Big Jobs Data Day

....................................................................................................................

Good morning traders,

US stock futures are ticking slightly higher as markets position ahead of the long-delayed January jobs report, a release many are calling the “Super Bowl of labor data” because of its potential impact on rate-cut expectations.

Futures on the S&P 500, Nasdaq 100, and Dow are up about 0.2%, with the Dow coming off a third straight record close — momentum is intact, but conviction is cautious.

Expectations have been notably revised lower.

Consensus forecasts point to roughly 68,000 new jobs with unemployment steady near 4.4%, and officials have already signaled the number could disappoint.

A softer print would add to concerns after flat December consumer spending data surprised to the downside.

On the corporate front, McDonald’s and Kraft Heinz report before the open, offering a read on consumer strength, while Cisco’s results later today will test appetite for AI infrastructure spending.

📊 Futures Climb as Rally Broadens Beyond Big Tech

U.S. futures edged higher with Nasdaq +0.4%, S&P 500 +0.2%, Dow +0.2%, as traders shifted focus to Wednesday’s jobs report, wage data, and Fed remarks after recent AI-driven volatility.

🧠 Samsung Erases Losses as Exec Declares “HBM4 Is Back”

Samsung shares rebounded after a top executive touted its HBM4 memory tech leadership, with mass production starting this month and Nvidia expected as the first major customer.

🥇 Gold Holds Above $5,000 as Weak U.S. Data Boosts Rate-Cut Bets

Bullion climbed up to 0.9%, consolidating above $5,000 per ounce, as weak retail sales pushed 10-year yields to a one-month low and extended the dollar’s four-day slide.

🛍️ Shopify Soars 7% Ahead of Earnings on AI Optimism

Shopify jumped 7% — its best day in six months — on Wall Street upgrades and excitement around “agentic commerce,” though the stock remains down 23% year-to-date.

📉 S&P Global Plunges 16% on Weak 2026 Outlook

Shares sank 16% at the open after forecasting 2026 EPS of $19.40–$19.65, below the $19.94 analysts expected, adding to a stock already down 15% this year.

🍺 Heineken Jumps 4% Despite 6,000 Job Cuts

Heineken rose 4% in early trade after announcing plans to cut 5,000–6,000 jobs, even as 2025 production volumes fell 1.2% and operating profit grew 4.4%.

₿ Bitcoin Slips 3% as Analysts Warn Bulls Lack Momentum

Bitcoin dropped roughly 3%, with analysts cautioning that upside momentum is fading and warning of potential weakness toward the $69,000 level.

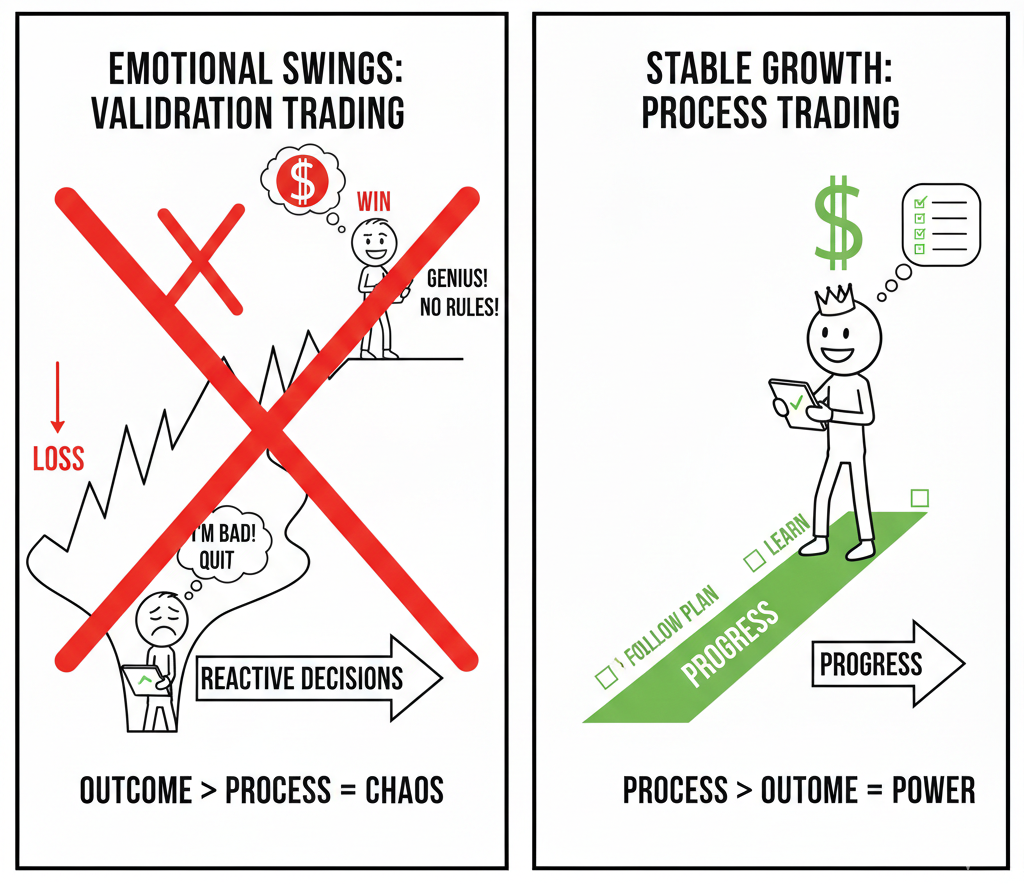

Stop Letting One Trade Define You

One loss does not mean you are bad at trading. One win does not mean you are skilled. Yet many traders treat each outcome like a final judgment.

This mindset creates emotional swings. After a loss, confidence drops. After a win, discipline fades. Decisions become reactive instead of structured. The focus shifts from process to validation.

Strong traders think in sequences. They measure performance over dozens of trades. They review execution, not just outcome. A single result is data, nothing more.

When you stop attaching identity to one trade, stability returns. You follow your rules. You evaluate patterns. You improve with clarity instead of emotion.

If you want trading guidance that reinforces process over outcome and helps you build long-term consistency, these newsletters help. They focus on disciplined execution and structured thinking that compounds over time.

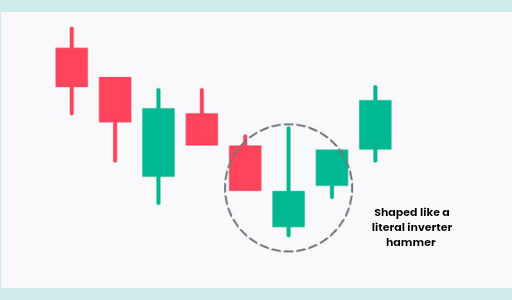

Inverted Hammer

The Inverted Hammer is a bullish reversal pattern that appears at the bottom of a downtrend. It looks like a Shooting Star, but its context is the opposite.

It consists of a small body at the lower end of the candle with a long upper wick. This pattern tells a story of "testing the ceiling"—it shows that buyers finally stepped in to push the price up significantly, and even though they couldn't hold the high, the bears were no longer strong enough to keep the price at the lows.

🛠️ The Strategy Logic

Use these logical triggers to identify when a trend is shifting from bearish to bullish:

- IF: The upper wick is at least two times the length of the candle body and forms after a decline...

- THEN: The signal is valid. The long upper wick represents a "liquidity grab" and proof that bulls are starting to challenge the dominant downtrend.

- THEN: The signal is valid. The long upper wick represents a "liquidity grab" and proof that bulls are starting to challenge the dominant downtrend.

- IF: The Inverted Hammer is followed by a green candle that closes above its body...

- THEN: The reversal is confirmed. This is the most critical step; the Inverted Hammer is a "warning," but the following candle is the "trigger" that proves the bulls have taken control.

- THEN: The reversal is confirmed. This is the most critical step; the Inverted Hammer is a "warning," but the following candle is the "trigger" that proves the bulls have taken control.

- IF: The pattern forms at a major support level or the Lower Keltner Channel...

- THEN: You have a "Spring" setup. The market has dipped into a value zone, and the Inverted Hammer shows the first sign of life from the buyers at that specific price floor.

- THEN: You have a "Spring" setup. The market has dipped into a value zone, and the Inverted Hammer shows the first sign of life from the buyers at that specific price floor.

- IF: The volume on the Inverted Hammer candle is higher than the previous red candles...

- THEN: The signal is high-conviction. It indicates that a large number of shares or contracts changed hands at the bottom, suggesting a "transfer of ownership" from panicked sellers to steady buyers.

- THEN: The signal is high-conviction. It indicates that a large number of shares or contracts changed hands at the bottom, suggesting a "transfer of ownership" from panicked sellers to steady buyers.

- IF: The body of the Inverted Hammer is green...

- THEN: The signal is slightly more bullish than a red one. While the wick is the most important part, a green body means the bulls actually managed to close the price higher than the open despite the intraday volatility.

💡 Pro Tip

The "Bulls are Testing" Secret: Think of the Inverted Hammer as a "reconnaissance mission." The long upper wick is the bulls testing the strength of the sellers higher up. They might have retreated by the end of the day, but they’ve proven the path upward is open.

If you see an Inverted Hammer followed immediately by a regular Hammer, you have a "Double Bottom" on a microscopic scale, which is one of the most powerful bullish setups in candlestick trading.

The "One More Trade" Lie

You tell yourself you’re done. Clean session. Solid discipline. Decent P&L.

Then price twitches… and suddenly your mouse has “one more trade” energy.

Let’s call it what it is — A TRAP WE DRESS UP AS OPPORTUNITY.

The market always looks most attractive right after you decide to stop.

That’s not edge.

That’s exhaustion wearing a clever disguise. I’ve seen traders protect rules for six straight hours — then donate the day’s profit in the final 20 minutes because they wanted a “bonus win.”

Late trades are rarely planned. They are emotionally negotiated.

FATIGUE DOESN’T FEEL LIKE TIREDNESS — it feels like urgency.

IMPULSE PRETENDS TO BE CONVICTION.

Make your rule mechanical:

MAX TRADES PER DAY = HARD STOP. Platform closed. No chart “just checking.” No hero entries.

Treat your trading day like market hours. There is an opening bell — and there must be a closing bell.

Discipline is not proven at the first trade.

It’s proven at the last one you refuse to take.