FedEx Sees $1B Hit

....................................................................................................................

Happy Monday, traders.

Wall Street is still buzzing after the Fed’s first rate cut of 2025 sent stocks ripping to fresh records last week.

What some are calling a “honeymoon rally” has defied September’s bearish reputation, with the AI trade and looser financial conditions fueling the charge.

Bank of America’s Michael Hartnett says bubbles don’t pop this fast—his century-long study shows manias can run 244% before breaking, and the Magnificent Seven are only 223% off their 2023 lows.

Add in AI-driven productivity optimism and strong earnings, and strategists argue this rally may have more gas left.

The crucial updates below break it all down.

⚡ Nvidia Scoops Enfabrica

$900M buys brains + software that link 100k chips without breaking a sweat. Bulls love the edge.

💰 FDX Smashes Q1

$3.83 EPS vs $3.61 est. Revenue blew past $22B. Bulls now eye $260 open.

🖥️ Intel Gets Trump Bump

Trump dropped a cryptic midnight meme — “Bought Intel at $20, now $30” — and retail went wild.

📉 Analyst Warns 70% BTC Crash

Into The Cryptoverse’s Benjamin Cowen says history shows Bitcoin bear markets often wipe out 70%+ from cycle highs.

📈 Adani Stocks Jump

Shares across the Adani Group rallied Friday after India’s SEBI dismissed key parts of Hindenburg’s market manipulation claims.

🐂 Powell’s Cut Sparks Bulls

Powell trimmed rates 25 bps, calling it “risk management”—Wall Street heard “bulls still in charge.”

💵 Dollar Flex Caps Shine

Powell’s cautious tone boosted the dollar, making gold harder to chase in other currencies.

No new trades on the board today.

The market isn’t giving us that “perfect pitch” yet, and we don’t swing just because we feel like it.

High-probability setups are what pay.

So we wait, ready to strike when the chart lines up.

Patience now means power later. ⚡

Information Overload is the Silent Killer of Progress

Drowning in trading books, YouTube tutorials, and endless Reddit threads doesn’t make you a trader.

It makes you stuck. Information overload feels productive, but in reality, it’s just another form of procrastination.

The market doesn’t reward the person who knows the most theories. It rewards the person who acts, tests, and adapts.

You don’t need a library in your head to place your first trade.

You need a clear system and the courage to pull the trigger.

Every day you sit on the sidelines waiting to “know more,” you’re losing time that could’ve been spent learning through real experience.

Start simple. Trade small. Learn faster by doing, not by drowning in research.

👉 That’s why we are are recommending this collection of trading newsletters designed to cut through the noise and give you only what matters.

Start here with the newsletters that matter.

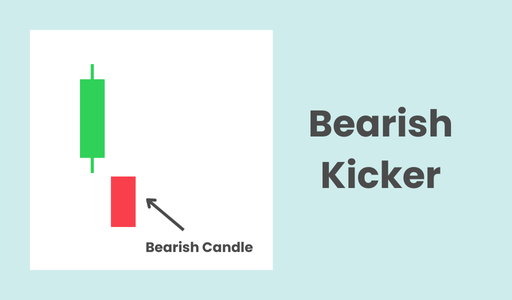

Bearish Kicker

The Bearish Kicker is a rare but powerful two-candlestick bearish reversal pattern. It signals a dramatic and sudden shift in market sentiment from bullish to bearish. It is one of the most reliable candlestick patterns because of the sharp price action it represents.

What to Look For

- First Candle (Bullish): The first candle is a bullish (green or white) candle, which confirms that the existing trend is up.

- Second Candle (Bearish): The second candle is a strong bearish (red or black) candle that gaps down from the first candle. The open of the second candle is often below the low of the first candle, and it continues to move lower, closing near its low.

- The Gap: A key feature of this pattern is the gap between the two candles. The second candle opens at a price level that is a significant jump down from the previous day's close, showing an extreme and sudden shift in sentiment. There is no price overlap between the two candles' bodies.

- Appearance After an Uptrend: For the Bearish Kicker to be a valid reversal signal, it must appear after a clear uptrend. It signifies that the bulls' power has been completely overwhelmed by a sudden influx of sellers.

- Psychology: The pattern reflects a total and surprising change in attitude. After a period of buying, the market is suddenly "kicked" in the opposite direction, often due to a major news event or a fundamental shift in perception. The decisive gap shows that sellers are willing to step in and push the price much lower without hesitation.

- Confirmation: Due to its dramatic nature, the Bearish Kicker is considered a strong signal on its own. However, high trading volume on the second candle provides added confirmation of the reversal.

Your Edge Isn’t IQ, It’s Control

Traders love to believe the market is a puzzle for the smartest to solve.

The sharper your analysis, the bigger your edge - right?

Wrong.

The market doesn’t reward brilliance.

It rewards discipline.

That’s why so many blow up.

Not because they can’t spot a trendline,

but because they can’t manage themselves.

They cut winners short,

let losers run,

jump in too early,

or chase too late.

All emotions. Zero control.

Here’s the secret nobody puts on a webinar:

Your greatest edge isn’t a tool or indicator.

It’s patience.

It’s sticking to the rules you set.

It’s keeping a clear head when the screen turns red.

And here’s why most traders never get it—

you can’t buy discipline.

No book, no Discord, no “secret system” sells it.

It’s built.

Trade after trade.

Rule after rule.

Loss after loss.

So the question isn’t “Am I smart enough to beat this market?”

The real question is—

“Am I disciplined enough to survive it?”

Because in the end, the profits don’t follow the genius.

They follow the trader who doesn’t flinch.