Gold Pullback Hard

....................................................................................................................

Happy Friday - let’s finish the week strong.

Markets are waking up green this morning as investors brace for the big one: the September inflation report.

It’s the first major data drop since the government shutdown began, and it could reset expectations for the Fed’s next move. CPI is expected to hover around 3%, still too warm for comfort but traders are hoping for signs of cooling.

Futures are modestly higher across the board, putting the S&P 500 and Dow on track for weekly gains of just over 1%. The calm before what could be a data-driven storm.

Over in earnings land, Intel Corporation is stealing the spotlight - up 8% premarket after crushing expectations and fueling optimism that the chip sector’s AI story still has legs. Target Corporation also ticked up after announcing plans to cut 8% of its corporate workforce, its first major layoff in a decade.

Meanwhile, optimism just got a boost after the White House confirmed that President Trump and China’s Xi Jinping will meet next week in South Korea. The long-awaited face-off has traders betting on some cooling in U.S.–China tensions just in time for earnings season’s next wave.

It’s a busy Friday - inflation, AI, and US-China face-off all in motion.

Let’s dive into what’s shaping the session ahead. The Crucial Updates are next with the top seven stories moving markets right now.

🚗 Tesla Profit Falls Short Despite Record Sales

Tesla reported record third-quarter revenue, but profit failed to meet Wall Street expectations due to higher tariff and research costs, as well as a drop in income from regulatory credits.

🔮 Polymarket Eyes $15 Billion Valuation

Polymarket reportedly seeking new funding at a valuation up to $15 billion, highlighting the rapid growth in decentralized prediction markets following a $2 billion investment from ICE.

💸 U.S. National Debt Surpasses $38 Trillion Milestone

The U.S. government's gross national debt surpassed $38 trillion, marking the fastest accumulation of a trillion dollars outside of the COVID-19 pandemic and raising fiscal concerns.

📉 Standard Chartered: Bitcoin Drop Below $100K Is 'Inevitable'

Standard Chartered analysts predict that Bitcoin could briefly dip below the $100,000 mark, framing the move as the "last time Bitcoin is EVER below 100k" and a major buying opportunity before a rebound.

⚡ Tesla Profit Falls Short Despite Record Sales

Tesla reported record third-quarter revenue that beat Wall Street estimates, but profit fell short due to higher tariff and research costs, as well as fading regulatory credits.

🌍 Asian Markets Slide on Russia Sanctions & China Fears

Shares were mostly lower in Asia following a retreat on Wall Street, while crude prices jumped more than $2 after U.S. President Donald Trump announced sanctions on Russian oil giants Rosneft and Lukoil.

🪙 Gold Extends Pullback from Record High Amid Profit-Taking

Gold prices eased, extending their sharpest one-day fall in four years after hitting an all-time high, as investors engaged in profit-taking amid global market jitters and volatility.

You Don’t Need a Finance Degree, You Need a Game Plan

Most traders overcomplicate things.They think they need a finance degree, an MBA, or some fancy certification before they can trade confidently.

That’s not true.

The market doesn’t care where you went to school. It only cares how you react - how you plan, manage risk, and control emotions when the pressure hits.

Having a game plan will beat having a diploma every single time. Because degrees might teach theory. But trading demands practice, patience, and precision.

If you can stay consistent, follow structure, and learn from credible trading newsletters, you’ll be far ahead of most “educated” traders who still trade on emotion.

Start with the right guidance - explore top trading newsletters that help you build a real plan instead of relying on luck:

Subscribe to recommended newsletters here.

Average True Range (ATR)

The Average True Range (ATR) is a technical analysis indicator that measures market volatility. It was developed by J. Welles Wilder Jr. and is crucial because it provides a quantitative measure of how much an asset is moving on average over a specific time period.

ATR does not indicate price direction or momentum; it only indicates the degree of price movement or "truth" in the market. A high ATR suggests high volatility and a wide trading range, while a low ATR suggests low volatility and a tight trading range. The standard look-back period for ATR is 14 periods (days, hours, etc.).

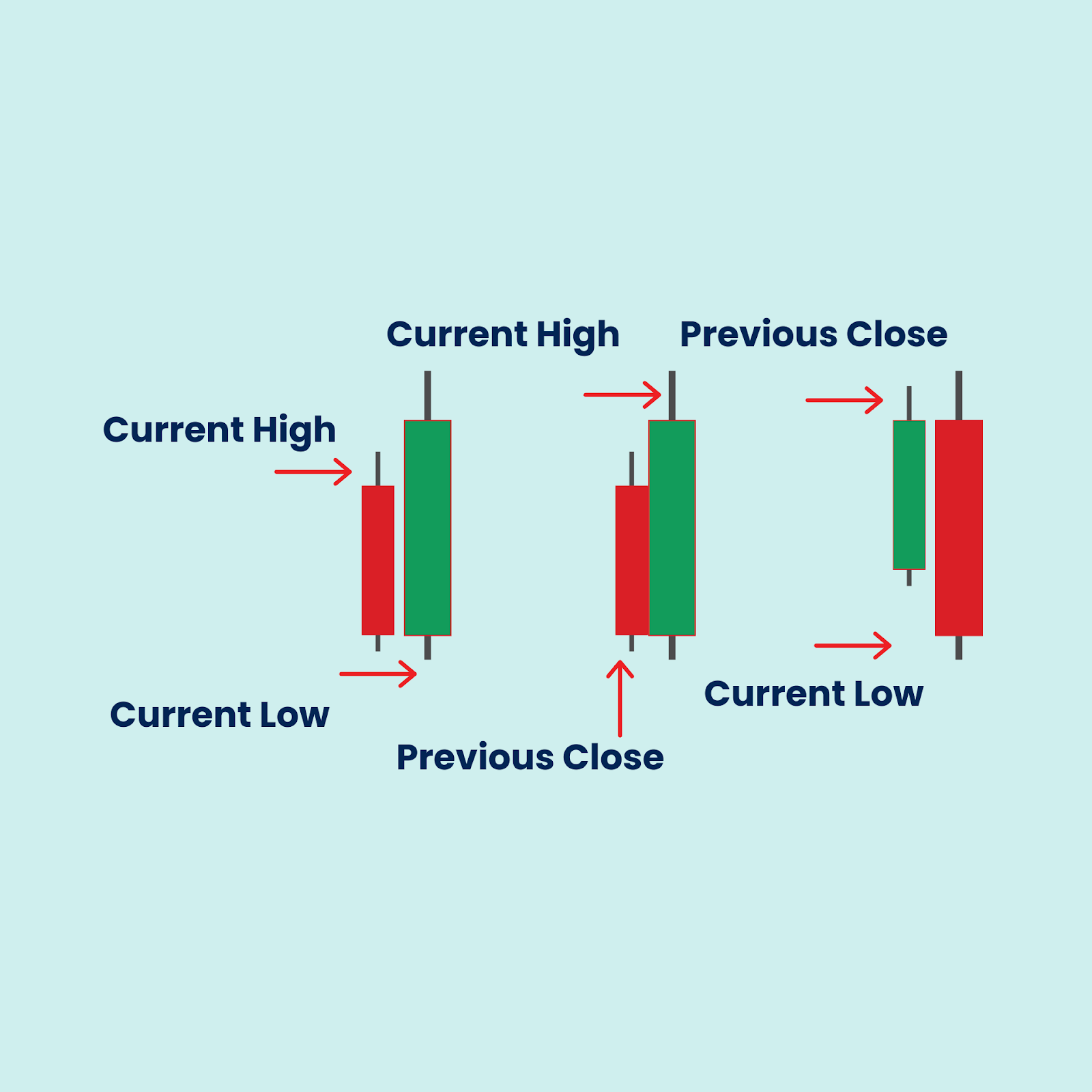

The ATR is calculated by first finding the True Range (TR), which is the greatest of three values for a given period:

- Current High minus the Current Low.

- Absolute value of the Current High minus the Previous Close.

- Absolute value of the Current Low minus the Previous Close.

The ATR is then the moving average (usually a Simple Moving Average) of these True Range values over the chosen period.

Here are the key signals traders look for:

- Volatility Confirmation: Look for the ATR line to rise during periods of strong market moves (up or down). A rising ATR confirms that the trend is strong and the moves are becoming more volatile, indicating a likely continuation.

- Contraction Signal: Look for the ATR line to reach historic lows. A very low ATR often signals a period of market contraction and consolidation (tight range). This typically precedes a significant price breakout as volatility is about to return.

- Exhaustion Signal: Look for a high ATR reading that is then followed by a drop. A surge in ATR at the end of a long trend (a parabolic move) can signal the climax or exhaustion of that trend, often preceding a reversal.

- Stop-Loss Placement: The primary use of ATR is setting dynamic stop-loss levels. Traders often place their stop-loss a multiple (e.g., $1.5$ to $3.0$) of the current ATR below their entry price for a long trade, or above their entry price for a short trade. This ensures the stop-loss is placed relative to the asset's current volatility.

- Position Sizing: ATR can be used to manage risk by calculating position size. A higher ATR means the market is more volatile, so a trader would use a smaller position size to ensure the dollar risk remains consistent across different trades.

Quiet Wins vs Loud Losses

The market doesn’t always shout when it’s offering opportunity.

Most of the time, it whispers.

The best trades?

They rarely trend on X.

They don’t come with hype, flashing signals, or bold predictions.

They happen quietly when everyone else is distracted, emotional, or chasing noise.

Quiet wins come from calm minds.

From traders who wait, who observe, who execute with patience instead of impulse.

Loud losses, on the other hand, love attention.

They come when greed takes over, when the crowd gets excited, when you feel the urge to “catch the move before it’s gone.”

That’s usually when it is gone.

If you feel pressure, noise, or hype - step back.

Your best work as a trader happens in silence. In routine. In focus.

Let others chase headlines.

You stay quiet, deliberate, and steady.

In trading, the loudest room is rarely where the real money is made.