Alibaba Frenzy

....................................................................................................................

Happy Friday 👋

Markets are tiptoeing higher after Trump swung fresh tariffs at pharma, furniture, and heavy machinery.

Nasdaq futures barely blinked, Dow and S&P nudged 0.2%.

Meanwhile, Trump also signed off on a $14B TikTok deal (pending Beijing’s blessing), while Fed Governor Lisa Cook fired back at Trump’s Supreme Court play to oust her - warning it’d spark “chaos and disruption” in markets.

In today’s edition: Alibaba’s $53B AI pledge, Euro’s stablecoin experiment, Nvidia caught in China’s crossfire, ETH whales flipping the dip, and gold’s historic march toward $5K.

📦 Alibaba Soars 8% on AI Spend Pledge, Nvidia Deal

Eddie Wu vows to top $53B AI commitment as Alibaba unveils Qwen3-Omni model. A fresh pact with Nvidia cements its cloud-and-AI push despite US-China trade frictions.

💶 Big Banks Unite to Launch Euro Stablecoin

ING, UniCredit, and seven others team up on a regulated digital euro project in the Netherlands. Aiming for central bank oversight, they want to set the standard for trusted on-chain payments.

🇨🇳 Nvidia Caught in the Middle: China Pushback Meets Billion-Dollar Bets

China’s chip crackdown clipped Nvidia’s wings just as it was riding the AI rocket. But even with investments raising eyebrows, retail traders are still calling “bullish”. Are they seeing strength the analysts are missing?

🐋 Ethereum Slips Below $4K: Whales Liquidated, Whales Reload

A $140M wipeout torched leveraged longs in hours, sending ETH tumbling into the $3,900 zone. But just as fast, whales scooped up $855M worth of tokens—turning pain into accumulation fuel.

💻 Apple-Intel Talks Spark Retail Frenzy

Message boards lit up as INTC’s volume nearly doubled on whispers of Cupertino cash. A cup-and-handle chart pattern now has bulls calling for $40–$45 targets in a hurry.

💵 Global Funds U-Turn: U.S. Assets Back in Vogue

Tariffs drove investors away in April, but a 7% S&P rebound has them piling back in. With small caps and Treasuries gaining favor, the “rest-of-world” trade is suddenly out of fashion.

⚡ Gold Rally Turns Historic Run as Traders Eye $5K

Six straight weekly gains, record ETF flows, and the highest RSI in nearly half a century. Rate cuts and Trump’s NATO remarks just threw fuel on the fire, but can this gold run keep burning, or is a pullback inevitable?

We have been keeping a keen eye on the market but there's still no stocks recommendation today.

Looks like the market hit the snooze button.

We’ll let it wake up and stretch before we make our move.

Be ready.

Capital Isn’t the Barrier You Think It Is

Most people picture trading as a playground for hedge funds, Wall Street elites, or anyone sitting on stacks of cash.

That picture is outdated. Modern trading platforms make it possible to start small, sometimes with less than the cost of a night out.

What matters isn’t the size of your account but how you use it.

Smart risk management, consistent practice, and the right strategy turn even modest capital into a powerful teacher and a solid starting point.

Waiting until you’ve “saved enough” often means never starting at all.

The door isn’t locked. It’s already open. The only question is whether you’ll step through it.

👉 Start small. Start here Trade smart. Growth follows action.

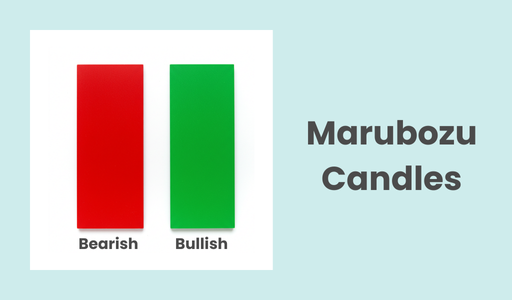

Marubozu

The Marubozu (Japanese for "close-cropped" or "bald") is a single-candlestick pattern that represents the strongest conviction possible in a single period.

It signals that either buyers or sellers were in full control from the very moment the trading period opened until it closed.

What to Look For

- No Wicks/Shadows: The defining characteristic is the lack of an upper or lower shadow (wick). This means the open and close prices were also the high and low prices for that period.

- Long Body: The Marubozu must have a relatively long body compared to surrounding candles, which emphasizes the decisive nature of the move.

Two Main Types and Their Meaning:

- Bullish Marubozu (Green/White):

- Open Price = Low Price

- Close Price = High Price

- Signal: Buyers were in control throughout the entire period, never allowing the price to dip below the open. This shows extreme bullish commitment.

- Bearish Marubozu (Red/Black):

- Open Price = High Price

- Close Price = Low Price

- Signal: Sellers were in control throughout the entire period, never allowing the price to rise above the open. This shows extreme bearish commitment.

- Continuation or Reversal: The significance of the Marubozu depends heavily on its context:

- Continuation: A Bullish Marubozu within an uptrend suggests the trend is strong and likely to continue. A Bearish Marubozu within a downtrend suggests the downward pressure will persist.

- Reversal: A Bullish Marubozu that forms at the end of a downtrend can signal a major bullish reversal, as it shows a powerful shift in sentiment. A Bearish Marubozu at the peak of an uptrend can signal a major bearish reversal.

- Support & Resistance: The high/low (which are the open/close) of a Marubozu candle often act as very strong support or resistance levels in future trading.

Most traders think their problem is strategy.

It’s not.

The truth is, you could have the cleanest setup in the world and still blow it if nobody’s checking you when you start to slip.

A trading partner who calls you out when you’re over-risking. Someone who reminds you to stick to your rules when emotions start whispering.

Isolation breeds bad habits. It makes inconsistency feel normal.

Accountability, on the other hand, keeps you sharp.

It forces you to respect your plan, to journal your moves, to stop chasing every candle like it’s your shot at redemption.

The difference between traders who survive and traders who stall isn’t just knowledge.

It’s who they let keep them honest.

So ask yourself today: Who’s holding you accountable?