TikTok seals US deal

....................................................................................................................

Good morning,

After two sessions of relief-fueled gains, US stock futures are treading water as traders step back and reassess a week dominated by sharp swings in sentiment and sudden shifts in Washington’s tone.

With President Trump easing his rhetoric around Greenland, the immediate geopolitical pressure has faded — but caution is still firmly in the driver’s seat.

The rally earlier in the week was built on relief, not conviction. Investors welcomed Trump’s tariff reversal and signs of a diplomatic “framework,” pushing major indexes higher as risk appetite cautiously returned. But Friday’s muted open reflects lingering nerves, especially as weak tech earnings remind markets that fundamentals still matter.

Gold’s relentless climb to fresh records tells the deeper story.

Even as equities stabilize, demand for safety remains elevated, underscoring how fragile confidence is heading into the close of another volatile, policy-whipsawed week on Wall Street.

🧈 Gold hits new all-time high

Gold just punched through ₦4,980 and didn’t even flinch. When fear whispers, gold doesn’t listen—it runs.

♪ TikTok seals US deal

After years of threats, bans, and political chest-beating, TikTok finally cut a deal. The app lives—and Washington blinked first.

📈 Oracle jumps on TikTok deal

TikTok’s US revival didn’t just save an app—it handed Oracle a starring role and another reason for bulls to stay loud.

🗽US futures pause after rally, Dow, S&P, Nasdaq futures muted

Another wild week, another calm open. Futures went quiet—not because risk is gone, but because traders are exhausted

💻 Intel stock tumbles as company's Q1 outlook falls short of Wall Street expectations

Wall Street wanted confidence. Intel delivered caution. The result? A brutal after-hours selloff and shaken faith.

🇪🇺 European markets edge lower; Ericsson pops 11%

Davos headlines, geopolitical tension, and uneasy nerves pushed European markets into reverse as optimism faded fast.

⬆️ Asia markets rise, BOJ holds

With rates unchanged and tensions cooling, Asian markets caught a bid. Sometimes, no surprise is the best news.

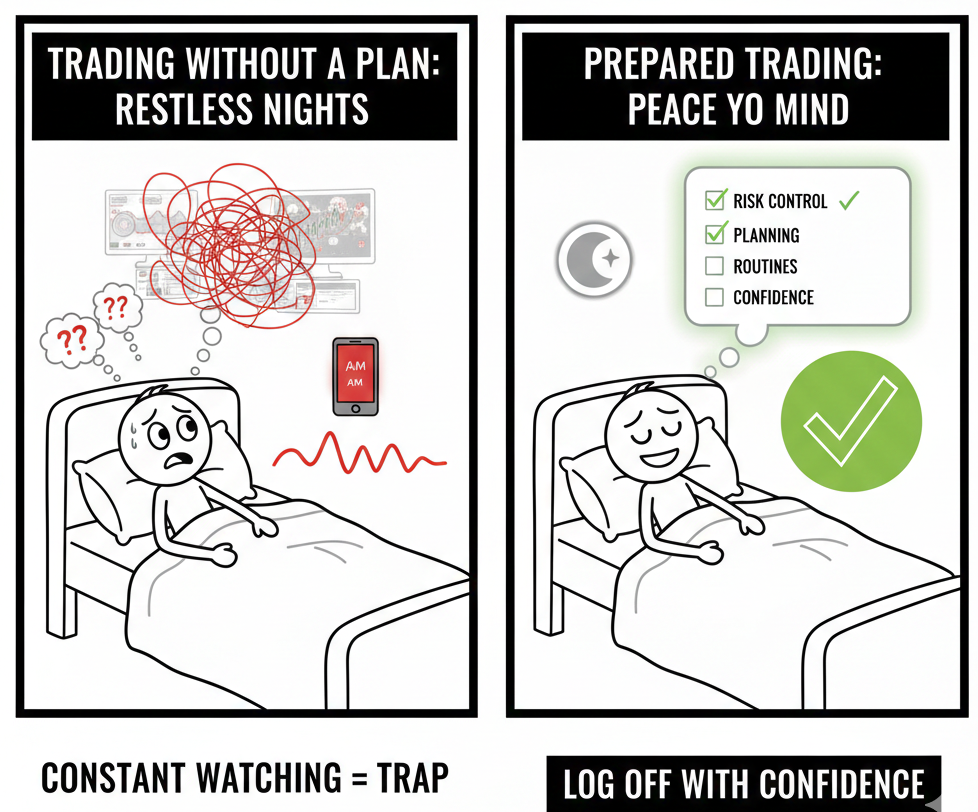

Trading Should Let You Sleep

If trading keeps you awake, something is wrong. Late-night chart checks, constant worry, and panic refreshes come from uncertainty, not opportunity.

Calm trading is planned trading. Risk is defined before entry. Position size matches comfort. Exit points are clear. Once those decisions are made, there is nothing left to manage at night.

Trading should support your life, not interrupt it. When structure replaces guesswork, peace follows. Good trades allow rest. Anxiety signals a broken process, not a better one.

If you want trading guidance that prioritizes planning, risk control, and peace of mind, these newsletters help. They reinforce calm decision making and routines that let you log off with confidence.

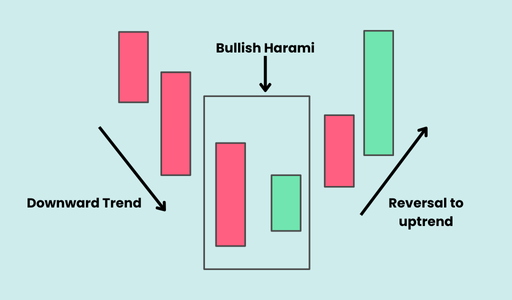

Bullish Harami

The Bullish Harami is a two-candle reversal pattern that signals a sudden "hush" in selling pressure.

The word "Harami" is Japanese for "pregnant," which describes the visual of a large mother candle (red) containing a small baby candle (green).

It represents a moment where the bears have run out of steam and the bulls are quietly beginning to push back.

🛠️ The Strategy Logic

Use these logical triggers to identify when a downtrend is losing its grip and a potential bounce is forming:

- IF: The second (green) candle’s body is completely contained within the first (red) candle’s body...

- THEN: The pattern is valid. This shows that the market tried to continue lower but was met with enough support to stay within the previous day's range, signifying a "pause" in the trend.

- IF: The Bullish Harami forms after a steep, aggressive decline or at a major support level...

- THEN: The signal is high-probability. This suggests that the "selling climax" has passed and the market is entering a phase of accumulation.

- IF: The second candle is a "Doji" (a tiny body that looks like a cross)...

- THEN: The pattern is called a Bullish Harami Cross. This is a much more powerful signal than a standard Harami because a Doji represents total indecision, making the reversal more explosive when it finally triggers.

- IF: The price breaks and closes above the high of the first (large red) candle...

- THEN: The bullish reversal is confirmed. Many traders use the "high" of the mother candle as their official entry trigger for a long position.

- IF: The pattern is accompanied by a Bullish Divergence in the MFI or RSI...

- THEN: You have a "Smart Money" setup. The candles show the pause, but the indicator shows that buying volume is already flowing in beneath the surface.

💡 Pro Tip

The "Inside Bar" Connection: In modern price action trading, a Harami is often called an "Inside Bar." The key to trading this successfully is patience. A Harami is a sign of consolidation, not an immediate moon-shot. Always wait for the price to break the "mother candle" high before entering. If the price breaks the mother candle's low instead, the pattern has failed and the downtrend is continuing.

Discipline rarely disappears in one bad decision

It fades in small moments that feel harmless at the time.

You size up a little because the last trade worked. You skip a rule because the setup looks clean enough. You enter early because price will probably give you what you want.

Nothing explodes right away, so the mind files it under progress.

That is how discipline slips.

Losses do not usually come from breaking rules loudly. They come from bending them calmly.

One adjustment turns into a habit. The habit turns into a new normal. Soon, your original process feels restrictive instead of protective.

The market does not punish you for being aggressive. It punishes you for being inconsistent.

Strong traders stay boring on green days. They follow rules even when confidence is high. They treat wins as proof that the system works, not permission to improvise.

If your discipline only exists after losses, it is already gone. Real discipline shows up when you feel unstoppable.

That is when restraint matters most.

The goal is not to trade bigger after wins. The goal is to trade the same. Same size. Same patience. Same respect for risk.

That is how accounts survive.

Quietly. Consistently.