Disney [BEAST MODE]

....................................................................................................................

![Disney [BEAST MODE]](/content/images/size/w1200/2025/05/Newsletter-128-Disney-BEAST-MODE.gif)

Happy Friday, legend.

The charts are alive, the newsfeed’s on fire, and your stop-loss?

Hopefully not too tight today.

Markets are moving like they’ve got insider tips and zero chill - Trump major US-UK trade deal, the Fed, and Bitcoin are all trying to steal the spotlight.

Let’s break down what’s actually worth your screen time before the weekend hits.

🇬🇧 UK Deal Sparks Market Buzz

Deal of the Year?” Markets leap on rumors of a game-changing US-UK trade agreement.

📟 Trump Boosts Nvidia’s Chip Dreams, Stock Rises

Nvidia jumped after news that Trump might roll back Biden’s AI chip export curbs.That move could reignite AI trade with China and pump billions back into the sector.

🎬 Streaming Surprise Sends Disney Flying

Disney’s comeback arc just hit a new level: streaming profits soared, and a Middle East mega-park is on the way. Can it keep the momentum in a shaky global economy?

💵 No Rate Cut Put Dollar on Front Foot

The Fed just made it clear: no rush to cut rates. That sent the dollar flexing its strength again, even as markets begged for relief. Are rate cuts still on the table - or totally off?

🪙 Bitcoin Eyes $100K on Trump Deal

Bitcoin is sniffing $100K as Trump hints at a historic UK trade deal. Analysts say it could ignite another wave of institutional buying - and a rally for the ages.

🌎 Global Share Rise As Fed Holds Rates Steady

Global stocks edge higher — but behind the gains, Powell stalls, Trump threatens tariffs, and India-Pakistan tensions explode.

📈 Gold Rise on Economic Uncertainty

Gold rose again as the Fed warned of persistent economic risk. Traders are moving to safety as trade talks with China heat up once more.

Two Tech Giants, Same Message: It's Time to Trim

Today, we’re stepping into two short positions.

Different industries, same underlying pattern: strength showing signs of fatigue, and early signals suggesting a pullback is on the horizon.

Netflix Inc. (NASDAQ: NFLX)

Netflix has been running hot. But even the strongest runners need to breathe.

Price is pressing into an overextended zone, and while the crowd is still cheering, the chart is whispering something else.

Candles are softening, momentum is cooling, and the setup is lining up for a technical pullback.

We’re stepping in before the mood changes.

🎯 Targets:

Sell: $1144.43

TP1: $1095.12

TP2: $1060

Cadence Design Systems Inc. (NASDAQ: CDNS)

Cadence has had a strong, clean run.

But now it’s showing the first signs of a stall.

It’s still holding high, but the structure is starting to lean.

This isn’t panic.

This is anticipation.

A setup that suggests the bulls might take a breather, and we’re positioning for the unwind.

🎯 Targets:

Sell: $307.86

TP1: $299.48

TP2: $289.53

Not every reversal starts with a bang.

Sometimes it starts with a pause - and that’s exactly where we strike. 🎯🔥

Think You’re Not the ‘Trading Type’? That Type Doesn’t Exist.

Seriously - there’s no zodiac sign required.

Trading doesn’t require a specific personality, background, or magical gut instinct.

It’s not about being aggressive or having some Wall Street swagger - it’s about having the right information and a repeatable process.

If you’ve ever hesitated because you didn’t feel like you "fit the mold," these newsletters will prove there is no mold.

They break down strategies, explain concepts without the jargon, and help you explore trading at your own pace - no pressure, no assumptions, just clarity.

👉 If you’re tired of guessing your way through trading, these newsletters will give you the guidance you need to move forward with confidence.

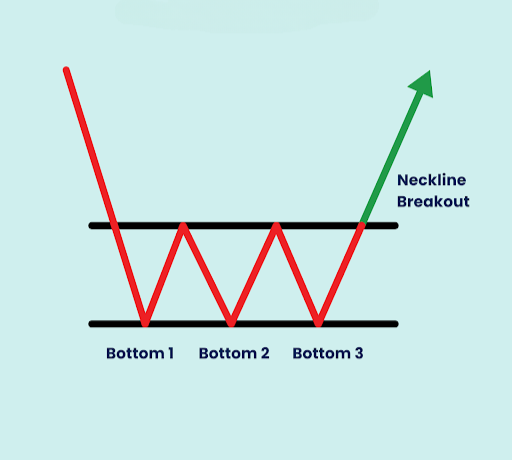

Triple Bottom

The triple bottom is a strong bullish reversal pattern signaling the potential end of a downtrend and the start of an uptrend.

It shows buyers successfully defending a price level three times, indicating increasing strength.

What to Look For:

- Three Distinct Lows: The price forms three clear bottoms at roughly the same level.

- Peaks in Between: Rallies occur between the lows, creating two intervening peaks and a "W"-like structure.

- Neckline Breakout: Confirmation occurs when the price breaks above the resistance level formed by connecting the two peaks (the "neckline"), often leading to a significant price increase.

Slow Down or Burn Out

Let’s be honest - some traders are acting like the market’s going somewhere.

But it’s not.

It’ll be here tomorrow.

And the day after that.

Candles don’t care if you’re tired, frustrated, or chasing losses - they’ll keep printing with or without you.

So if you’re having a rough day or the week’s just not clicking, take a step back.

You don’t have to trade every single move.

You don’t have to force plays just to feel “productive.”

That’s how you burn out - fast.

Sometimes the smartest thing you can do… is do nothing.

Rest. Reset. Regroup.

The market’s not running away. But your peace of mind might be if you keep pushing when you’re drained.

Play the long game. Protect your edge.

Be sharp, not just active.

That’s how you win.