Gold Goes Hot!

....................................................................................................................

Good morning,

Markets try to find their footing after a brutal shock.

Wall Street is attempting a tentative bounce after suffering its worst single-day selloff since October, triggered by a sudden spike in geopolitical and policy risk. Futures are edging higher, but the mood remains cautious as investors digest a sharp reset in risk appetite sparked by President Trump’s renewed Greenland threats and tariff rhetoric.

Tuesday’s session was a clear risk-off moment. Stocks sank across the board, megacap tech led the retreat, and traditional safe-havens surged as traders rushed to protect capital. The simultaneous jump in Treasury yields, slide in the dollar, and fresh record highs in gold underscored how abruptly sentiment shifted from confidence to caution.

With volatility back on the table, attention now turns to a packed slate of catalysts — from Trump’s appearance in Davos and a landmark Supreme Court case tied to Federal Reserve independence, to a critical stretch of corporate earnings.

For markets, the question isn’t whether the rebound can hold — it’s whether confidence can be rebuilt at all.

📉 Dow, S&P 500, Nasdaq Futures Rise After Trump’s Greenland Threats Follow Worst Day Since October

Stock futures climbed even after a steep market sell-off — the worst since October — triggered by President Trump’s controversial Greenland remarks and broader risk skittishness, as traders looked for stabilizing cues to start the week.

📺 Netflix Stock Falls After Q4 Beats But Warner Bros Deal Uncertainty Looms

Netflix shares dipped after reporting better-than-expected fourth-quarter results, as uncertainty over its ongoing deal with Warner Bros weighed on investor sentiment despite solid subscriber growth.

🥇 Gold Rises to Record High as Crisis Sentiment Bolsters Safe-Haven Demand

Gold prices climbed to fresh record levels as investors scaled into safe-haven assets amid mounting geopolitical and macro risks, reinforcing bullion’s status as a core hedge in turbulent markets.

🚁 Zipline Soars 76% After $6 Billion Valuation Boost

Shares of drone delivery company Zipline jumped sharply — gaining roughly **76% — after the firm secured a valuation topping $6 billion, reflecting heavy investor appetite for logistics and autonomous tech plays.

📉 Crypto Stocks Slide as Bitcoin Weakens Amid New Tariff Threats

Cryptocurrency-linked equities lagged as Bitcoin softened and markets priced the risk of fresh trade tariff pressures, dragging down sentiment across digital-asset stocks.

₿ Bitcoin Trader Sticks With $100K Target as Gold Hits Record $4,750 A prominent Bitcoin trader reaffirmed a $100,000 price target for BTC, even as gold climbed to an unprecedented $4,750 an ounce, underscoring divergent safe-haven and risk-asset narratives gripping markets.

🌏 Asian Shares Extend Selloff as Global Bond Rout Stokes Fresh Anxiety

Major Asian equities fell sharply amid a renewed selloff that saw global bond yields spike, fueling investor anxiety and broad risk-off positioning across regional markets.

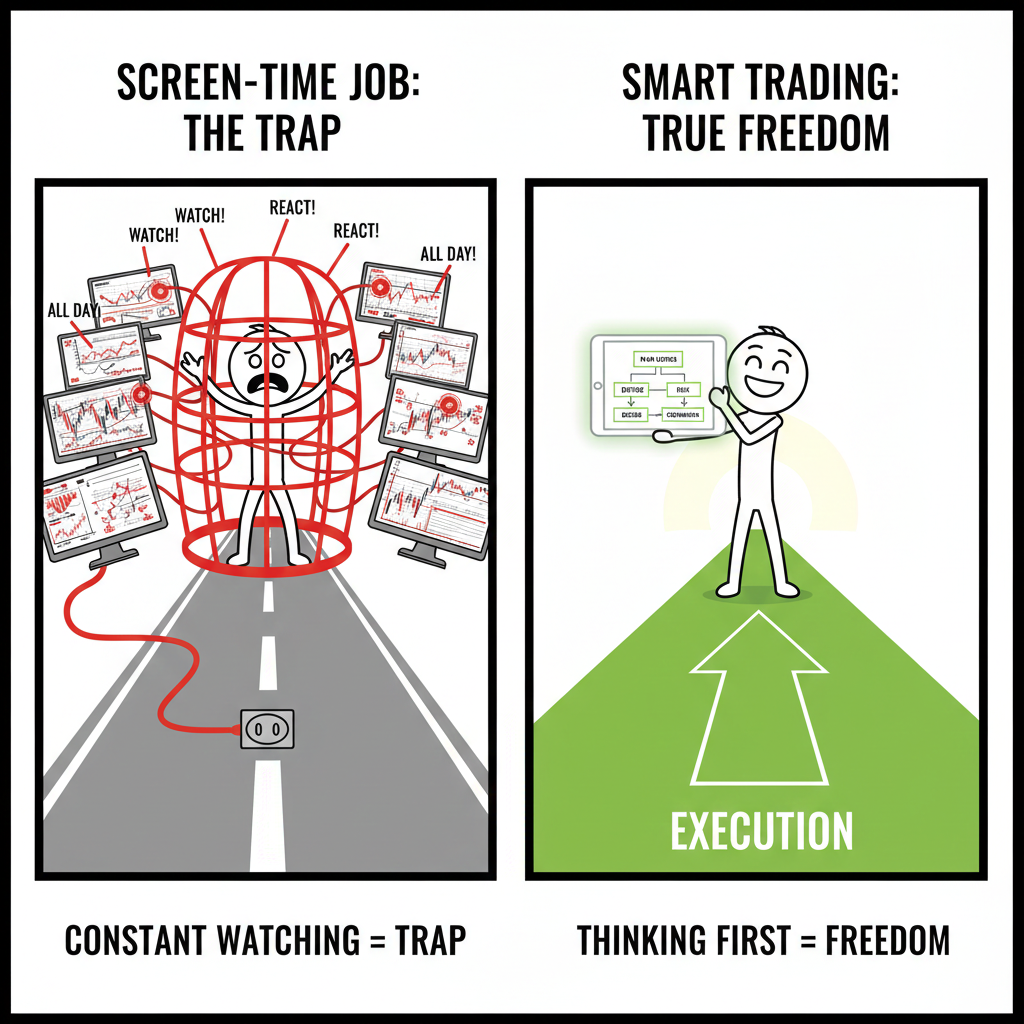

Trading Is Not a Screen-Time Job

Many people avoid trading because they imagine being glued to charts all day. Constant watching. Constant reacting. That picture makes trading feel like a trap, not freedom.

In reality, screen time does not equal skill. Most strong trading happens away from the chart.

Levels are planned. Risk is defined. Scenarios are decided in advance. Execution is quick because the thinking is already done.

When you stop treating trading like a job that rewards hours, decisions improve. Overtrading drops. Focus returns. Trading becomes a tool that fits your life instead of consuming it.

If you want guidance that shows how to trade with structure without living on screens, these newsletters help. They focus on planning, discipline, and routines that protect your time.

Detrended Price Oscillator (DPO)

The DPO is a unique indicator because it purposely ignores the long-term price trend to focus solely on short-term cycles.

By comparing the current price to a displaced moving average, it "detrends" the data, making it much easier to see the peaks and troughs of market cycles.

It is designed to help traders identify when an asset is at a cyclical high or low, regardless of whether the overall trend is up or down.

🛠️ The Strategy Logic

Use these logical triggers to identify when a major uptrend has ended and a deep correction is starting:

- IF: You see three consecutive red candles with large bodies and very short lower wicks...

- THEN: The bearish conviction is extreme. Small lower wicks indicate that the bears pushed the price down and kept it there until the very end of the session, leaving no room for a bounce.

- IF: Each candle in the sequence opens within the body of the previous candle...

- THEN: The decline is orderly and powerful. This shows that even when the market tries to open slightly higher, it is immediately met with a wall of selling pressure that "engulfs" the previous gains.

- IF: The pattern forms after a parabolic (near vertical) move upward...

- THEN: This is a "Trend Exhaustion" signal. It often marks the exact moment the "bubble" bursts, and the subsequent move lower is likely to be fast and aggressive.

- IF: The bodies of the candles get progressively larger as the pattern develops...

- THEN: The panic is accelerating. Increasing candle size shows that more sellers are rushing for the exit, which often leads to a sustained downtrend rather than a brief pullback.

- IF: The third candle breaks below a major moving average (like the 50-day SMA) or the Middle Keltner Channel...

- THEN: You have a "Structural Breakdown." The pattern hasn't just reversed the trend; it has broken the support levels that were keeping the uptrend alive.

💡 Pro Tip

The "Oversold" Trap: Because Three Black Crows involves three big down days, the market can often look "oversold" by the time the pattern is finished. Do not buy the dip immediately. While you might see a small relief bounce, the "Crows" indicate that the long-term trend has changed. Use any small bounce back toward the middle of the pattern as an opportunity to exit longs or enter shorts, rather than a signal to go long.

Profits Erase Memory

Nothing wipes rules faster than a winning streak.

After profits, discipline feels unnecessary.

The rules that once protected you start sounding conservative. You loosen entries. You stretch stops.

You justify it by telling yourself you’re “reading the market better now.”

That’s rule amnesia.

Rules aren’t there for bad days. They’re there for good ones — when confidence is high and consequences feel distant.

The market doesn’t punish rule-breaking immediately. It waits until you’re fully convinced you don’t need them anymore.

That’s when it strikes.

If your rules only matter when you’re losing, they aren’t rules. They’re emotional crutches.

Truth: Consistency isn’t proven in drawdowns. It’s proven when you’re winning and still refuse to bend.

Because the market loves traders who forget why the rules existed — and then reminds them.