Apple? Who Cares! THIS $2 Stock Could Make You a Millionaire

Today we are leaving the big guys on Wall Street and diving into a $2 stock with the potential to make you a millionaire.

Yes, you read that right – just two dollars could be worth more for you in a few years from now.

Today we are leaving the big guys on Wall Street and diving into a $2 stock with the potential to make you a millionaire.

But that's not all!

We're also exploring the rise of BRICS nations and whether they're on track to outpace the US economy.

Plus, we'll take a look at Japan's massive intervention in the currency markets, and offer insights on how to prepare your portfolio for a potential drop in interest rates.

💰 This $2 Stock Could Mint Millionaires

Apple might be a household name, but this $2 stock is quietly gaining momentum. Discover the investment opportunity that's shaking up the market.

🇷🇺🇺🇸 Will BRICS Outpace the US Economy?

Goldman Sachs predicts the BRICS nations will rule the economic world by 2075. The BRICS boom could be your next big investment opportunity.

👨🔧How to Prepare for Falling Interest Rates

Falling interest rates can create opportunities and challenges. Here are three things you can do to maximize your financial gains.

🇭🇰🇸🇬 The Wealth Shift: HK Loses, SG Gains

Hong Kong and Singapore; Two financial hubs, two vastly different wealth gap stories. What's driving this surprising trend?

💴 Japan Splashes Billions in Bid to Stabilize Currency

The yen's fate hangs in the balance as Japan makes a bold move to stabilize its currency. Will this intervention be enough to turn the tide for this giant economy?

🏟 The Third Plenum: What's Really on China's Mind?

China's economy is at a crossroads, and the Third Plenum could be a turning point. Don't miss the signals that could impact your investment strategy.

🚧 Is This the End of the Road for Lucid Group?

Analysts predict that the company may file for bankruptcy protection in the near future, posing significant risks for investors and stakeholders.

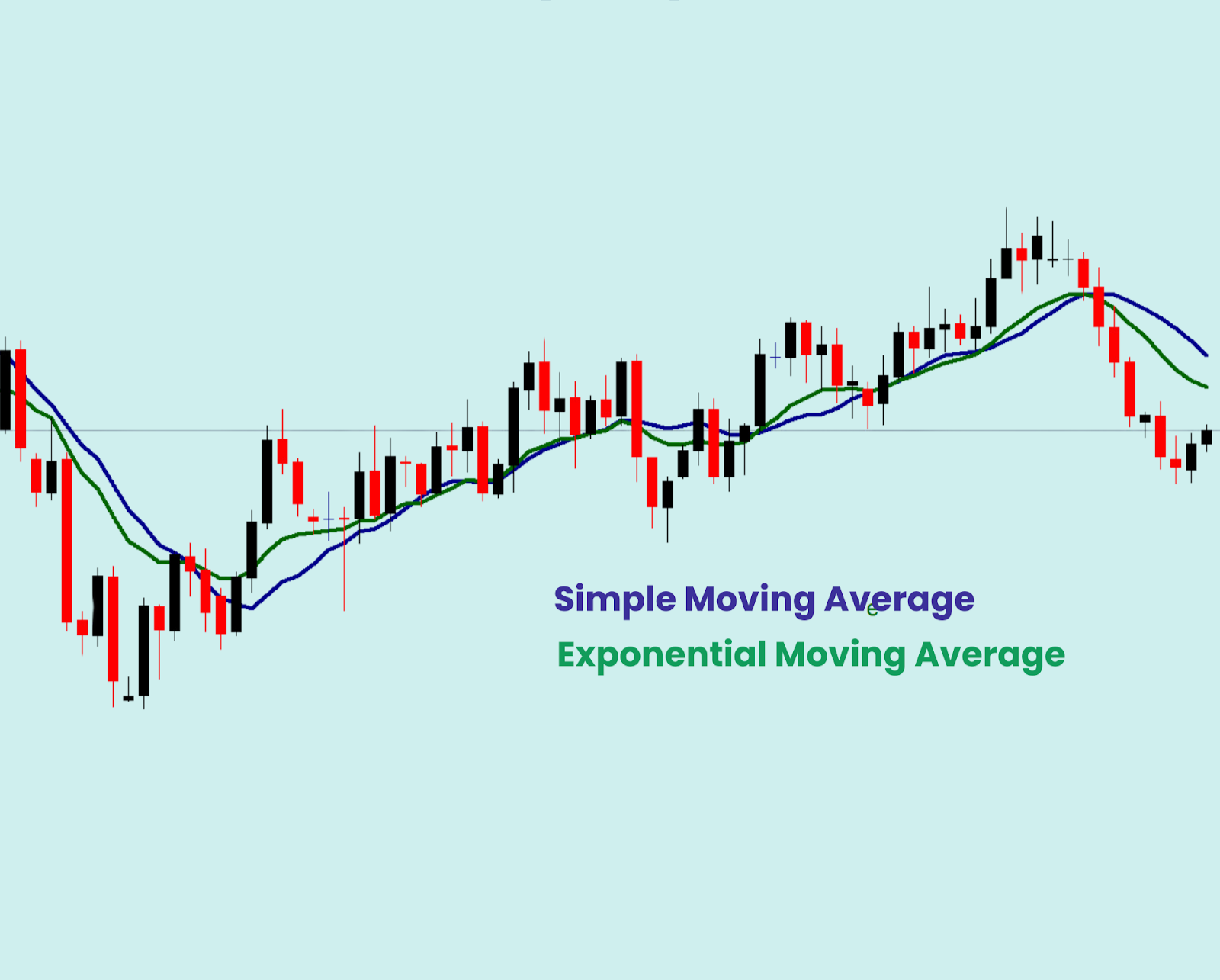

Exponential Moving Average (EMA)

Like SMA, the EMA smooths out price data to reveal the underlying trend.

However, the EMA gives more weight to recent prices, making it more responsive to new information.

This makes it particularly useful for spotting short-term trends and potential turning points.

What to Look For:

- Trend Direction: The EMA helps you see if the market is going up, down, or sideways. If it's going up, the market is rising. If it's going down, the market is falling. If it's flat, the market is stable.

- Crossovers: When the price crosses above the EMA, it's a good sign for buyers. When it crosses below, it's a warning for sellers.

- Dynamic Support and Resistance: The EMA can act like a safety net or a ceiling. In an uptrend, the price bounces off the EMA when it dips. In a downtrend, the price stalls at the EMA when it rises.

Let's be real – trading isn't always sunshine and rainbows.

There are days (or even weeks) when the market seems to be working against you, and staying motivated feels like an uphill battle.

But here's the thing: It's not about avoiding the lows, it's about learning how to navigate them.

Remember, trading is a marathon, not a sprint.

Celebrate your small wins, learn from your losses, and take breaks to recharge.

Most importantly, don't compare yourself to others – focus on your own progress and keep learning.

It's okay to feel discouraged, but don't let those feelings derail you.

You've got this!