Broadcom’s Massive $10B Win

....................................................................................................................

Good morning!

Stock futures are climbing this morning as traders lean into Fed rate-cut bets and earnings optimism. Dow futures are up 0.3%, S&P 500 ahead 0.4%, and Nasdaq 100 rising 0.5% after yesterday’s trade-driven rollercoaster.

Tensions flared when President Donald Trump threatened new restrictions on China over stalled soybean purchases. Beijing hit back with fresh sanctions. But traders are focusing on rate cuts and earnings momentum.

Gold surged past $4,200 as the dollar wobbled, while the ongoing U.S. government shutdown delays key inflation data.

Earnings are in focus: Bank of America, Morgan Stanley, PNC, and Abbott Labs report today, with United Airlines later.

Top movers: Broadcom lands a big chip deal with OpenAI, Samsung Electronics posts a 3-year profit high, and hedge funds circle crypto after a $500B flush.

Markets are wide awake. This session could run hot.

֎ Broadcom's AI Infrastructure Deal with OpenAIBroadcom just landed a massive custom chip deal with OpenAI, confirming the AI arms race is only getting hotter. Wall Street is cheering, bears are scrambling.

💵 JPMorgan Chase Q3 2025 Earnings

JPM is leading the Financials sector with strong growth forecasts. The street is optimistic - time to see if the big banks can deliver or if the fear of missing out was overdone.

💰 Samsung Profit Soars to 3-Year High

Samsung's numbers blew away expectations, mainly on a huge rebound in their memory and foundry divisions. Bulls are loading up as the cyclical downturn is officially over.

💸 Hedge Funds Rush in After Crypto Crash

A sudden $500 billion crypto plunge, triggered by market leverage, is being called a necessary "wake-up call" by analysts. Volatility is insane, but institutions see a generational buying opportunity.

🇺🇸 US Dollar Pulls Back on Risk Sentiment

With Euro and Yen weakness fading, the Dollar's rally is finally pausing. Traders are rotating out of cash and back into growth assets.

🇯🇵 Japan Stocks Slide, JGBs Face Scrutiny

Japanese stocks pulled back after JGB yields spiked to 17-year peaks on hawkish BOJ signals. The bond market is officially testing the central bank's control and spooking equity traders.

🏦 Wall Street's Biggest Banks Are Riding High

The biggest banks are entering earnings season with strong tailwinds from trading and M&A fees. Analysts are raising estimates, but watch for any signs of credit quality issues.

How Overthinking Is Silently Destroying Your Trading Progress

Overthinking feels productive. It feels like preparation. But in trading, it’s hesitation disguised as logic.

You tell yourself you’re waiting for confirmation.

You call it analysis. What you’re really doing is delaying action until the perfect setup appears and it never does.

The market rewards decision, not perfection.

Every trade you skip because you “need one more signal” costs you more than a loss ever could. It kills your progress. It breaks your rhythm. It chips away at your confidence.

You don’t need more information.

You need trust in your plan, your process, and your rules.

Decide faster. Execute cleanly. Review later.

If you want to build that kind of confidence, the kind that cuts through hesitation - start here.

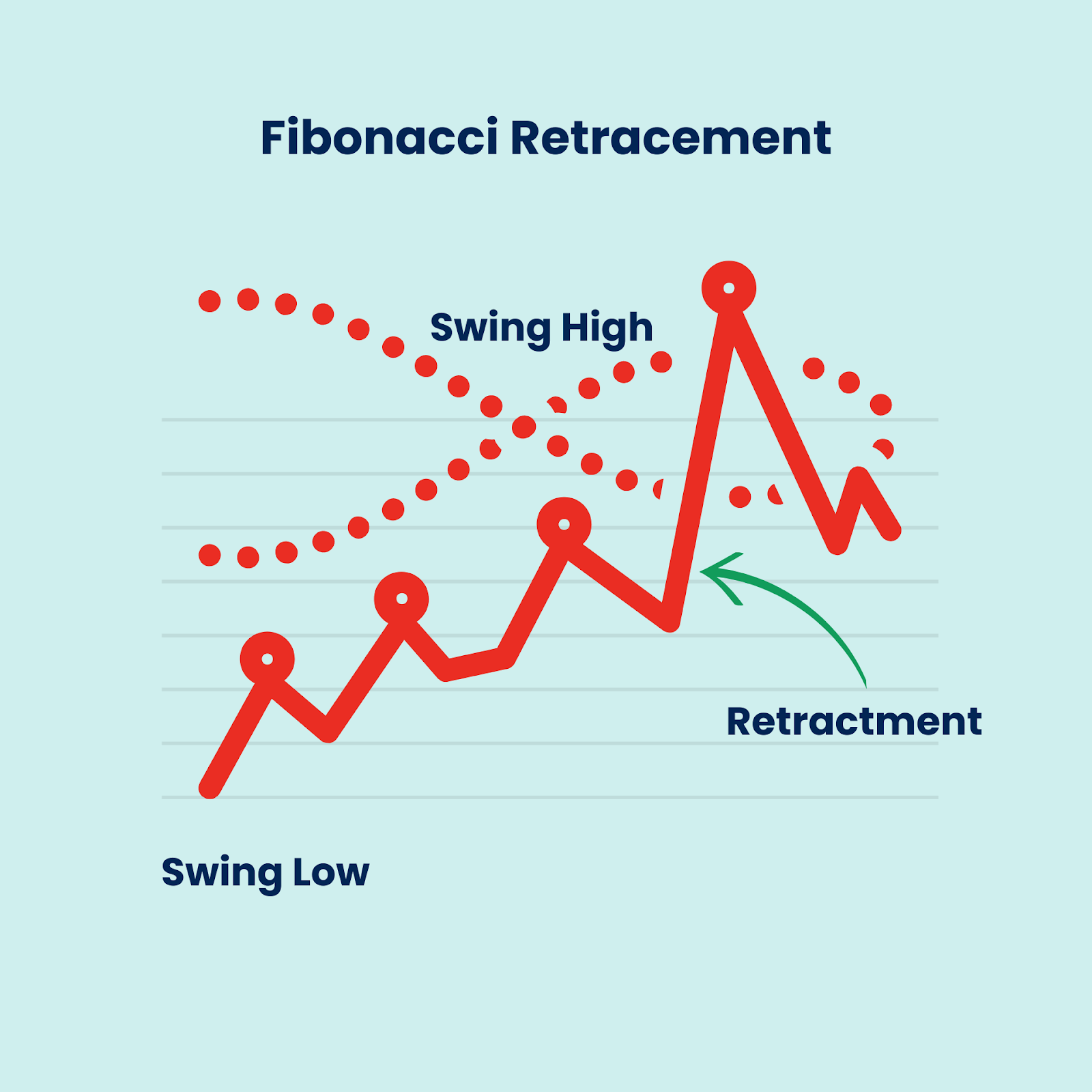

Fibonacci Retracement

Fibonacci Retracement is a popular technical analysis tool used to predict potential support and resistance levels where a temporary price move against the trend (a "pullback" or "retracement") is likely to end before the original trend resumes.

It is based on the mathematical ratios derived from the Fibonacci sequence (e.g., 0,1,1,2,3,5,8,13,…). When applied to a chart, these ratios are plotted as horizontal lines between a Swing High and a Swing Low to divide the move into key percentage zones.

What to look for:

- The Swing Points: First and foremost, correctly identify the Swing High and the Swing Low of the impulsive price move. In an uptrend, draw from low to high; in a downtrend, draw from high to low.

- The Golden Zone: Pay closest attention to the area between the 50.0% and 61.8% levels. This range is the most common area where price reverses before continuing the trend.

- The 61.8% Level: Treat this as the most significant single level. It's the Golden Ratio, and a strong rejection or bounce here is a powerful signal of trend continuation.

- Confluence: Look for instances where a Fibonacci level aligns with another significant technical factor. This could be a previous horizontal support/resistance line, a trend line, or a major Moving Average (MA). This alignment, called confluence, confirms the strength of the reversal point.

- Confirmation: Never enter a trade just because the price hits a Fibonacci level. Wait for confirmation that the reversal is happening, such as a strong reversal candlestick pattern (like a hammer or engulfing candle) or a supporting signal from an oscillator (like RSI or MACD).

- Trend Invalidity: Watch the deeper retracement levels, especially the 78.6% and 100% lines. If the price closes past the 100% mark (fully retracing the initial move), the original trend is likely broken, and you should abandon the trade idea.

- Low-Risk Entries: In an uptrend, look to buy when the price pulls back to and bounces from one of the key support levels (50.0% or 61.8%). In a downtrend, look to sell when the price rallies to and rejects a key resistance level.

Fast Money Burns Fast

Some traders ignore every rule. They overleverage. They skip research. They buy garbage assets.

And sometimes, they walk away with millions.

You feel the pull when you see it.

It looks easy.

Fast money looks loud. But it dies fast.

They don’t show you the crash.

They don’t talk about the day the market takes everything back.

Every blow-up starts with a lucky streak.

Short-term wins mean nothing if they don’t last.

Real trading is about staying in the game.

You need to protect your capital before you grow it. Discipline beats luck.

Practical steps to remember:

• Stick to your system every day.

• Keep your leverage in check.

• Trade only what you understand.

• Diversify to protect your downside.

• Take profit when the plan says so.

If your edge isn’t repeatable, it isn’t real. Sustainable money comes from boring routines.

Luck fades. Discipline compounds.