AI's $200B Surge!

....................................................................................................................

Good morning traders,

It's been a bit of a bumpy road in the markets lately, hasn't it?

These past few weeks have definitely kept us on our toes.

It feels like we've been navigating some choppy waters, right?

But you know what? Something good might come out for us this week.

Maybe it's just wishful thinking, but we're optimistic.

Because we've got some crucial updates coming in the newsletter that you absolutely need to know.

So stick with us, because we're about to dive into the trading news, right now.

Let’s go…

🤖 AI Sparks $200B Boom in China Stocks!

Goldman Sachs just made a bold call - AI could pump a staggering $200 billion into China’s stock market. With tech giants rallying and investor confidence soaring, is this the breakout moment for Chinese stocks?

🐋 DeepSeek Sparks Emerging Stocks’ 3-Month High!

Emerging markets just hit a three-month high - and AI is leading the charge! With DeepSeek’s breakthrough and China signaling a business-friendly shift, are we looking at the next big rally?

📉 Crypto Dips as Volatility Fades

Crypto isn’t sitting still! Bitcoin, Ethereum, and Dogecoin slipped as trading volumes dried up - meanwhile, analysts warn against blindly longing BTC’s range lows. Could we see a deeper drop?

⚠️ Japan Braces for BOJ Rate Hike Shock

The Bank of Japan might hike rates sooner and higher than expected. Yields are spiking, and traders are scrambling to price in a surprise move.

💊 Novo Nordisk Surges - But Jim Cramer Has a Warning!

Novo Nordisk (NVO) is on fire, but Jim Cramer says investors should "be careful." The company is betting big on an oral weight-loss pill, with approval expected next year. Could this be a game-changer?

🪙 Gold Ticks Up - But Can It Hold?

Gold is bouncing back after last week’s sharp drop, but will the rebound last? Analysts say easing tariff fears could cap gains. Is this a technical blip or the start of a bigger move?

🛢️ Oil Prices Inch Up Amid Russia-Ukraine Talks

Oil prices are holding steady as the market looks to potential Russia-Ukraine peace talks. Will a resolution ease sanctions and flood the market with Russian oil, or will demand continue to prop up prices?

Quick Update: No Alerts Today

I’m overloaded with work today, so there won’t be any updates for now. I’ll be back with fresh insights and trade setups on Friday (if there are)

Stay sharp, and see you then! 🚀

Think Trading Platforms Are Designed to Confuse You? Here’s How to Make Them Work for You!

Ever opened a trading platform and felt like you were staring at a spaceship control panel?

Candlestick charts, endless indicators, confusing order types - it’s enough to make anyone close the app and walk away.

Many people never start trading simply because they assume they’ll never figure out the tech side of it.

But here’s the good news: you don’t need to be a tech genius to trade successfully.

That’s where these newsletters come in.

They break down trading platforms step by step, showing you exactly what you need to know without the overwhelming jargon.

You’ll learn how to place trades, set stop-losses, and use key features with confidence - without wasting hours trying to figure it out on your own.

Whether you’re using a desktop platform or a mobile trading app, these newsletters simplify everything so you can focus on trading, not struggling with the software.

Rising Three Methods

Rising Three Methods is a bullish candlestick pattern that signals a strong uptrend.

It consists of three consecutive bullish candles, each with higher highs and higher lows than the previous one.

What to Look For:

- Three Consecutive Candles: The pattern consists of three consecutive bullish candles.

- Increasing Highs and Lows: Each successive candle has a higher high and a higher low than the previous one.

- Confirmation of Uptrend: This pattern strongly confirms an existing uptrend.

- Potential for Continuation: The Rising Three Methods suggests that the uptrend is likely to continue.

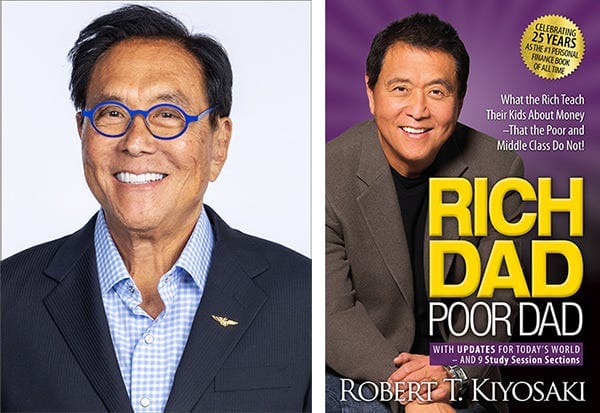

Today, we take a cue from one of the best-selling financial authors of all time - Robert Kiyosaki, the man who made Rich Dad Poor Dad a global phenomenon.

But beyond the book, Kiyosaki’s mindset offers powerful lessons for traders.

Robert Kiyosaki once said, “The average person is 95% eyes and only 5% mind when they invest.”

Sound familiar?

Too many traders chase flashy headlines, ignoring what truly moves the market.

REAL TRADERS SEE BEYOND PRICE - THEY READ TRENDS, SENTIMENT, AND DATA.

Here’s something you might not know:

Kiyosaki isn’t just about cash flow; he’s leveraged over $1 billion in debt.

Risky?

Only if you don’t understand it.

Leverage is a weapon - use it wisely, or it backfires.

He also warns, “You can’t solve a problem with the same brain that created it.”

Blown your account?

Revenge trading won’t fix it.

GROW, ADAPT, AND STOP REPEATING MISTAKES.

Kiyosaki’s famous “rat race” applies to traders too.

If you’re stuck overtrading and chasing losses, you’re just spinning the wheel.

Step back, strategize, and trade with purpose.

Trading isn’t just about making money - it’s about mastering discipline.

Train your mind like Kiyosaki trains his finances.

SEE BEYOND THE OBVIOUS, THINK LONG-TERM, AND PLAY SMART.

That’s how you break free.