Amazon Delivers 11% Gain

....................................................................................................................

Happy Monday and welcome back to the grind.

Last month gave you momentum, now it’s about carrying it forward with intention.

Markets are opening steady to slightly higher, riding the same AI-powered optimism that pushed tech to seven straight months of gains.

Amazon sparked the tone with a blowout AWS quarter, Nvidia just got another bullish nod from Wall Street, and global equities are hovering near highs as easing U.S.–China tensions keep investors leaning risk-on.

Gold is still holding above $4K, yields are creeping up, and crypto just took its first monthly breather in years - a reminder the market always tests conviction before rewarding patience.

Bottom line - it’s a new month, new catalysts, and your discipline sets the tone.

Let's lock in, stay sharp, and build on this energy.

Now - into the big stories 👇

📈 Amazon Shares Surge 11% as AI Drives AWS to 20% Growth

Amazon’s cloud unit posted its fastest expansion in three years - investors cheered a 20% uptick in AWS sales and a bullish outlook, pushing the stock sharply higher.

📊 Big Tech on Track for 7th Straight Monthly Gain

The Magnificent Seven companies keep powering markets with their seventh straight month of strength; raising questions about what happens once the streak ends.

🚀 Goldman Hikes Nvidia Price Target, Sees AI Traction

Goldman Sachs nudged its 12-month target for Nvidia upward amid increased confidence in the chipmaker’s AI partnerships and infrastructure leadership.

📉 Bitcoin Ends October With First Monthly Loss Since 2018

Bitcoin closed down nearly 5% in October, snapping a seven-year streak of gains as macro uncertainty and yield pressure weighed on the crypto market.

🆙 U.S. Treasury Yields Climb As Investors Adjust Expectations

Yields on long-term Treasuries ticked higher on shifting Fed signals and growing concerns over inflation and debt; raising pressure across risk assets.

🌍 Global Stocks Head for 7th Monthly Gain; Dollar Near 3-Month High

World equity markets are set for their seventh consecutive monthly advance, while the U.S. dollar hovers near a three-month peak, highlighting strong tech earnings but also rising currency risk.

🪙 Gold Holds Above $4,000 as Traders Weigh Fed & China Signals

Gold remains elevated above the $4,000 level as traders assess unclear signals on U.S. rate cuts and a partial U.S.–China trade truce.

Trade Update 💥

PepsiCo Inc (NASDAQ: PEP) - TP Hit

Our short call delivered perfectly.

Price dropped straight into our TP zone after showing exhaustion near resistance.

A clean 5.04% gains before leverage.

Sweet!

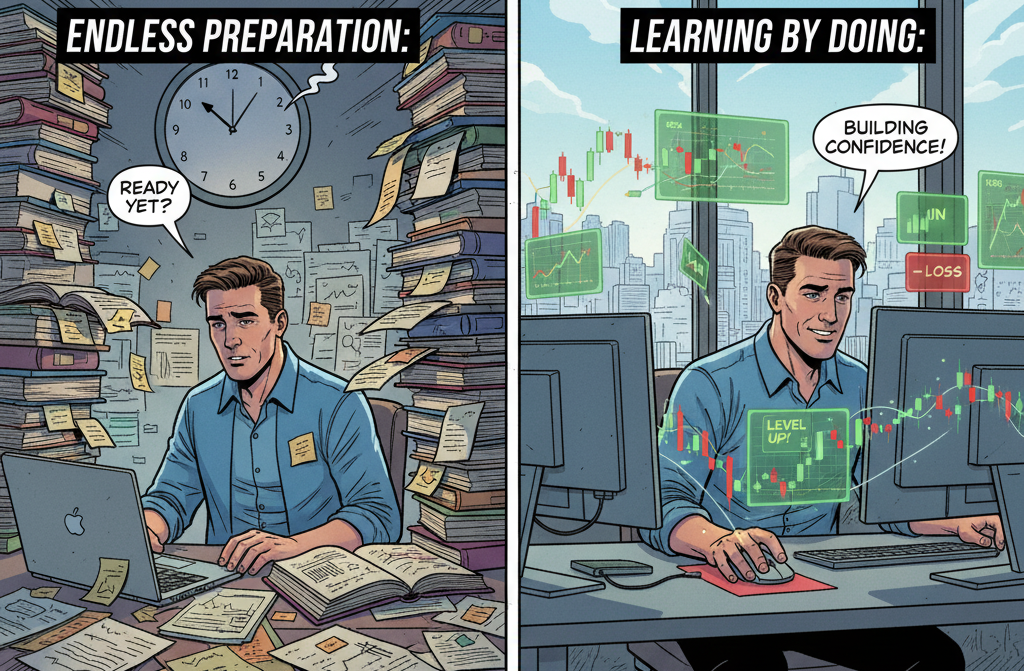

You’ll Never Be 100% Ready — Trade Anyway

You’ll never have all the answers before you start trading.

There’s no perfect moment, no secret formula, and no course that’ll make you “ready.”

Readiness comes after you begin — not before.

Most traders waste months studying charts, reading books, and waiting for some magical level of confidence.

But trading confidence doesn’t appear out of thin air. It’s built through experience - the wins, the losses, and the lessons that come with both.

If you wait until you’re “ready,” you’ll stay on the sidelines forever.

The only way to get good at trading is to trade - start small, stay smart, and learn as you go.

Start learning from traders who’ve already walked that path.

Explore trading newsletters that teach you how to trade with confidence — even when you’re not 100% ready:

Ichimoku Cloud

The Ichimoku Cloud is a complex, all-in-one technical indicator that provides insights into trend direction, momentum, and dynamic support and resistance levels.

Developed by Japanese journalist Goichi Hosoda in the 1930s, its name translates to "one glance equilibrium chart," as it is designed to give a complete market picture at a single glance.

It consists of five main components, two of which form the "Cloud" (or Kumo), and uniquely, the Cloud is projected forward, giving a forward-looking view of potential support and resistance.

What to Look For (Key Features and Signals)

The Ichimoku system involves five lines, each providing a different piece of information:

- Conversion Line (Tenkan-sen, 9 periods): This is the fastest line, indicating short-term momentum. A rising or falling slope confirms the short-term trend direction.

- Base Line (Kijun-sen, 26 periods): This is the medium-term line. It serves as a key level of dynamic support or resistance and is often considered the "anchor" for price action.

- The Cloud (Kumo): This is the shaded area between the two "Leading Spans" (Senkou Span A and B). It is plotted 26 periods into the future.

- Price Position vs. Cloud: The primary trend confirmation is determined by price relative to the Cloud. Above the Cloud signals a bullish trend; below the Cloud signals a bearish trend. Price within the Cloud suggests consolidation or an undetermined trend.

- Cloud Color: The color changes based on which Leading Span is on top. A Green Cloud (Span A above Span B) confirms a bullish long-term outlook, while a Red Cloud (Span B above Span A) confirms a bearish outlook.

- Lagging Span (Chikou Span, current close plotted 26 periods back): This line acts as a trend confirmation tool comparing current price to past price action. A bullish signal is confirmed when the Lagging Span is trading above the past price bars, and a bearish signal is confirmed when it is below.

- Trading Signals (The Crossover): A strong Buy Signal occurs when the Conversion Line crosses above the Base Line while the price is trading above the Cloud. The reverse cross is a strong Sell Signal.

False Urgency

There is a voice in your head that whispers hurry.

It tells you price is leaving without you.

It tells you this is your moment and if you do not act right now, you will miss everything.

That voice is not wisdom. It is adrenaline pretending to be intelligence.

Most traders lose not because they lack a strategy, but because they rush when they should wait.

Markets reward patience far more than speed.

The best setups do not require panic.

They sit. They build.

They offer time to think.

Urgency creates sloppy entries, oversized positions, and emotional exits.

Waiting feels uncomfortable, but discomfort protects you more than excitement ever will.

The market does not punish you for missing trades. It punishes you for forcing them. Every great trader eventually learns this truth.

Time is not running out.

Price will move tomorrow.

Another setup will come.

The chart will open again in the morning.

Your edge grows when you stop reacting like the market owes you a fast win and start behaving like you have all the time in the world.

Slow hands last. Fast hands burn.

The trade you do not take often becomes the trade that saves you.