Crypto Already Bottomed?

....................................................................................................................

Wednesday opens with markets checking their pulse, not changing direction.

US stock futures are treading water after Wall Street powered deeper into record territory on Tuesday, and now the focus shifts from momentum to confirmation.

The Dow and S&P 500 are hovering near flat levels, the Nasdaq is slightly softer, and investors are lining up for the first real labor-market test of 2026—a data point that could either validate the early rally or force a rethink.

Tuesday’s session showed just how resilient risk appetite remains. Geopolitical tensions faded into the background, the Dow punched through 49,000 for the first time, and the S&P 500 continued flirting with the psychologically charged 7,000 level.

Crypto joined the optimism too, with bitcoin holding above $92,000 as confidence builds that the brutal Q4 sell-off is in the rearview mirror.

Now comes the heat check.

Jobs data over the coming days will help define whether this rally is built on solid economic footing or running ahead of itself.

Today isn’t about fireworks. It’s about evidence.

📈 Stock Futures Flat After Dow & S&P 500 Rally to Fresh Records

Stock futures were little changed as Wall Street kicked off trading following a big session where the Dow crossed 49,000 and the S&P 500 hit a new all-time high, shrugging off geopolitical worries and positioning ahead of key economic data.

🚗 Hyundai Motor Shares Soar 15% to Record High on Nvidia Tie-Up Speculation

Hyundai Motor stock jumped nearly 15% to a record as investors bet a deeper strategic partnership with Nvidia could unfold after CES meetings, lifting sentiment across Korea’s auto and tech names.

₿ Bernstein Says Bitcoin and Broader Crypto Markets Have Bottomed

Crypto markets entered 2026 with gains, and analysts at Bernstein say Bitcoin and wider digital assets look poised beyond recent lows, suggesting risk assets may have carved out a bottom.

🌏 Asian Markets Trade Mixed as Defense Stocks Pull Back

Asian equities traded unevenly as investors balanced recent Wall Street strength with deepening geopolitical jitters. Key defense names that had rallied earlier saw profit-taking, including Kawasaki Heavy Industries and Korea Aerospace retreating as part of a broader mixed session.

🇨🇳 Goldman Forecasts ~20% Gains for Chinese Stocks in 2026

Goldman Sachs projects strong upside for China’s equity markets this year, with key indexes like the MSCI China and CSI 300 expected to climb sharply as economic momentum and policy support improve.

🪙 Gold Drops as Traders Look Past Geopolitical Risk to US Data

Gold price dropped after recent strength, as traders balanced geopolitical headlines with incoming U.S. economic data that could shape Fed policy and safe-haven demand in early 2026.

🛢️Crude Oil Slumps, Shares Retreat as Global Tensions Intensify

Crude futures slid as markets wrestled with rising geopolitical uncertainty, while Asian equities eased lower, reflecting investor caution amid shifting risk sentiment and oil supply dynamics.

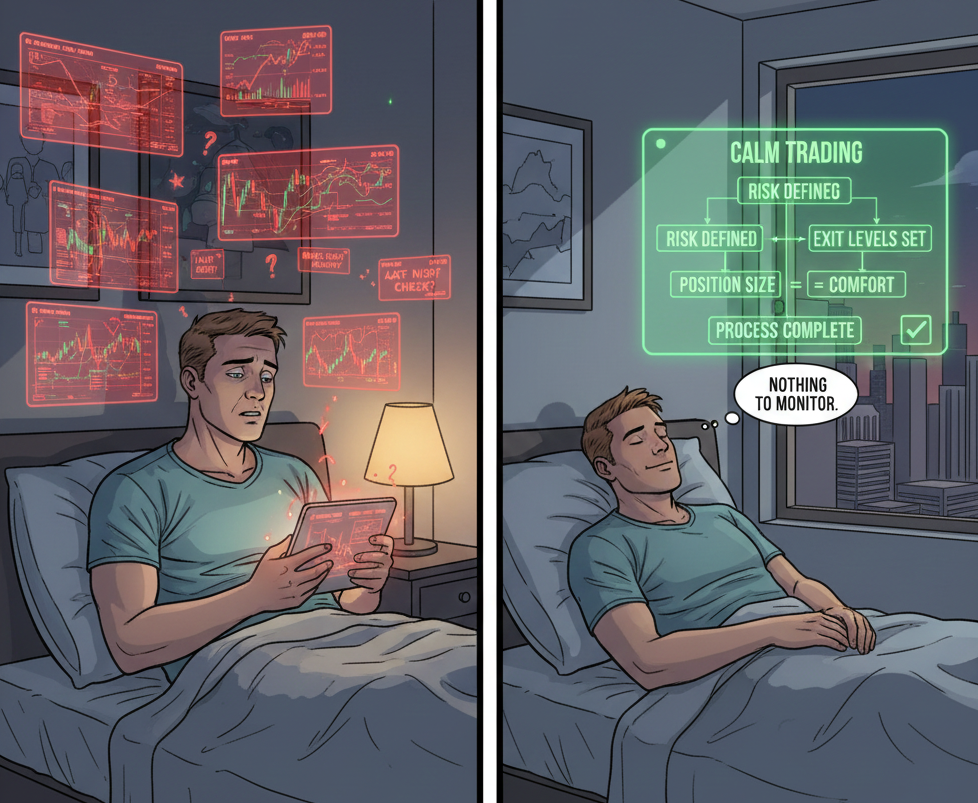

Trading Should Not Steal Your Sleep

Losing sleep comes from uncertainty. Open risk with no plan keeps the mind active. Random entries create worry. Late-night chart checks follow unclear rules.

Calm trading starts before the trade. Risk is defined. Exit levels are set. Position size fits comfort. Once those rules are in place, there is nothing to monitor.

Sleep improves when decisions feel finished. You trust the plan and step away. Trading supports life when structure replaces anxiety.

If you want trading guidance that emphasizes planning, risk control, and peace of mind, these newsletters help. They reinforce clear rules that let you log off with confidence.

Triple Exponential Moving Average (TEMA)

The TEMA is a high-speed technical indicator designed to remove the "lag" associated with traditional moving averages. By using a multiple exponential smoothing process, it stays much closer to the current price than a standard EMA. It is specifically built for short-term traders who need to identify trend changes the moment they happen

🛠️ The Strategy Logic

Use these logical triggers to navigate fast-moving markets with precision:

- IF: The price crosses from below the TEMA to above it... * THEN: Short-term momentum has turned bullish. Because the TEMA reacts almost instantly to price shifts, this crossover is often the earliest possible signal of a new uptrend.

- IF: The TEMA line is sloping steeply upward and price is "riding" the line... * THEN: You are in a "Strong Trend" phase. Do not attempt to short or sell; instead, use the TEMA as a trailing stop-loss. As long as the price stays above the TEMA, the momentum is intact.

- IF: The price moves significantly far away from the TEMA line (The Rubber Band Effect)... * THEN: The market is overextended. Because the TEMA is designed to stay close to the price, a large "gap" between the price and the line suggests a "snap-back" or mean-reversion move is coming shortly.

- IF: The TEMA line begins to "flatten" or point downward while price is still at highs... * THEN: This is a "Divergence of Momentum." It suggests that the internal strength of the move is dying out, even if the price hasn't crashed yet. This is a primary warning to exit long positions.

- IF: You use a TEMA crossover (e.g., a 13-period TEMA crossing a 34-period TEMA)... * THEN: You have a "Fast Trend" confirmation. This signal is significantly faster than a standard "Golden Cross," allowing you to capture a larger portion of the trend before it matures.

💡 Pro Tip

The "Noise" Warning: The TEMA's greatest strength—its speed—is also its greatest weakness in a sideways market. Because it is so sensitive, it will produce many "false starts" when the price is moving horizontally. To filter these out, only trade TEMA signals when the "spread" between the TEMA and a slower moving average (like a 50 SMA) is widening. If they are tangled together, sit on your hands.

Emotional Debt: Ignore It Now, Pay in Red Later

Every time you ignore a lesson, it does not disappear.

It waits.

You break a rule and move on.

You revenge trade and brush it off.

You size up after a loss and call it confidence.

Nothing happens right away.

That’s the trap.

The market allows small mistakes to pass without punishment.

That grace builds emotional debt.

Each ignored lesson adds a little more weight to your next decision.

Over time, the cost shows up.

Hesitation where there was clarity.

Oversizing where there was control.

Fear where there was patience.

By the time the damage feels obvious, the debt has already compounded.

The market does not collect loudly.

It collects quietly.

A bad week. A blown month.

A sudden drawdown that feels larger than the mistake that caused it.

Pay the debt early.

Review the loss.

Own the error.

Adjust the rule.

Then move on clean.

Learning hurts once.

Ignoring lessons hurts repeatedly.

Trading stays simple when you settle emotional debt as it appears, not when the market forces you to.