American Eagle Jumps 15%

....................................................................................................................

Good morning!

Markets are waking up slow, but at least they’re waking up.

US futures are inching higher today, trying to stretch Tuesday’s rebound into something that actually sticks. The major indexes are all up around 0.2%, powered by a tech bounce and a Bitcoin recovery after its nastiest drop since March.

But the spotlight isn’t on stocks — it’s on the Fed. With an 89% chance of a rate cut priced in, today’s ADP report is suddenly the MVP of the week. Nonfarm payrolls aren’t coming (thanks to the shutdown chaos), so this is one of the last clean reads on the labor market before the Fed decides how soft to land the plane on Dec. 10.

Earnings are adding some color too: Marvell is ripping, American Eagle is flying, and Salesforce + Macy’s step up next.

New month energy might be shaky — but the market is trying.

📈 U.S. Futures Climb as Wall Street Recovers on Bitcoin Bounce

U.S. stock futures are rising after a sharp rebound in major averages — helped by stabilizing bond yields and a bounce in Bitcoin — giving markets a much-needed shot of confidence after last week’s slump.

🦅 American Eagle Lifts Q4 Outlook on Retail Surge

American Eagle boosted its guidance for the holiday quarter as stronger-than-expected sales and upbeat consumer demand point to another solid earnings season.

💸 SoftBank Gains 6% as Asian Tech Tracks U.S. Strength

Japanese technology shares jumped — led by SoftBank — as Asian markets rode a wave from U.S. tech and crypto rallies, signalling renewed risk-on sentiment across the region.

⚠️ ASX Outage Deepens Confidence Crisis

A platform outage at the Australian Securities Exchange derailed key announcements, reviving investor doubts about its ability to modernize critical systems.

💻 Nvidia Pops on Mistral-AI Buzz, Stock Eyes Fresh Run

Shares of Nvidia surged after new AI models from debuted on its platform — a sign investors are betting big on a refreshed wave of data-centre demand.

💾 Amazon Rallies on New Chip Meant to Challenge Titans

Amazon surged after debuting its Trainium-3 AI chip — a direct challenge to Nvidia and Google in the AI-hardware race.

🪙 Gold, Silver, Copper Smash Records as Bulls Ask: What Next

Precious and industrial metals ripped to all-time highs in 2025 — but traders are now split on whether this dream run has fuel left or is about to hit its ceiling.

Your Money Needs Your Decisions, Not Someone Else’s

Many traders hesitate because they rely on friends, family, or “gurus” to make decisions for them. They watch others trade, copy their moves, and avoid action if nobody approves. That dependence kills confidence and keeps them out of the market.

Trading demands independence. You need to make your own entries, manage your own risk, and accept responsibility for your outcomes. Learning to trust your judgment comes from small steps, testing strategies, and seeing what works for you—not anyone else.

The moment you own your decisions, fear fades. You trade with clarity instead of hesitation, and your account reflects your skill, not someone else’s opinion.

If you want guidance that helps you build confidence and make your own trading decisions, these newsletters break down clear strategies and systems to follow.

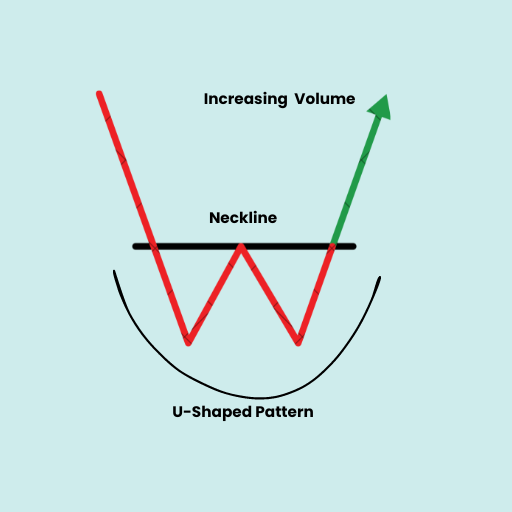

Rounding Bottom

The Rounding Bottom (or "Saucer Bottom") is a powerful, long-term bullish reversal chart pattern that signals a gradual, major shift from a downtrend to an uptrend.

The pattern gets its name from its visual appearance, which looks like a rounded bowl or a saucer at the bottom of a downtrend.

It reflects a slow, steady shift in market psychology from aggressive selling to gradual accumulation and eventual buying dominance.

It is typically a slow-moving pattern that can take weeks, months, or even years to fully form.

What to Look For (Key Features and Signals)

The Rounding Bottom is a patient trader's pattern, requiring observation of both price and volume over an extended period.

- Prior Downtrend: The pattern must be preceded by a clear, sustained downtrend for it to be a valid reversal signal.

- The Saucer Shape: The price movement creates a large, smooth, U-shaped curve. This is crucial—it should be a gradual curve, not a sharp "V" formation. This slow, steady shape represents the smooth transition from seller control (left side of the curve) to buyer control (right side of the curve).

- Volume Characteristics: Volume provides the primary confirmation of this pattern's sincerity:

- Decreasing Volume: Volume typically declines as the price moves down the left side of the cup and reaches the lowest point. This confirms seller exhaustion.

- Increasing Volume: Volume should increase steadily as the price moves up the right side of the cup. This signals genuine accumulation and growing buying pressure.

- Breakout Confirmation (The Neckline): The pattern is fully confirmed when the price breaks decisively above the resistance level formed by the highest point of the pattern (the start of the rounding formation). This breakout should be accompanied by a noticeable spike in volume to validate the strong bullish reversal.

- Target Price (Measured Move): The price target is calculated by measuring the depth of the bottom (the vertical distance from the highest peak of the pattern down to the lowest point of the curve) and projecting that distance upward from the breakout point.

Regret Management Is a Skill

Regret is baked into trading.

You will miss clean setups.

You will exit too early.

You will hold too long.

You will take trades you had no business touching.

There is no version of trading where every decision feels correct.

The game moves too fast for that.

Most traders waste years trying to eliminate regret instead of learning how to carry it.

They replay charts. They beat themselves up.

They spiral into overcorrection.

One regretful trade turns into a hunt for the “perfect” next one, and that chase destroys more accounts than any losing setup ever could.

Regret management is the real skill.

You acknowledge the sting without letting it shape your next move.

You study the mistake, extract what matters, then move forward with a clear head. The goal is not perfection.

It is emotional recovery.

You cannot stop regret from showing up, but you can decide how long it stays.

The traders who learn that distinction are the ones who stay steady while everyone else panics, presses, and blows up.