets are looking past rate uncertainty toward 2026, with analysts betting that accelerating earnings growth will be the main driver of equity gains.

🪙 Bitcoin Slips Into Weekly Close as $86K Becomes a Key Line in the Sand

Bitcoin sold off into the weekly close as rising macro uncertainty put pressure on bulls defending the critical $86,000 support level.

💥 Crypto Market Loses $100B as U.S. Shutdown Fears Trigger Risk-Off Move

Digital assets plunged over the weekend, wiping out $100 billion in market value as traders reacted to mounting fears of a U.S. government shutdown.

💴 Asian Markets Retreat Again as Yen Strength Sparks Export Stock Selloff

Stocks across Asia fell as renewed yen strength raised intervention expectations and weighed heavily on Japan’s export-driven equities.

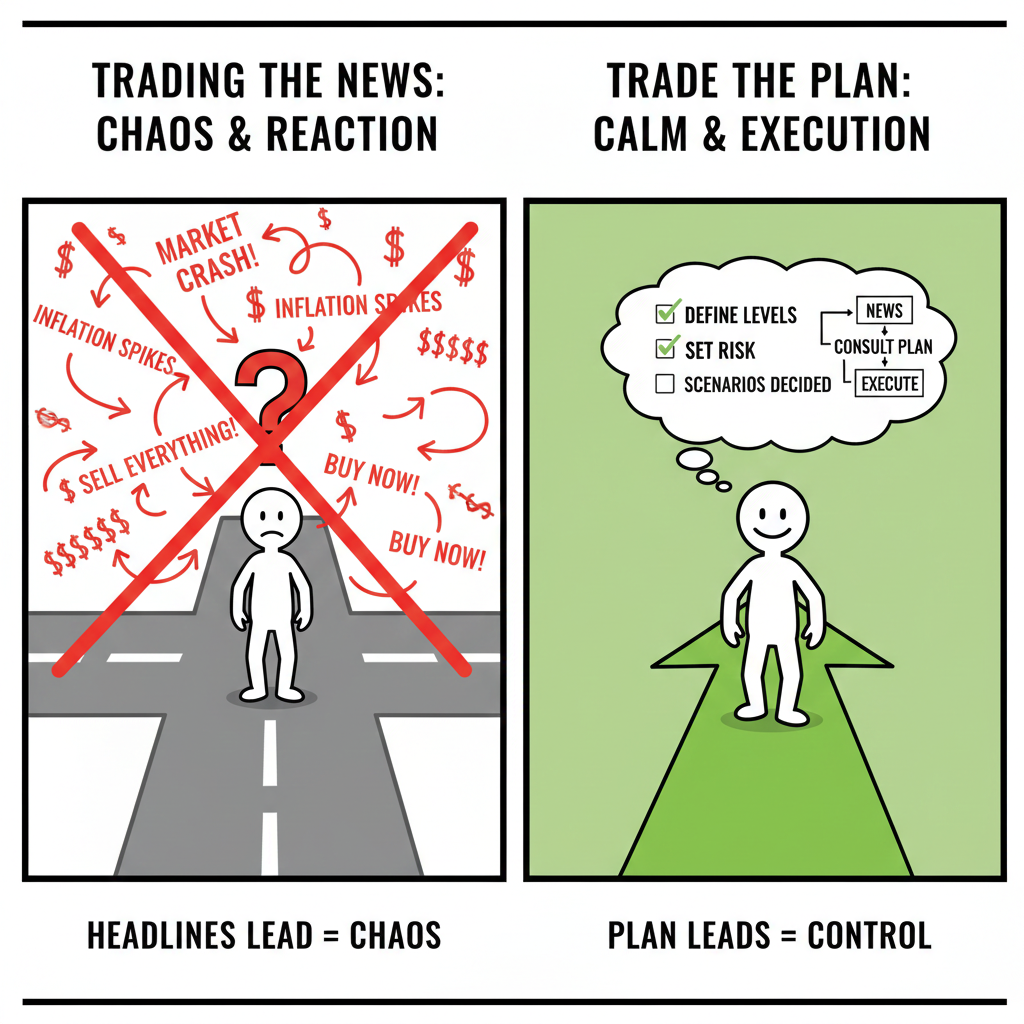

Stop Trading the News. Trade the Plan

News feels urgent. Headlines flash. Opinions multiply. That pressure pushes traders into rushed decisions that do not match their strategy.

Strong traders decide before the noise. They define levels, risk, and scenarios in advance. When news hits, they already know what they will do. The plan leads. Headlines follow.

Trading improves when you stop reacting and start executing. News becomes background information, not a trigger. Clarity replaces confusion when the plan stays in control.

If you want guidance that helps you focus on structured plans instead of noisy headlines, these newsletters help. They reinforce disciplined thinking and clear frameworks that keep decisions calm.

Elder's Force Index (EFI)

Developed by Alexander Elder, the Force Index combines price movement and volume to measure the actual "power" behind a trend.

It identifies three key elements: the direction of price change, the extent of the change, and the volume.

It is one of the few indicators that can tell you if a trend is being driven by high-conviction "big money" or just weak retail fluctuations.

🛠️ The Strategy Logic

Use these logical triggers to determine if a trend is healthy or if a reversal is being fueled by institutional pressure:

- IF: The EFI line is above zero and rising while price is also rising...

- THEN: You are in a high-conviction uptrend. The "force" of the bulls is increasing, confirming that the trend has significant volume support and is likely to continue.

- THEN: You are in a high-conviction uptrend. The "force" of the bulls is increasing, confirming that the trend has significant volume support and is likely to continue.

- IF: The EFI line drops below zero during a strong uptrend...

- THEN: This is a "Buy the Dip" signal. In a healthy uptrend, a brief dip below zero represents a temporary exhaustion of sellers and offers a high-probability entry point before the bulls take control again.

- THEN: This is a "Buy the Dip" signal. In a healthy uptrend, a brief dip below zero represents a temporary exhaustion of sellers and offers a high-probability entry point before the bulls take control again.

- IF: Price hits a new high, but the EFI makes a lower high (Bearish Divergence)...

- THEN: The trend is "hollow." This indicates that while prices are rising, the volume and power behind the move are dying out. This is a primary warning of a major price collapse.

- THEN: The trend is "hollow." This indicates that while prices are rising, the volume and power behind the move are dying out. This is a primary warning of a major price collapse.

- IF: The EFI spikes to an extreme level (very high or very low) and then snaps back...

- THEN: A "Climax" has occurred. An extreme spike suggests a moment of panic buying or selling. This usually marks the end of a move, and price is likely to consolidate or reverse shortly after.

- THEN: A "Climax" has occurred. An extreme spike suggests a moment of panic buying or selling. This usually marks the end of a move, and price is likely to consolidate or reverse shortly after.

- IF: The EFI is hugging the zero line with very little movement...

- THEN: The market is "featureless." There is no significant force from either side. Avoid entering new trades here, as the lack of volume makes the market prone to unpredictable "whipsaws."

💡 Pro Tip

The 2 vs. 13 Rule: Alexander Elder recommended using two different versions of the EFI together. Use a 2-period EFI for short-term timing (looking for those quick dips below zero to buy) and a 13-period EFI to identify the overall trend direction. If the 13-period is above zero, only use the 2-period for "Buy" signals. This keeps you on the right side of the "big money" flow.

When Wins Start Lying to You

A big win changes the story in your head.

You remember the profit clearly. The entry feels cleaner in hindsight.

The timing feels intentional. The risk feels earned.

What fades is the part where price chopped first. Or the news you ignored. Or the stop that should have been hit before a sudden reversal saved the trade.

Wins edit memory.

They remove the luck and replace it with confidence. That is where distortion starts.

After a big green day, traders trust their instincts more than their process.

They size up because it worked before.

They loosen rules because the last trade felt controlled. They start believing the outcome came from skill alone.

That belief is dangerous.

The market often rewards you even when execution is messy.

It does not do it consistently. If you learn the wrong lesson from a win, you pay for it later.

Smart traders dissect wins harder than losses.

They ask what was planned and what was accidental.

They separate skill from timing. They write down where luck played a role.

Profits feel good. But clarity keeps you alive.

If a win makes you feel smarter than your rules, it is already working against you.