Broadcom Leads Tech Selloff

....................................................................................................................

Monday opens quietly — but don’t let the calm fool you.

Futures are barely moving after a choppy week where Big Tech lost its grip and money quietly rotated into cheaper corners of the market. Oracle and Broadcom took the heat, AI cooled off, and suddenly the “Magnificent 7” didn’t look so untouchable. The Dow held up fine. The Nasdaq didn’t.

Now the market’s eyes are locked on the calendar, not the charts.

This week brings a flood of delayed but critical data — jobs, retail sales, and inflation — all landing after the shutdown blackout. These numbers will shape rate expectations and decide whether last week’s tech selloff was a pause… or the start of something bigger.

Quiet tape. Heavy stakes. This is one of those weeks where the data does the talking.

🔻 Stocks Pull Back After Rally as Tech Stocks Crack

U.S. markets slipped from record levels as a sell-off in chip and AI names — led by Broadcom and Oracle — offset optimism from the latest Fed rate cut, signaling that the tech leadership rally may be cooling.

📈 Wall Street Bullish on 2026 Rally After Fed Rate Cut

Investors remain upbeat on stocks heading into 2026, betting that lower interest rates and broader economic resilience will fuel a new leg of gains — even as tech faces pressure and valuations normalize.

🚨 Wall Street Warns of AI Bubble as Sell-Off Deepens

From Nvidia to Oracle, AI-linked stocks have stumbled amid rising doubts over lofty valuations and cash-burning capital plans — sparking fresh debate over whether the technology boom has overheated.

📉 Asian Shares Slide as Wall Street Stumbles and Bitcoin Drops

Asian markets fell after Wall Street logged its worst session in three weeks, with traders bracing for a Bank of Japan rate hike and bitcoin slipping below $90,000.

✅ Alphabet’s SpaceX Bet Pays Off as Valuation Hits $800B

SpaceX’s latest insider stock sale has pushed its valuation to $800 billion, setting Alphabet up for another major paper gain just as analysts lift price targets on Google’s AI momentum.

⚠️ Bitcoin’s Calm Is Breaking — $50K Back on the Table

Bitcoin is stuck near $90,000, but traders warn this “extreme” low volatility won’t last—setting the stage for a sharp breakout or a deeper drop toward $50K.

🚀 Copper Set for Stratospheric Highs Amid U.S. Hoarding Frenzy

Copper prices are already at record highs—and traders say tariff fears and aggressive U.S. stockpiling could push the red metal into “stratospheric” territory, flashing a powerful signal about the global economy.

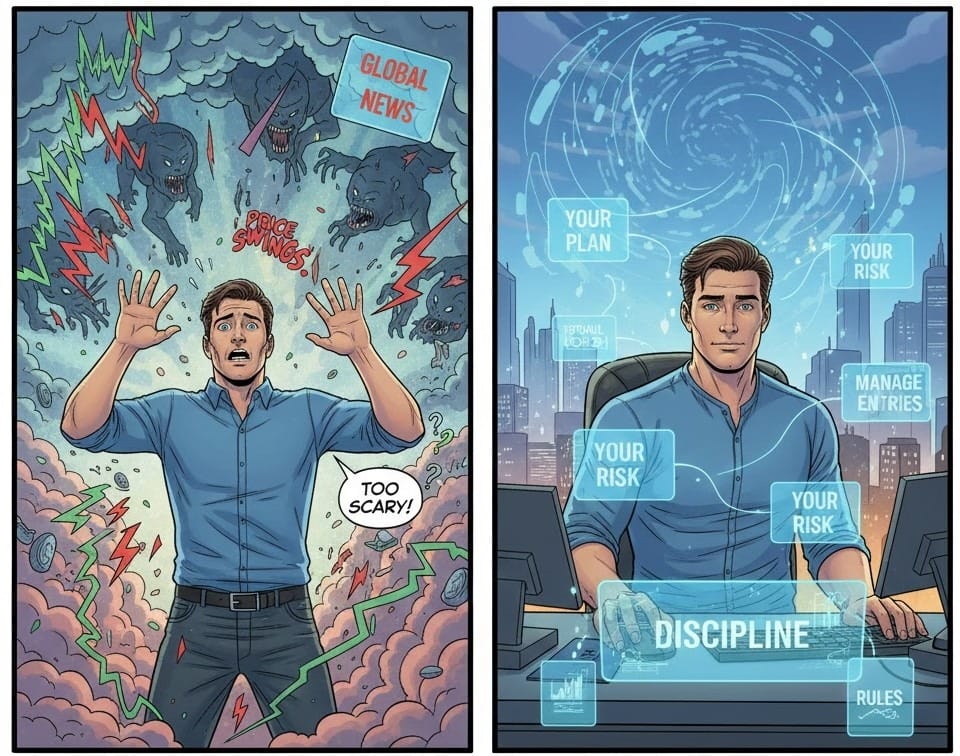

You Can’t Control Markets. You Can Control Yourself

Many traders hesitate because markets feel unpredictable. Every price swing seems random, every news headline threatening. That fear makes them avoid trading altogether.

The truth is simple: you will never control the market. No strategy, bot, or indicator can eliminate uncertainty. What you can control is your approach. Your plan. Your risk. Your entries and exits. Discipline replaces panic. Rules replace guessing.

When you focus on what’s within your control, trading stops feeling like chaos. You react with intention, not fear. Your results reflect your process, not market moods.

If you want guidance that helps you build control over your decisions instead of trying to control the market, these newsletters break down clear, repeatable steps to follow.

ADX (Average Directional Index)

The Average Directional Index (ADX) is a technical analysis indicator that measures the strength of a price trend, rather than its direction. It is typically used alongside two other lines, the Positive Directional Indicator (+DI) and the Negative Directional Indicator (-DI), which indicate the trend's direction.

What to Look For:

The ADX system is composed of three lines, which should be analyzed together for comprehensive signals:

A. The ADX Line (Trend Strength)

- ADX Value Range: The ADX line is typically plotted from 0 to 100.

- 0-20 (Weak/No Trend): Indicates the price is ranging, consolidating, or trending very weakly. Avoid trend-following strategies.

- 20-25 (Trend Start/Change): Indicates a potential new trend is emerging.

- 25-50 (Strong Trend): Confirms a strong, well-established trend is in force. Trend-following strategies are most effective.

- 50-75 (Very Strong Trend): Indicates an extremely powerful, accelerating trend.

- High ADX Falling (Trend Maturity): When the ADX is high (above 40 or 50) but starts to turn down, it signals that the current trend is maturing and momentum is weakening, suggesting a potential trend reversal or consolidation phase.

B. The +DI and -DI Lines (Trend Direction)

- The +DI and -DI lines show which side (buyers or sellers) has the directional control:

- Bullish Crossover: A Buy signal is generated when the +DI line crosses above the -DI line. This shows buyers are gaining control.

- Bearish Crossover: A Sell signal is generated when the -DI line crosses above the +DI line. This shows sellers are gaining control.

- The Rule of 20: Crossovers are typically only considered reliable trading signals when the ADX line is above the 20 or 25 level, confirming the crossover is happening within a true trend.

C. Combining Direction and Strength

- A strong, clear trend is present only when the ADX is above 25 AND the +DI and -DI lines are clearly separated (one is high, the other is low).

Quiet Markets, Loud Mistakes

Most traders do not lose money because the market tricks them.

They lose because the market gets quiet.

Nothing moves. No clean setups. No headlines. No adrenaline.

Just candles drifting and time passing.

This is where impatience sneaks in. You start forcing trades. You lower standards.

You convince yourself something is there because doing nothing feels wrong.

Your edge does not disappear in quiet markets. It actually shows itself there.

Calm conditions test whether you respect your rules or only follow them when things feel exciting.

Anyone can trade during volatility. Few people can sit still when nothing is happening.

Boredom exposes the truth about discipline. It reveals whether your strategy runs you or you run it.

The traders who last are comfortable with empty charts and slow sessions.

They know that waiting is part of the job, not a failure of it.

They understand that capital is protected more often by patience than by precision.

Quiet markets are not wasted time.

They are filters.

They push out the impatient and reward the consistent.

If you can survive boredom without inventing trades, your edge stays intact.

Most people never get past this stage.